Warsaw-based ORLEN announces two acquisitions

ORLEN Upstream, a Warsaw, Poland, based subsidiary of PKN ORLEN SA (ticker: PKN), which trades on the Warsaw Stock Exchange, announced two separate acquisitions today for assets in Canada and Poland. The deals included the purchase of all outstanding shares of FX Energy (ticker: FXEN) for total consideration of US$119 million for assets concentrated in Poland, and Alberta-based Kicking Horse Energy (ticker: KCK) for total consideration of C$356 million (US$274 million) for its assets in the Montney Basin.

ORLEN expands in Canada

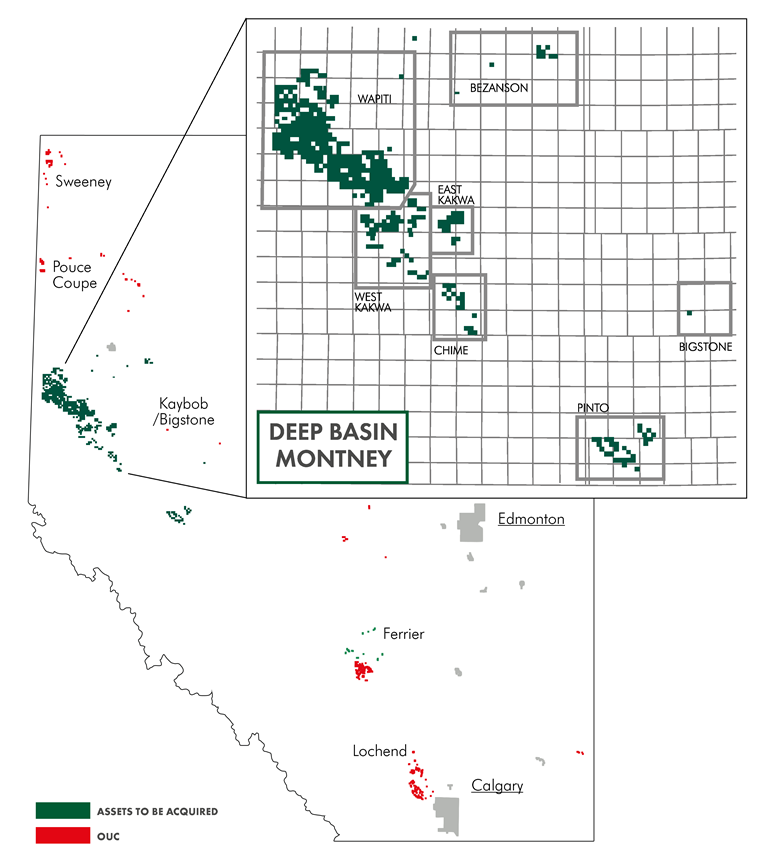

ORLEN’s first announced deal today was for Canadian E&P Kicking Horse Energy, which received C$4.75 per share, or C$293 million, plus the assumption of KCK’s debt, working capital and other adjustments for a total consideration of C$356 million. ORLEN expects daily production from KCK’s assets in the Montney Basin of 4,000 barrels of oil per day (50% condensate), giving the deal an implied value of C$89,000 per flowing BOE (US$68,640 per flowing BOE), 57% more than the median price per flowing BOE for the 54 Canadian listed E&P companies in EnerCom’s database.

Kicking Horse Energy’s key assets are situated in the in the Western Alberta’s highly prolific Deep Montney Basin. According to an assessment carried out as part of a due diligence process, total 2P reserves amount to 30 MMBOE, making the deal value C$11.89 per BOE of total 2P reserves. Kicking Horse shares were trading at $3.24 on Friday, September 9.

The acquisition is part of the company’s continued push to diversify its assets outside of Poland. PKN ORLEN currently holds assets in the Cardium, Dunvegan and Montney formations, where it produces more than 7,000 BOE/d and holds approximately 50 MMBOE of total 2P reserves.

Other recent deals in the Montney include Alberta-based Canamax’s (ticker: CAC) acquisition of 64 net sections of land in the Gremshaw area of the Montney. Canamax purchase 750 BOE/d (54% liquids) and 4.3 MMBOE of total 2P reserves for total consideration of US$24 million, giving the deal an implied value of $32,000 per flowing BOE/d, and $5.58 per BOE of proved plus probable reserves.

Montney Players

The Montney is becoming an increasingly popular play in Canada particularly as companies look to target the liquids- and condensate-rich window in the pursuit of better returns. Blackbird Energy (ticker: BBI) has drilled test wells demonstrating the play’s economics. Blackbird’s 6-26 middle Montney well tested at over 130 bbls/mmcf, while its 5-26 upper Montney well tested at over 340 bbls/mmcf, Blackbird CEO Garth Braun told Oil & Gas 360® in an exclusive interview. Early results from BBI’s wells, as well as positive results by nearby operators, give BBI confidence to move from a plug and perf design with 13 clustered stages (51 intervals) to 71 individual stages for this third well. Blackbird spud its third well in the Montney at the end of September.

Blackbird has been able to acquire 81 sections in the Montney for approximately C$85,000 per section, while other companies like NuVista Energy (ticker: NVA) have purchased land nearby for as much as C$2.9 million per section. Based on the C$356 million consideration for Kicking Horse Energy’s 350 net sections, today’s announcement implies a C$1.02 million value per net section at KCK’s position. Applying the same value of C$1.02 million per net section implies a value of C$82.6 million for Blackbird’s position

ORLEN’s first Canadian acquisition was in September 2013, when it purchased TriOil Resources for total consideration of C$183.7 million before turning TriOil into ORLEN Upstream Canada, the subsidiary that purchased KCK earlier today. The company’s last acquisition was also in Canada when it purchased Birchill Exploration in June of last year for C$255.6 million for 2.6 MMBOE of annual production and 48 MMBOE of total 2P reserves.

ORLEN Expands in Poland

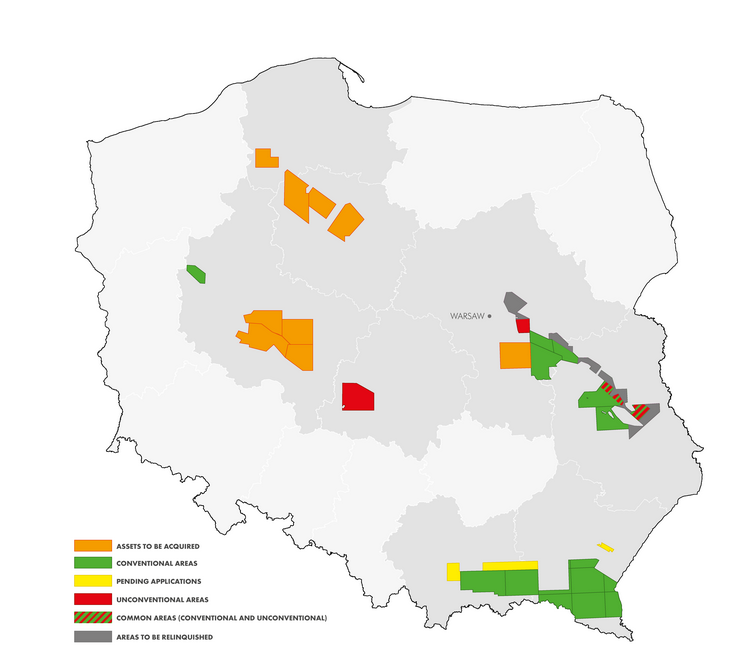

ORLEN acquired its first assets in Poland in 2007, and began drilling for oil and gas in 2011. The company’s operations are focused on unconventional resources, and the company claims its hydraulic fracturing operations are the most intensive in terms of technical parameters, including pumping rates, of their kind completed in Europe to date. The company’s North American assets help to expand and derisk its portfolio while also offering it the opportunity to work in a more mature shale industry. The experience gained in North America is then brought back and used in Poland, according to ORLEN.

ORLEN’s purchase of FX Energy consisted of $1.15 per ordinary share and $25 per preferred share for $83 million, plus the company’s $36 million of debt for total consideration of $119 million. According to Q2’15 numbers from FX, the company produced roughly 11.4 MMcf/d of natural gas, or 1,900 BOEPD. This implies a deal value of $62,631 per flowing BOE, 8% higher than the median price per flowing BOE of $58,892 for the 85 U.S. listed E&P companies in EnerCom’s database. According to a press release from ORLEN, the FX acquisition will add 8.4 MMBOE of total 2P reserves, at an implied value of $14.17 per BOE of reserves.

The assets owned by FX Energy in Poland are located in two areas, Fences and Edge, shown in the map below. The company also possesses a concession block in the Lublin Basin neighboring ORLEN Upstream’s concessions (Wołomin and Garwolin). FX Energy also produces crude oil from conventional assets in Montana and Nevada, USA.

Fences consists of four exploration blocks located in Greater Poland Voivodeship, according to ORLEN. The primary target reservoir and prospective subsurface is Rotliegend sandstone, at a depth below 2,000 meters. FX Energy owns 49% in seven producing fields, with the remainder being held by Polskie Górnictwo Naftowe i Gazownictwo (PGNiG), the Polish state-run oil and gas company.

The Edge project area consists of four exploration blocks 100% owned by FX Energy. In addition, in 2013, the company discovered Tuchola deposit currently being prepared for development.

Majors have left the country

As ORLEN looks to increase its investments in Poland other international oil companies have all taken flight. In June of this year, ConocoPhillips (ticker: COP) announced that it would be leaving the country, making it the last international oil company to leave Poland. COP said its subsidiary Lane Energy Poland has invested around $220 million in Poland since 2009 without any commercial success.

According to the Energy Information Administration (EIA), Poland’s energy resources consist mostly of coal, but there was some hope that gas could be extracted from shale formations using hydraulic fracturing. Poland’s technically recoverable shale gas resources were downgraded to 148 trillion cubic feet (Tcf) in 2013 from a 2011 estimate of 187 Tcf.

Apache Energy (ticker: APA), Chevron (ticker: CVX), ExxonMobil (ticker: XOM), Marathon Oil (ticker: MRO) and Total (ticker: TOT) have all tried to produce commercial quantities of shale gas in Poland, but all decided to abandon operations after little success.