Acreage purchase, trade

PDC Energy (ticker: PDCE) announced two acreage moves yesterday, expanding the company’s position in the Wattenberg.

The first deal PDC announced is a bolt-on acreage purchase from privately-held Bayswater Exploration & Production. PDC purchased about 8,300 acres for $210 million in cash. These properties are currently producing about 2,200 BOEPD, with 60% of production consisting of crude oil. Opportunities for increased development are present, as there are 30 operated DUCs on the property, and a further 240 gross drilling locations. The acquired acreage is directly contiguous with some of PDC’s current acreage, and will increase PDC’s working interest in about 60 existing locations. If each flowing BOE is valued at $35,000, this purchase equates to an acreage valuation of $16,025/acre.

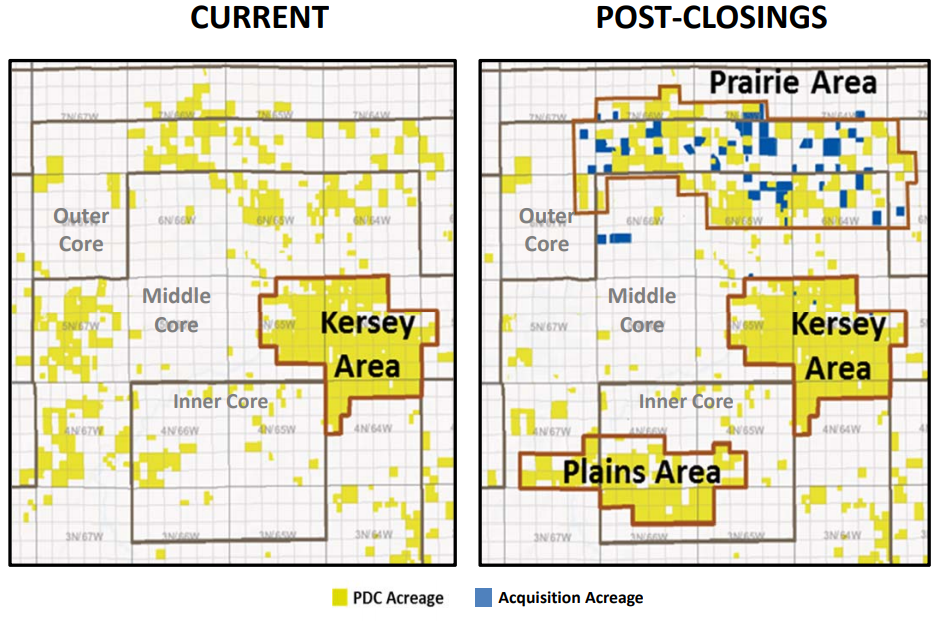

This acquisition has allowed the company to form a focus area, called the “Prairie Area” in the middle and outer core of the Wattenberg, where the company has relatively consolidated acreage. The purchase is expected to close before the end of the year.

Moves make three areas to focus operations

The second deal made by PDC is an acreage trade with an undisclosed operator. PDC will receive about 11,700 net acres in exchange for 12,100 net acres. The trade exchanges acreage that is spread out in the middle core portion of the Wattenberg for acreage that is concentrated in the inner core. Notably, this trade does not include production, wellbores or existing facilities.

Like in the acreage purchase, the acreage trade allows PDC to form an additional concentration area, called the “Plains Area.” The company will focus on these areas in future drilling activities, along with its already-established Kersey Area.

PDC President and CEO Bart Brookman remarked, “These strategic business development initiatives offer PDC a great opportunity to not only drill more extended-reach lateral wells, but add to our existing inventory of highly economic projects in the Core Wattenberg Field. As we have experienced first-hand in our Kersey Area, there are significant capital and operational efficiencies, reduced surface impacts, and incremental value created through consolidated acreage positions.”