OilService Companies are Finding Ways to Make Business Work in this Price Environment

The people working in American industry can be pretty darned resilient and very creative when markets get rough. Oil and gas producers and oilservice companies are certainly no exception. Companies in and around the businesses associated with oil production are finding new ways to do things better, cheaper, faster and with more impact.

Diamond Offshore and GE Oil & Gas Unveil Unique Performance Based Service Contract

Diamond Offshore Inc. (ticker: DO; DiamondOffshore.com) and GE Oil & Gas (ticker: GE; GEoilandgas.com) have announced a new breed of oil service contract for blowout prevention offshore drilling that will be performance based, a first-of-its-kind for offshore oil service companies.

As part of the deal GE Oil & Gas will purchase the blowout preventers (BOPs) from Diamond Offshore for use aboard Diamond’s four drillships in the Gulf of Mexico for $210 million. GE will purchase a total of 8 BOPs at $26.25 million per unit. These units will be utilized by Diamond on a pay for performance basis over a ten-year period. GE will be responsible for the maintenance, certification, repair, and data monitoring of the units and GE personnel will be aboard the drillships to ensure the functionality of the BOPs.

GE Oil & Gas is the manufacturer of the equipment that would typically be on the outbound sales end of the deal. However, the structure of this deal entails that GE will be responsible for the rental and service of the product. GE will still generate revenue through this structure, and the technology will likely lead to higher returns on the use for the product for Diamond. GE also possesses monitoring and analytics solutions that were previously unavailable to Diamond.

“Subsea equipment repair and maintenance is the single largest cause of nonproductive time across our industry, resulting in great expense to both drillers and operators,” said Marc Edwards, President and CEO of Diamond Offshore. “In today’s market, we have to make the economics of offshore drilling more competitive for our clients. The purpose of our new Pressure Control by the Hour service model is to incentivize all parties to prioritize equipment reliability and availability for the ultimate benefit of our customers.”

Skin in the Game

Among the unique aspects of this deal is the ‘skin in the game’ principal with this partnership. GE has guaranteed the performance of the BOPs and have assigned personnel accordingly, this in turn simplifies Diamond’s operations. With experts on board to handle any issues that may arise, both companies are incentivized to reduce downtime, which equates to fewer disruption and increased revenue.

“This is a key part of GE’s business strategy to collaborate with drilling contractors and operators to push the boundaries of our industry,” said Lorenzo Simonelli, President and CEO, GE Oil & Gas. “Our new CSA model addresses the current needs of drilling companies, and establishes the roadmap for smart, predictive, condition-based services and maintenance in our digital-industrial future.”

GE Oil & Gas gains from this situation due to the new stream of revenue and the new construct of how that revenue is generated. Diamond gains from the sale price and increased liquidity, a reduction of personnel on the ship, and the guarantees that GE has placed on the performance.

This and other pay-for-performance contracting arrangements between partners in the oil service industry could signal a beneficial new paradigm has is emerging out of the downcycle.

No Fuss, No Muss, and No Cash Needed until Results are Generated

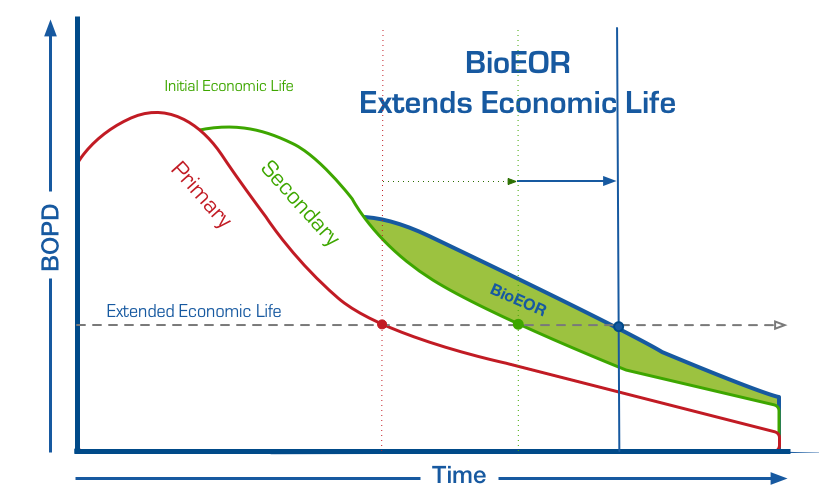

Another example of this contracting model comes from Transworld Technologies. Transworld makes a unique BioEOR additive that excites microbes that live in the formations that are now under mature waterfloods to the point where the native microbes will successfully redirect the operator’s ongoing flood into hard to reach pockets of oil, generating as much as a 25%-50% production uplift. Transworld offers the service with a zero upfront cost structure to the operator.

The operator doesn’t have to buy or lease equipment, pay for transportation of materials, build infrastructure or hire any new personnel. “Most importantly, they don’t have to interrupt the waterflood operation; they simply add a small concentration of our Activ8 formulation to the flood injection they’re already doing,” Karl Weber, Transworld’s president, told Oil & Gas 360® in an interview about the technology this week.

Cost Savings in Every Department: Improved Efficiency in Making Royalty Payments

The financial service companies are keenly aware that oil and gas companies are facing high profile challenges.

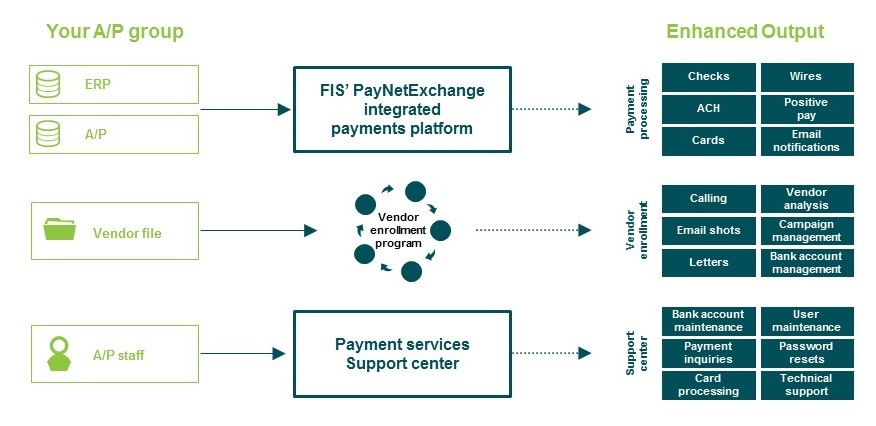

On the accounting side of oil and gas, payments is an area that is often ripe for increasing efficiency and cost savings for oil and gas companies. Many companies are still disbursing paper checks, a practice that is generally agreed to be highly inefficient and costly, but Jacksonville, Florida based FIS and other third party financial services providers are creating efficiencies for royalty payments and the accounts payable functions.

Oil and gas companies typically have two distinct accounting functions responsible for making payments: a traditional accounts payable (A/P) function to make payments to vendors and suppliers, and a royalty department to pay royalty owners for the production that takes place on their lands.

Often the volume and detailed accounting of royalty payments is significantly higher than that of everyday accounts payable. Royalty payments are sent out once a month and tend to come with very detailed statements outlining the amount of oil and gas companies that has been produced by a particular well. While the A/P department might just send a check and remittance record, the royalty payment team may have to compile three to eight pages of accompanying documentation for the produced oil and gas from multiple wells.

Outsourcing payments to an integrated payments platform that can print and mail checks as well as migrate paper checks to electronic payments can sometimes reduce or even eliminate payment processing costs. The integrated payments platform can also offer vendor enrollment, data management, and ongoing support services—common hurdles for companies who lack the resources to manage these functions and often prevent companies from migrating checks to electronic payment.

Paying Vendors with Virtual Cards

Another twist from the financial world is that companies now have the option to disburse their A/P payments via virtual cards. These are single-use, unique card numbers with fixed credit limits that are set based on a given company’s payment instructions. An integrated payments platform permits electronic remittance advice to be viewed by vendors or owners via a secure portal and it would be downloadable in a variety of industry standard file formats for input to the vendor’s A/R system.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.