Skepticism remains about OPEC deal as group’s production chalks up another record high

Both U.S. and international crude oil benchmarks WTI and Brent were down over $1 per barrel today following a rally in prices brought on by last week’s OPEC production agreement. Oil prices shot over the $50 per barrel mark after OPEC announced it would cut 1.2 MMBOPD of production, and non-OPEC producers including Russia pledged to cut another 600 MBOPD.

Skepticism around whether or not OPEC and others will actually hold up the bargain began to weigh on prices more heavily Tuesday, not even a week after the cartel’s long awaited Dec. 1 meeting.

According to a survey conducted by Reuters, OPEC production hit 34.2 MMBOPD in November—another record—up from 33.8 MMBOPD in October, and 1.7 MMBOPD more than the group’s new production quota of 32.5 MMBOPD.

Also adding to concerns that the battle for market share may not be over between members of OPEC, Saud Arabia offered a deeper-than-expected price cut to its Asian customers.

“What you want to keep a watch out for now is the (price) for Iran,” said Bob Yawger, director of the futures division at Mizuho Securities USA Inc. “If they undercut the Saudis, then we have a problem.”

A race to the bottom for oil prices to customers in Asia could encourage increased production from regional rivals Saudi Arabia and Iran. Many analysts worried that divisions between the two would stymie a production deal last week, and now a continued battle for market share could seriously threaten the stability of the deal that was struck.

“Adherence to assigned OPEC quotas is apt to be limited and enforcement of such nearly impossible,” Jim Ritterbusch, president of Chicago-based energy advisory firm Ritterbusch & Associates, said in a note.

“With most of the planned reduction falling on the shoulders of the Persian Gulf producers, we look for other OPEC members to virtually ignore assigned quotas,” Ritterbusch said.

Traders and analysts will keep a close eye on exports next year for evidence of the cuts. OPEC’s history of complying with quotas is far from perfect, and many are concerned the group may not follow through on production cuts. A note from Commerzbank suggested that Saudi Arabia may wait until January to seasonally adjust its production to its lower winter level rather than making cuts to production.

Higher shale production could cause price volatility

The losses today were not completely unexpected, with some traders taking profits on the sharp increase in oil prices over the last week. Adding to downward pressure is the expectation that government data will show a build in U.S. crude oil inventories Wednesday as higher oil prices encourage shale developers to boost production in the United States.

Stockpiles at Cushing, Oklahoma, rose by about 3 MMBO in the week ended Friday, The Wall Street Journal reported, citing numbers from Genscape.

Increased production from shale plays in the U.S. will likely make oil prices volatile for some time, according to IEA chief Fatih Birol. Prices approaching $60 per barrel will encourage more production from the U.S., he said.

“What does it mean? Again downward pressure on prices. A lot of oil and the demand will not be able to eat up that oil. So therefore the upward push on prices may end up in stronger growth from United States and elsewhere which are profitable not at $45 but profitable around $55-$60.

“This volatility may be with us for some time … We are entering a period of greater oil price volatility,” Birol said.

But there are U.S. producers who say they can make money when oil is below $60 per barrel. The largest of the independent E&Ps, ConocoPhillips, said in November it has retooled its business to work at a $50 breakeven oil price.

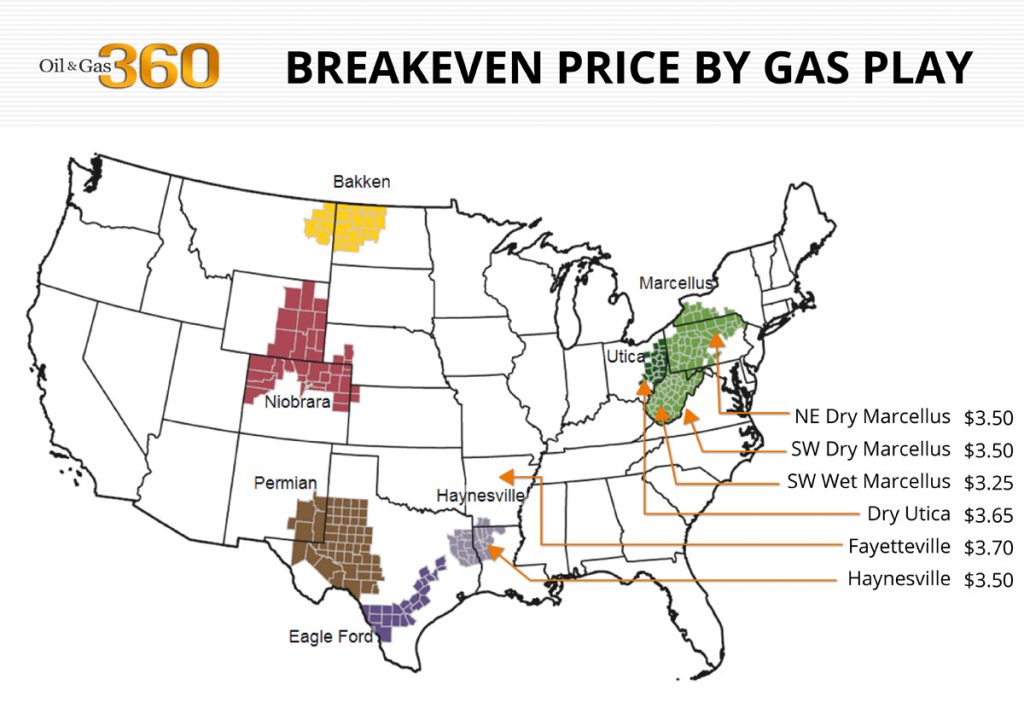

Last spring, KLR’s energy research team came out with a report that calculated the median breakeven price for oil drillers is $55 per barrel. For gas, KLR says the median breakeven is $3.50 per Mcf.

As far as the OPEC producing member breakevens, the only two countries who are even close are Qatar at $58 and Kuwait at $52, according to a Statistica report detailing breakeven prices in Middle Eastern and North African countries.