Countries exempt from the OPEC production deal are ramping up production

Even as the Organization of Petroleum Exporting Countries looks to rebalance markets through coordinated production cuts within its ranks and with other non-members, production from the group is up.

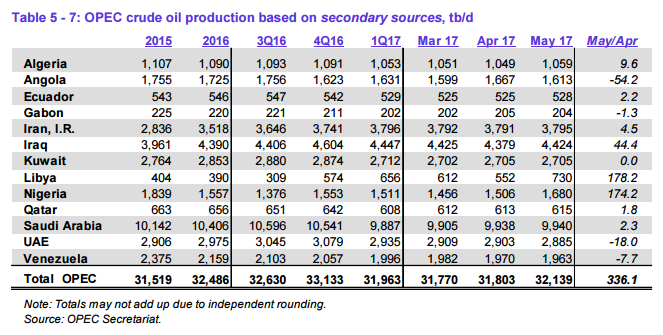

OPEC released its June Monthly Oil Market Report Tuesday showing that its production grew 0.34 MMBOPD to 32.1 MMBOPD in the month of May.

The bulk of the additions in May came from Libya and Nigeria which added 178.2 MBOPD and 174.2 MBOPD, respectively, to their overall production. Both countries are exempt from the current production cut deal as they look to regain production that has been lost due to civil war and attacks on oil and gas infrastructure. While the added production does not violate OPEC’s agreement, it does undercut the effect the group is trying to achieve as a glut of oil continues to put downward pressure on oil prices.

Both WTI and international benchmark Brent crude oils were down over 3% Wednesday following the news that OPEC production was up, and that inventories in the United States continued to build. Prices have faltered since OPEC and the non-OPEC producers who agreed to cut production along with the group extended their cuts nine months but did not deepen the amount of production they were taking off the market.

OPEC maintains demand growth forecast, but some crude is already stranded at sea

In its report, OPEC maintained its oil demand growth forecasts from last month. The group said world demand last year is expected to clock in at 1.44 MMBOPD while demand growth for 2017 should reach 1.27 MMBOPD for a total of 96.38 MMBOPD, both of which are in-line with the group’s previous report. The forecast for oil demand growth in China and India have also been left unchanged at 0.34 MMBOPD and 0.12 MMBOPD, respectively.

Currently, some crude sellers are facing obstacles finding buyers for the crude that has already been produced. The supertanker Saiq, chartered by Royal Dutch Shell (ticker: RDSA), is currently sitting 530 miles off the coast of the Canary Islands looking for a buyer, according to Bloomberg.

The ship originally intended to deliver some 2 MMBO of North Sea oil to China, but the country does not appear interested in making the purchase. This left the Saiq idling off the coast of Africa after it had already departed from its port of origin near Edinburgh. Shell went so far as to offer to do a ship-to-ship transfer all the way back in Scotland but was unable to find any interested buyers.

Production from non-OPEC producers including the United States is also expected to continue putting pressure on oil prices, according to the International Energy Administration. The group believes that total non-OPEC production will grow 700 MBOPD this year creating more supply for markets to absorb even as it looks for places to sell cargos like the one held aboard the Saiq.