Occidental Petroleum Corporation (ticker: OXY) reported a core income of $708 million for the first quarter of 2018, or $0.92 per diluted share. Total average daily production volumes were 609,000 BOE for the first quarter of 2018, compared to 621,000 BOE in the fourth quarter of 2017.

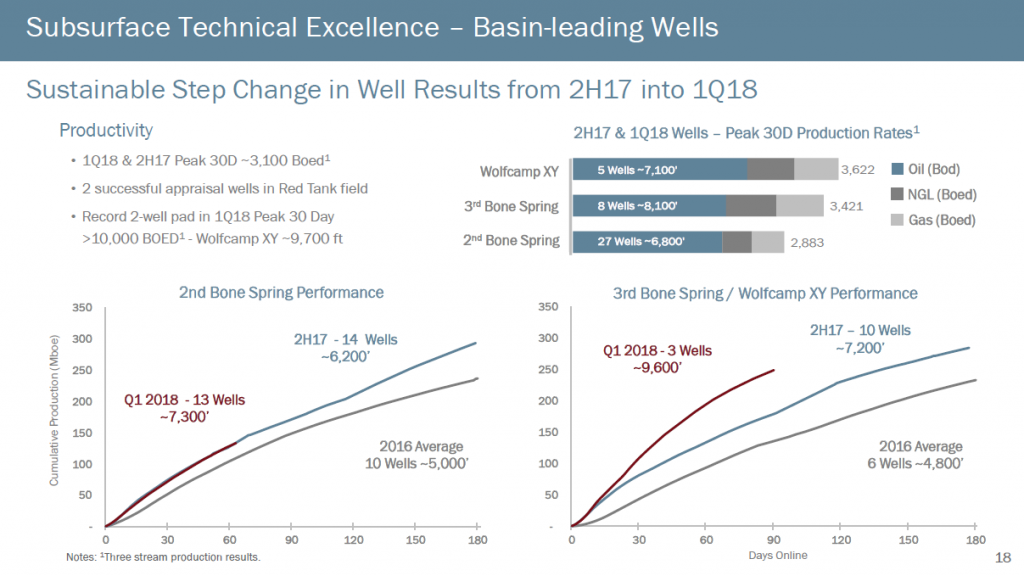

Permian average daily production volumes improved from the prior quarter by 18,000 BOE, or 11%, to 177,000 BOE in the first quarter of 2018. Occidental said that better than expected results from the Greater Sand Dunes contributed to the improved volumes – 16 wells reported 30-day production rates averaging 3,100 BOEPD.

However, international average daily volumes were lower in the first quarter of 2018 by 29,000 BOE, compared to the fourth quarter of 2017. This was due to planned maintenance related to the Al Hosn Gas and Dolphin operations, as well as the impact of higher prices on production sharing contracts.

“We are on track to complete our “Breakeven Plan” in the third quarter and are well positioned for continued strong performance and growth,” President and CEO Vicki Hollub said. “Therefore, we now intend to resume our long-standing share buyback program.”

Conference call Q&A excerpts

Q: As for the Permian, what are the moving pieces around that and potential upsides? What type of well productivity improvements? And how about the natural decline rates in the Permian?

SVP and President of Domestic Oil & Gas Joseph C. Elliott: We tend to take a cautious approach to updating our type curves and projections on new wells.

As we get data beyond the 24-hour IP, beyond the 30-day IP, we really want to start seeing consistency in the 6-month cumes, or even the 1-year cumes, we start moving up our type curves. So some of that is baked into this forward guidance.

The wells on-line count, we’re confident about that, given all the investment in Aventine and the logistics work and the improvements in our execution. The variability in those numbers is really just the fact that a lot of these land right at the end of the quarter, and so a few wells moving in or a few wells moving out changes your count, but it doesn’t appreciably change your production forecast.

Q: On slide 50, you talk about how you drilled some of the best wells in the last 12 months, without any meaningful increases in your completion intensity… can you talk about that?

Elliott: This all really starts with subsurface characterization. It’s what we’ve been talking about over the last year of improvements on geomechanics and geochemistry and integrating our seismic and advancing our petrophysical modeling to better understand what we call flow units, and then how those flow units will behave with a stimulation. That leads to then a better stimulation design that’s customized for basically each well.

But from that customization comes efficiency gains built around standardization. So all of the execution with leveraging Aventine, with how we execute in the field, delivery of sand, the commercial arrangements that support that then turn something that’s very customized into something that’s very manufacturing-oriented. So the combination of those things is really what’s driving what we believe is play-leading capital efficiency.

The other piece in the middle that I want to highlight is what the team does in the area of field development planning. They take all of those attributes and then optimize what’s the best way to develop the field or the different flow units. Do we do them concurrently? Do we do them individually? How do you pace the rigs, how many rigs, how many frac cores? And there are many, many iterations on trying to optimize that, and the ultimate goal is maximum value per section.

And so our teams have gotten very, very good at that, but they also retain flexibility in those field development plans, so as we have new learnings, we have surprises, both positive and negative, we can adjust those plans accordingly. So we really are hitting on all cylinders from subsurface through execution at the wellhead.

Q: Can you walk us through your CapEx?

President and CEO Vicki Hollub: I’ll let Jody cover a little bit more of the lumpiness of the resources business and what we had expected to see in the beginning of the year. But when we laid out our program, we intentionally designed it so that toward the end of the year we would have the flexibility to ramp down, and that’s built into the capital program for 2018.

What we wanted to do is to have the flexibility to ramp down to our $3.3 billion capital in 2019 if we were seeing a $50 environment, which is what we had talked about. Since we’re not sure what pricing will do in 2019 and we want to stay within cash flow with our capital programs in the future, we haven’t set that yet.

So what you’re seeing is an upfront-loaded 2018 capital. With respect to how the wells fit into that, I’ll let Jody talk about that.

Elliott: When you think about the plan for this year, the front end is considerably loaded with more facility activity. In fact, in the second quarter, we’ll be commissioning two large facilities in New Mexico.

And so as you move through the year, even though some of the well count is going up on the completion side, you’re offsetting that with less facility spending. The wells are also the place where all of these efficiencies, the benefits of Aventine which are just starting and which will grow over the year, start coming into play.

Q: You talked about achieving the milestone for cash breakeven as a potential turning point for the new OXY strategy going forward. I’m just wondering what you think is the right level of growth for a company of your size. What do you think your portfolio can support?

Hollub: I think what the portfolio can support and what’s appropriate and prudent to do are maybe two different things.

Our portfolio would support significant growth rates. But we believe that a growth rate certainly above 8% is where we can be very efficiently and effective, and we think that that’s the growth rate that would be appropriate for our dividend level and for the other cash flow priorities we have, as we mentioned earlier, buybacks.

I’m not sure where that ultimate number would be. It really depends on how efficient we get and what types of projects come up. But certainly, one of the things we always want to do is stay within cash flow, so it will be somewhat driven by prices.