Bloomberg’s numbers are less

OPEC cut compliance has hit its highest point in in this round of cuts, according to a story released by Reuters today.

Total cut compliance, including both OPEC and non-OPEC countries, reached 106% in May, Reuters reports. OPEC countries are displaying 108% compliance with their share of cuts, while non-OPEC producers are in 100% compliance. According to Reuters’ sources, this is the highest compliance rate since the beginning of the deal in January.

Bloomberg data suggests 100%

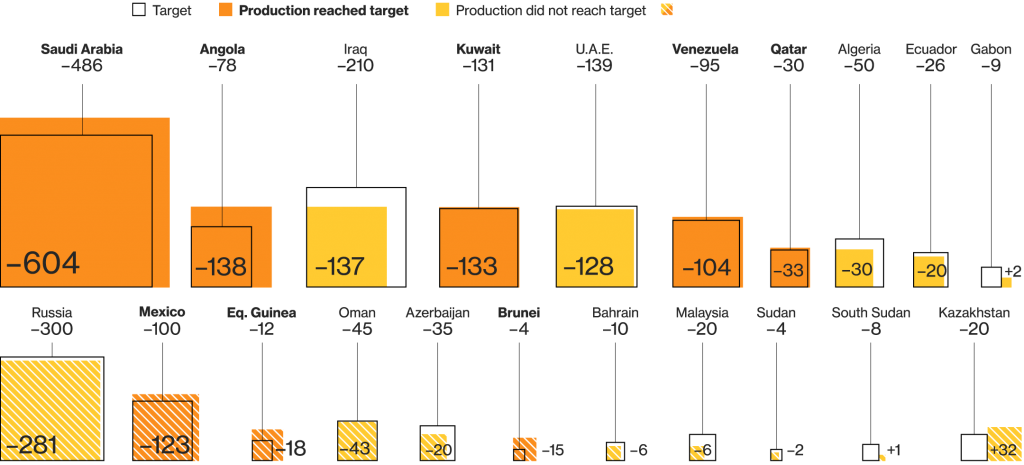

Bloomberg reports a different story, however. According to Bloomberg, OPEC countries cut production from October levels by 1,237 MBOPD, representing 106% cut compliance. Non-OPEC producers, by contrast, cut only 481 MBOPD from October production levels, only 86% compliance. Bloomberg’s estimated total cut compliance, therefore, is only slightly below 100%.

Bloomberg singles out two countries as over-contributing to ensure the total OPEC compliance stays high. Saudi Arabia is producing 604 MBOPD less than it was in October, compared to its pledged cut of 486 MBOPD. Among OPEC nations Angola displays the highest level of cut compliance, at 177%.

U.S. oil imports still haven’t been affected by OPEC cuts

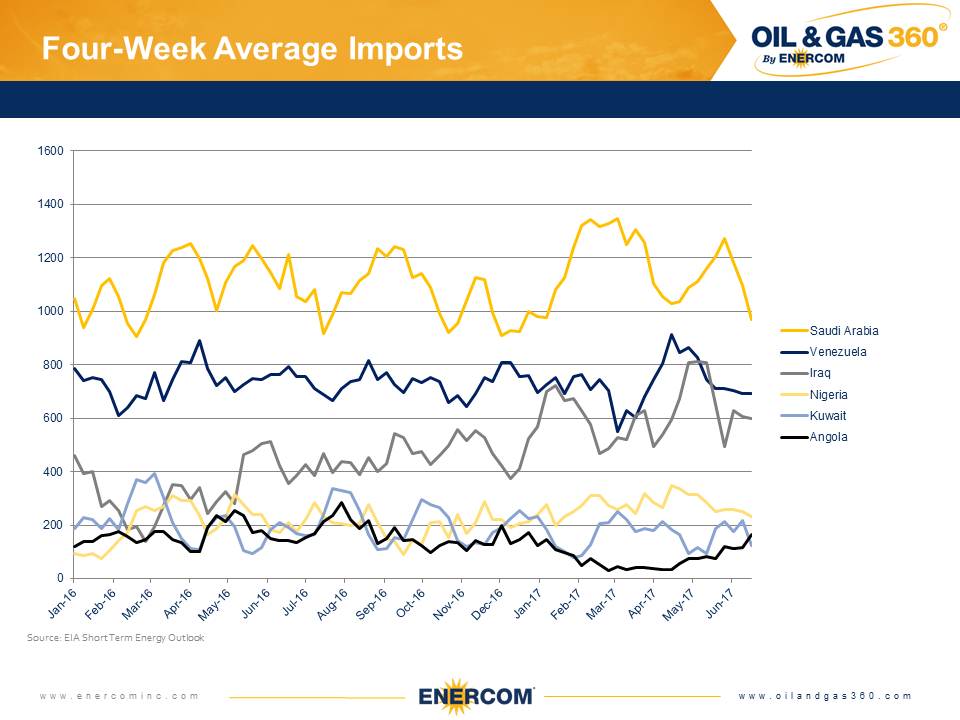

While both Reuters and Bloomberg agree that OPEC cut compliance is high, the effects have not yet been borne out in U.S. imports. American oil imports from Saudi Arabia rose sharply in January, and then fell in March and April. A rise in May was counterbalanced by a sharp drop in June.

Imports from Venezuela, Iraq and most other OPEC producers show similar patterns. Significant variability occurred since cuts began, but little overall change is seen. This situation could change soon, though—Saudi Arabia says it may cut exports to U.S. in July.

OPEC’s official goal is rebalancing the global oil market, but an additional goal is to increase oil prices. As current U.S. inventories seem to be one of the main drivers of price changes, Saudi Arabia is considering targeting oil prices more precisely.

According to CNBC, Saudi Arabia plans to cut exports to the U.S. in July. This would almost certainly result in a decrease in oil inventories, as refineries are running at record highs this year. John Kilduff of Again Capital estimates that Saudi exports to the U.S. could drop by 100 to 250 MBOPD, which represents 10-25% of the current four-week average.

If Saudi Arabia’s plan does increase draws on crude oil inventories, OPEC’s as-yet unachieved goal of raising oil prices may succeed after all.