Reserves grew 9% to 2.4 billion BOE; 2017 CapEx target is $3+ billion

Occidental Petroleum (ticker: OXY) announced fourth quarter results and 2016 reserves today, reporting a net loss of $272 million, ($0.36) per share, for Q4 2016.

Oxy also released reserves on Monday, showing an increase of 9% to 2.4 billion BOE. The company had additions of 437 million BOE in 2016 and production of 231 million, giving a reserves replacement ratio of 190%. Estimated company-wide finding and development cost was $9.65/BOE. The company reported strong results in the Permian with 210% of production replaced at an F&D cost of less than $9/BOE.

Permian production could double over next 4 years

Since Oxy refocused in 2013, the Permian has become a major facet of the company’s business. Oxy production in the Permian doubled from 2013 to 2016 and can double again over the next four years, according to Oxy CEO Vicki Hollub. The company estimates that its total cost per BOE is ~$20 in the Permian, making current margins greater than 50%.

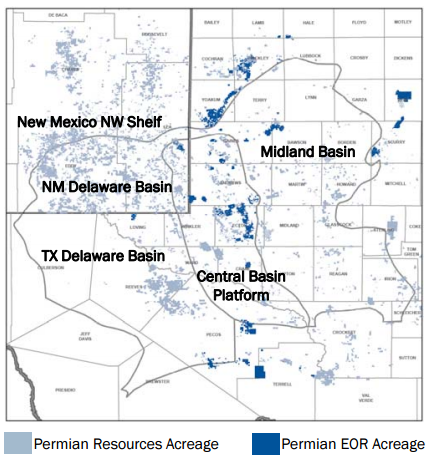

Oxy owns 2.5 million net acres in the greater Permian basin, with 650,000 in the Delaware and Midland basins.

2017 CapEx is expected to be $3 billion to $3.6 billion in 2017, compared to $2.9 billion in 2016. Spending will increase significantly in the Permian, especially in southeast New Mexico and the Greater Barilla Draw area. With an estimated 11,650 drilling locations in the Permian, Oxy has significant room to grow in the basin.

Other projects – UAE, Colombia

- The Shah field, a large gas field in the UAE where Oxy optimized the processing plant to increase capacity by 10% for minimal capital,

- The La Cira-Infantas field, an EOR project in Colombia operated with Ecopetrol, Colombia’s NOC,

- Teca, a heavy oil field in Colombia where a thermal recovery pilot has produced encouraging results.

Q&A from OXY Q4 conference call

Q: My question is your relative capital allocation in 2017, it’s increasing for the Permian Resources up to the mid-30s following these positive well results and inventory update. That appears to be a shift in the strategy towards the Permian. So how should we think about relative capital allocation within this growth bucket? Is it the high end of your Permian guidance, the first call on incremental capital above the dividend and maintenance? And would asset sales drive activity upside in 2017 on the strip?

OXY CEO Vicki A. Hollub: Thanks, Evan. First of all, going back to our cash flow priorities, when we’re looking at the use of cash flow from operations, as I said in my script, we first allocate to our maintenance capital, our HES [Health, Environment, Safety] safety and sustainability capital. Then we fund the dividend. Beyond that, what we consider the growth capital, to allocate that, what we really look at is the combination of what it can provide for us in terms of returns, and also what it does for us in terms of long-term cash flow. So when we make the allocation decisions, it’s a combination of those two that we need to support our objectives and to continue to support the dividend.

But within the portfolio now in terms of what we see in the Permian Resources business, that has been and will continue to be generally our highest return business. And we had this past year – it was really a focus for us. We’ve said for a long time that the Permian Basin is pretty much the foundation of our company, and so Permian Resources is the main growth engine. However, as you can see from the slide 23, of our free cash flow swing in 2017, $400 million we’re expecting to come from our international operations. And of that $400 million, about two-thirds of that will come from our Block 9 contract, which we re-signed last month. So the rest will come from Colombia and Al Hosn. So it’s critically important for us to continue to work on growing our cash flow while at the same time ensuring that we invest as much as we can in the Permian Resources business, which for now for us is generating really good returns.

Q: Could we discuss the 2,500 locations [in the Permian], and then I guess the discussion of the 650,000 acres? What should we think of as the key items that get analyzed and changed such that you are able to double the number of locations and then think about and increase the number of below-$50 breakeven locations going forward? What are the critical path items we should be paying attention to here?

OXY Domestic Oil and Gas President Joseph C. Elliott: For us it’s really probably two things. It’s better execution efficiency. So we’re drilling more wells with the same number of rigs at a lower cost. So our time to market is faster. That changes your economics. The other is subsurface characterization combined with stimulation design. So we’re landing our wells in places that we believe give us the highest stimulated rock volume. We’re staying in zone at a much, much higher percentage through our drilling technologies. And our stimulation designs, in general you’re seeing larger, per-sand volumes tighter cluster spacing. But those are really custom designed by each area. So that’s really created a lot of the increase as well as we continue to appraise and derisk new acreage.

The 2,500 locations below $50, I would think that’s a pretty conservative number given that our approach to spacing we think about in that capital-efficient return-based approach. We don’t want to overcapitalize these assets, and so we look hard at what spacing ought to be. We evaluate that. We test different spacing scenarios, and then continue to look at spacing scenarios from our OBO exposure and learn from those as well.