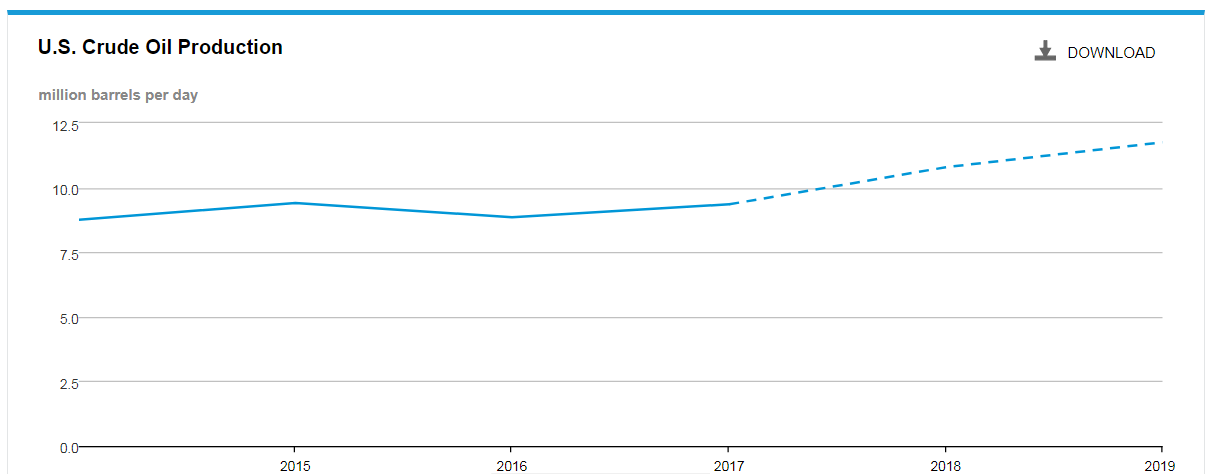

EIA forecasts 11.8 MMBOPD for total U.S. oil production in 2019

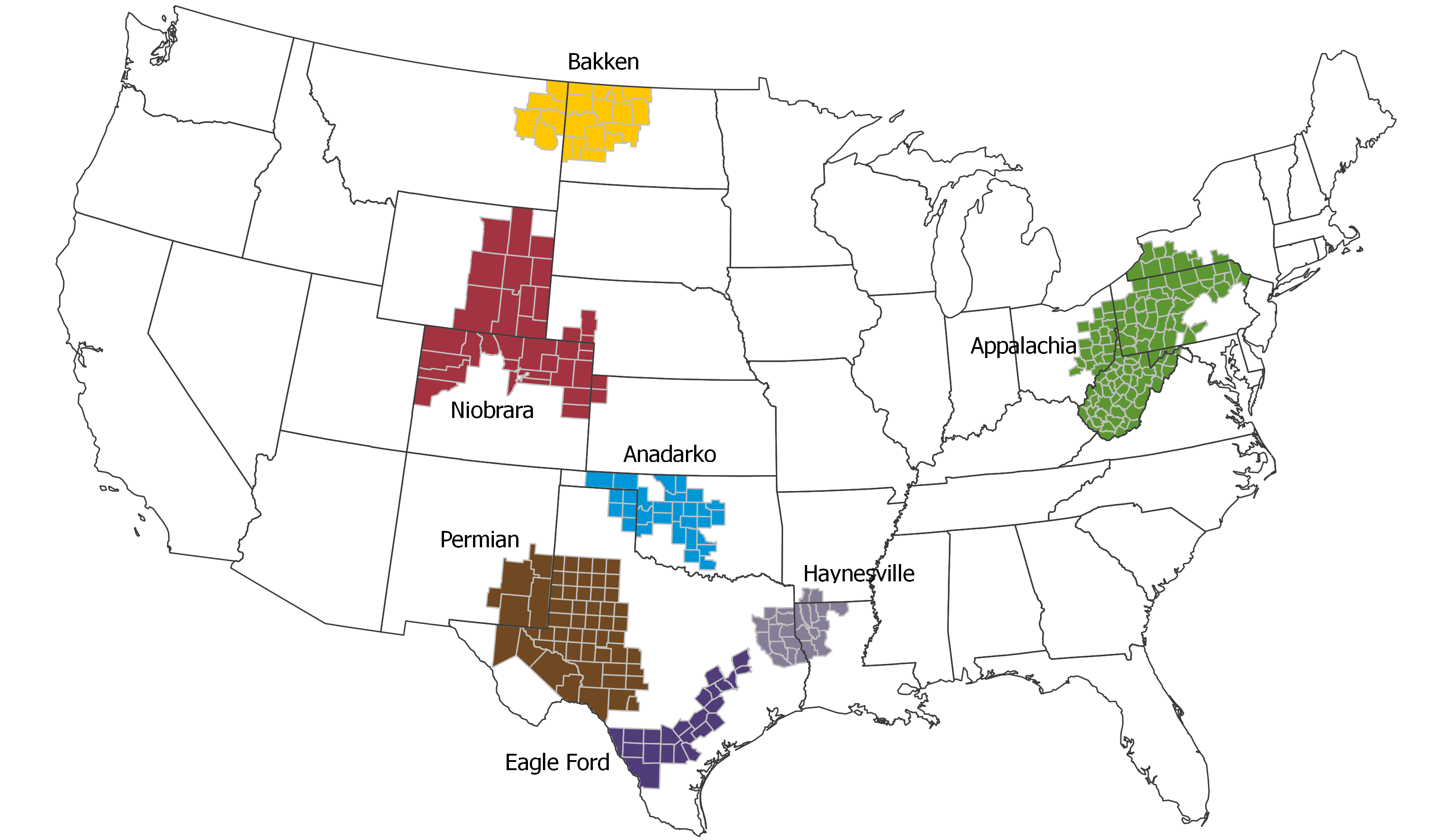

A new IHS Markit outlook released today expects the Permian Basin’s crude oil production to more than double its 2017 record of 2.5 MMb/d to 5.4 MMb/d by 2023.

This level of production would elevate the U.S. to a power exporter status that rivals Saudi Arabia, with total U.S. exports potentially reaching 4MMb/d.

Not just oil

Production of natural gas and natural gas liquids in the Permian are also expected to double during this time. IHS Markit expects Natural gas to reach 15Bcf/d and NGLs to reach 1.7 Mbd.

The one major obstacle for the Permian to overcome right now is the takeaway bottleneck of the region—the pipelines are full. Currently producers lack enough ways to transport their products out of the Permian. Following the service start of Enterprise Products Partners (NYSE: EPD) 300,000 b/d capacity Midland-Sealy pipeline in early December of 2017, the Permian’s takeaway capacity rose to roughly 2.8 MMb/d. However, the regions capacity is still nearly maxed out and has been reflected in price discounts.

In its outlook, IHS Markit believes the introduction of 41,000 new wells and the spending of $308 billion on upstream infrastructure between 2018-2023 will allow the Permian to fully develop.

Key Outlook Assumptions:

- WTI crude oil prices, on average, of $60/bbl or higher

- Upstream cost inflation of roughly 33 percent by 2023 relative to 2017 levels

- Net upstream cash flow 2018-23: +$47.5 billion

- A 2.5 Mbd expansion of crude oil pipeline capacity

- An 8.0 Bcf/d expansion of natural gas pipeline capacity

- Additional gas processing capacity of 7 Bcf/d by 2023 to handle liquids-rich gas production

- Decelerating production growth in the early 2020s due to high capital investment requirements and an assumption of little productivity improvement

According to Raoul LeBlanc, executive director and head of the HIS Markit Performance Evaluator, this outlook is “far from a ‘best case’ forecast, the IHS Markit outlook applies realistic scenarios and anticipates likely bottlenecks.”

EIA short-term production forecasts: U.S. crude oil imports will drop to lowest level since 1959

The EIA put out its Short Term Energy Outlook yesterday, saying U.S. crude oil production will average 10.8 million b/d in 2018, up from 9.4 million b/d in 2017, and will average 11.8 million b/d in 2019.

EIA forecasts that total U.S. crude oil and petroleum product net imports will fall from an annual average of 3.7 million b/d in 2017 to an average of 2.5 million b/d in 2018 and to 1.6 million b/d in 2019, which would be the lowest level of net oil imports since 1959.

EIA forecasts crude oil production from OPEC will average 32.0 million b/d in 2018, a decrease of 0.4 million b/d from the 2017 level. OPEC crude oil production is expected to increase slightly to an average of 32.1 million b/d in 2019. The agency said that the increase in production in 2019 is expected to occur despite falling production in Venezuela and Iran. EIA assumes these decreases will be offset by increasing production from Persian Gulf producers, primarily Saudi Arabia.

On the gas side, EIA forecasts dry natural gas production will average 81.2 Bcf/d in 2018, establishing a new record. EIA expects natural gas production will rise again in 2019 to 83.8 Bcf/d.

Growing forecast U.S. natural gas production supports increasing forecast liquefied natural gas (LNG) exports. LNG exports averaged 1.9 Bcf/d in 2017. EIA forecasts LNG exports to average 3.0 Bcf/d in 2018 and 5.1 Bcf/d in 2019. Dominion Energy’s Cove Point LNG facility is ramping up exports. In April, the facility exported an estimated 13.4 Bcf, implying baseload utilization of 65%, and in May, it exported an estimated 23.5 Bcf, implying baseload utilization of 94%.

EIA expects Henry Hub natural gas spot prices to average $2.99/million British thermal units (MMBtu) in 2018 and $3.08/MMBtu in 2019.