“We bought one shale and got another one for free.”

Continental Resources (ticker: CLR), the nation’s eighth-largest E&P based on market capitalization, held its 2014 Analyst Day today in Oklahoma City, its first since 2012.

The Springer Shale is Unveiled

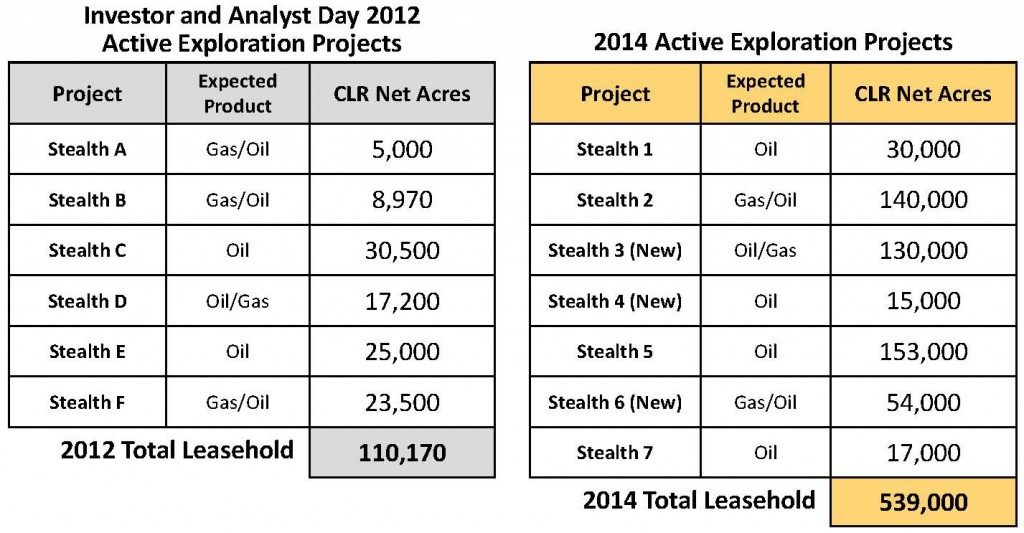

At the Analyst Day, Will Parker, Senior Exploration Geologist, said CLR published a list of six stealth plays in 2012. “Using our expertise, we have turned a stealth play into a reality,” he said.

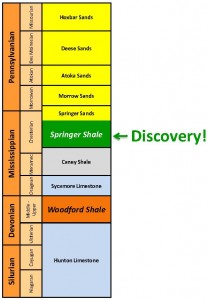

Continental’s find is the Springer Shale, in the heart of the SCOOP play.

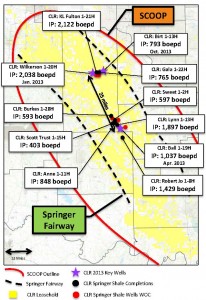

The company’s first discovery well, named the Wilkerson 1-20H, was completed in January 2013. The well returned an initial production (IP) rate of 2,038 BOEPD. Continental responded by drilling two more wells in the Springer’s oil window. The Ball 1-19H, a stepout well drilled 25 miles to the southeast, served as a delineation test and returned an IP rate of 1,037 BOEPD. The Birt 1-13H was drilled near the Wilkerson and produced an IP rate of 793.

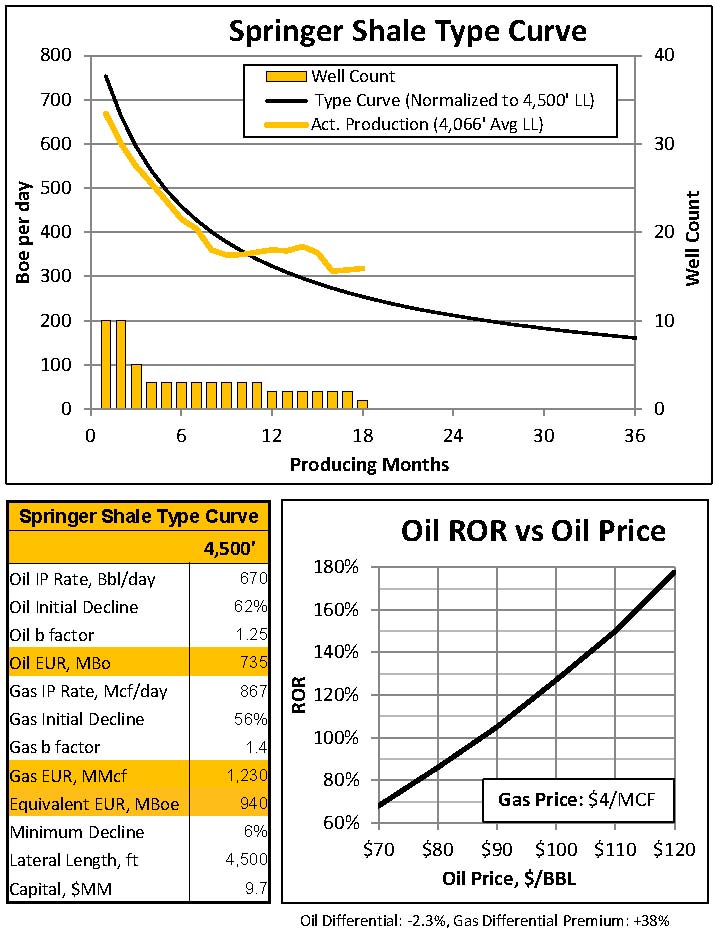

CLR opted to go stealth, keeping quiet on its find and making land acquisition its priority. Since 2012, the company has boosted its SCOOP acreage by 540% and now holds 195,000 net acres. A total of 11 wells have been completed to date, with the highest IP registering at 2,133 BOEPD. The 11 Springer wells, on average, are returning IPs of 700 BOEPD and a type curve of 940 MBOE – sufficient for a 100% rate of return at costs of $9.7 million per well. The Wilkerson has produced a cumulative total of 300 MBOE in its first 20 months of production.

Additional well results are coming: three are on flowback and two will be completed before the end of the month.

Doubling Down in the Woodford

Since the Springer Shale is above the Woodford, all previously drilled Woodford wells provide a “free look” into the Springer, according to CLR management. Additionally, the company can list two formations as held-by-production with a single wellbore. “We got a two-for-one,” said Parker. “We bought one shale and got another one for free.”

CLR previously had one rig running in the Springer. By the end of 2014, they’ll have eight, and its first drilling density test (on 128 acre spacing) is underway. Under its current program, the company has 11 to 12 years of drilling inventory focused solely on the oil window.

More Bakken CapEx: Two Mile Laterals, Enhanced Completions

The Analyst Day presentation extensively reviewed CLR’s operations in the Bakken and Mid-Continent and plans on ramping up its 2015 capital expenditures to $5.2 billion from 2014’s forecast of $4.55 billion.

The majority of the increase can be attributed to higher well costs involved with enhanced completion techniques. The average cost for Bakken wells will be around $10 million, which is $2.0 million to $2.5 million above current costs due to the desire to drill “two mile laterals whenever possible,” according to company management. CLR expects volume rates to increase in 2015 as a result of using enhanced completion techniques, and the company still expects to exit 2014 at a production rate of 200 MBOEPD.

What Else Does Oklahoma Hold?

The South Central Oklahoma Oil Province, or SCOOP, was estimated by CLR at the beginning of the year to hold as much as 70 billion barrels of oil. Matt Portillo, managing director of equity and research for Tudor, Pickering, Holt & Co, expects the play’s production to reach 100 MBOEPD by 2018.

CLR management mentioned a handful of other formations as potential add-ons to its current progress, including the Northwest Cana and the Meramec “STACK.” The Meramec, known by some throughout the industry as the SOHOT play, was identified as a core play by Unit Corporation (ticker: UNT) in May 2014. The company’s first well in the area averaged 1.1 MBOEPD for its first 30 days and has returned 115 MBOE through its first 115 days of production, according to its Q2’14 release.

Similarly, CLR has experienced a slow decline curve on its Wilkerson well. “This a little different than your typical shale play,” said Parker. “When you look at the way the decline curve flattens out, that itself says there’s something else in this reservoir that we’re trying to understand. We’re seeing evidence of a hybrid type play that’s performing unlike a typical shale play.”

Stealth Plays

Continental Resources featured its exploration team on a slide in the Analyst Day, saying it has tripled the members of its team since 2012. CLR management repeatedly mentioned its commitment to exploration throughout the Analyst Day and highlighted its work on “stealth plays,” which are listed below, and none are in the core areas of the Bakken and Woodford. Play #3 turned out to be the Springer Shale.

“We don’t want to go out and pay retail value for acreage,” said Tony Barrett, Geologic Manager for Continental Resources. “We want to be there first, and we want to be the innovators… These stealth projects all have the potential to be the next great growth driver for the company.”

The company is adopting a wait-and-see approach on SCOOP expenditures, but do expect 25% of 2014 capital to be directed to the play. That number will increase to 30% by 2015. The Bakken will command the majority of CLR’s budget in the near term.

However, competitor Newfield Exploration believes Oklahoma does have one benefit over the Bakken, and that is: “Location, Location, Location.” In an interview with the American Association of Petroleum Geologists, Steve Campbell, Newfield’s Vice President of Investor Relations, mentioned the state’s established procedures, favorable laws and extensive infrastructure, which offer “a distinct advantage.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.