Venezuela’s citizens are left holding a bag, one that is saddled with $60 billion dollars worth of debt.

Citizens of Venezuela have been buying into bonds due to government policies of subsidizing the purchase of foreign debt by individual investors, Reuters reported in December 2017.

Big businesses in the country have also poured money into the bonds, hoping to capitalize on the exorbitant yields and balance out losses from the OPEC nation’s collapsing economic system.

Schlumberger Limited (ticker: SLB) and Halliburton Company (ticker: HAL) both wrote-down investments due to Venezuela’s instability. Schlumberger recorded a charge of $938 million during the fourth quarter of 2017 and Halliburton recorded an aggregate charge of $385 million during the fourth quarter of 2017.

“Venezuelan bond investors range from taxi drivers to large companies, and everything in the middle. A lot of companies also got in to protect themselves from the depreciation of the currency. Even very orthodox companies who were never involved in capital markets started buying them as a means of hedging,” local broker Victor Silva told Reuters.

Too many zeros

Bloomberg reported that Venezuela’s hyperinflation has people paying bolivar by the pound (or kilogram). The inflation has gotten so bad that six-digit deli scales can’t weigh bolivar accurately enough. With so much money/inflation, it’s faster to weigh the paper bills rather than count them out – especially when a kilogram of ham costs about 1.48 million bolivars, or $44.40 U.S.

Older debit and credit card machines are having a hard time keeping up with the million-dollar transactions as well. Screen sizes limit the full dollar amount, so some retailers have to break the transaction amount into multiple transactions and receipts.

The Café Con Leche Index tracks how much a cup of coffee costs in Venezuela. One cup costs about 75,000 bolivars—$2.25 in U.S. currency—which is an increase of 4,067% over the past 12 months. At that time, a cup of coffee was only 1,800 bolivars.

Bolivars for US dollars?

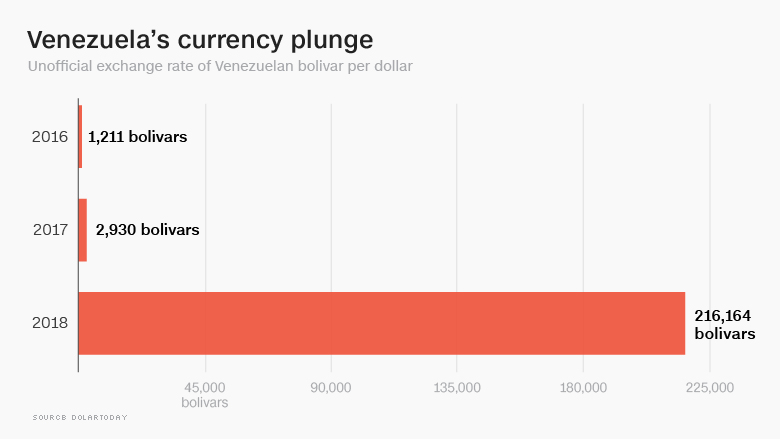

The bolivar has lost 98% of its value due to inflation, according to one statistic from CNN Money. To address this issue, one solution has already been implemented by some small nations such as El Salvador and Ecuador – dollarization, replacing the bolivar with American greenbacks.

“There’s no way they can get anything under control in Venezuela unless they dollarize. The bolivar is gone already,” Steven Hanke told CNN Money. Hanke is a professor at Johns Hopkins University and he advised the governments of Ecuador and Montenegro as both institutions dollarized.

The government would have to establish a temporary exchange rate for citizens to turn bolivars into dollars. However, the exchange rates vary dramatically according to who’s answering. One presidential candidate, Henri Falcon, and his team said that the exchange rate would be 68 bolivars per U.S. dollar.

However, the unofficial exchange rate is about 216,000 bolivars per U.S. dollar – the rate that Venezuelans use right now.

OPEC reports Venezuela’s oil production still crashing

According to OPEC’s Oil Market Report for February production, Venezuela pumped 1,548 MBOPD in February, 52.4 MBOPD below last month’s production level. According to Bloomberg, the country is producing at the lowest rate since early 1989, almost 30 years ago. The country has seen production drop by almost 24% since the beginning of 2017, a truly drastic decline. With no regime or policy change in sight, it seems likely that Venezuela’s production slide will continue in coming months.

“Venezuela remains highly dependent on oil revenues, which account for almost all export earnings and nearly half of the government’s revenue, despite a continued decline in oil production in 2017,” the CIA said in its World Factbook of country intelligence.

“In 2017, GDP contracted 12%, inflation exceeded 1000%, people faced widespread shortages of consumer goods and medicine, and central bank international reserves dwindled. In late 2017, Venezuela also entered selective default on some of its sovereign and PDVSA bonds. Domestic production and industry continues to severely underperform and the Venezuelan government continues to rely on imports to meet its basic food and consumer goods needs.

Falling oil prices since 2014 have aggravated Venezuela’s economic crisis. Insufficient access to dollars, price controls, and rigid labor regulations have led some US and multinational firms to reduce or shut down their Venezuelan operations. Market uncertainty and state oil company PDVSA’s poor cash flow have slowed investment in the petroleum sector, resulting in a decline in oil production.”

Election postponed

Venezuela’s government and opposition parties are postponing the upcoming April presidential election by a month. They are to be held in May now.

President Nicolas Maduro plans to run for a second six-year term “amid an economic collapse that has sent migrants to neighboring countries,” Reuters reported.

The main opposition coalition is boycotting the election on the grounds that the elections council has historically favored the ruling Socialist Party, and because the best-known candidates have been jailed or barred from holding office, Reuters said.