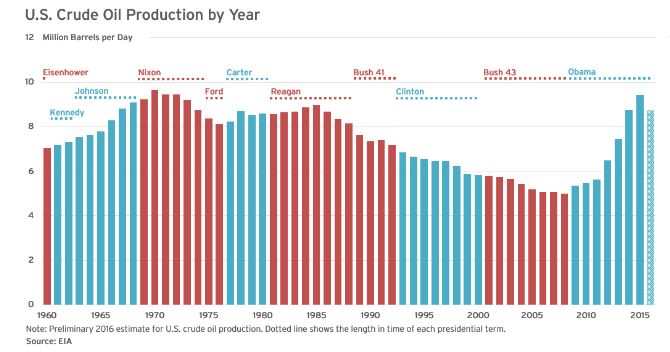

Regardless of who is living in the White House, global demand and supply cause price movements and drive production of crude oil.

SAFE has added the presidential terms to the bars of crude oil production since the end of Dwight Eisenhower’s term.

The U.S. presidential election is Tuesday, Nov. 8. Don’t forget to vote.

The website Diffen.com presents a comparison of the two major candidates’ tax plans:

Candidate Comparison Chart – Tax Plans

| Donald Trump’s Tax Plan versus Hillary Clinton’s Tax Plan comparison chart | ||

| Donald Trump’s Tax Plan | Hillary Clinton’s Tax Plan | |

| Tax Philosophy | Cut taxes for everyone | Increase taxes, especially on high-income earners. |

| Tax Brackets – Ordinary Income | Three – 12%, 25%, 33%. Earlier proposal: 10%, 20%, 25% | Eight – 10%, 15%, 25%, 28%, 33%, 35%, 39.6%, 43.6% |

| Tax Brackets – Investment Income | Three – 0%, 15%, 20% | Complex. Long-term gains will be redefined to assets held > 6 years. Tax rates of 0%, 15%, 20% and 24% on long-term. Additional surcharges on some. Higher rates for all if assets held for fewer than 6 years. |

| Net Investment Income Tax | Repeal | Retain |

| Estate Tax | Repeal | Retain and expand. Increase tax rate from 40% to 45%; and add new tax brackets for 50%, 55% and 65% for estates worth more than $10 million, $50 million and $500 million respectively. |

| Gift tax | Repeal | Retain |

| Impact on GDP | Positive 11% (as estimated by the Tax Foundation) | Negative 1% (as estimated by the Tax Foundation) |

| Impact on Job Creation | Positive. 5.3 million new jobs (as estimated by the Tax Foundation) | Negative. 311,000 fewer jobs (as estimated by the Tax Foundation) |

| Impact on Government Debt | Negative. $10 trillion higher government debt (as estimated by the Tax Foundation) | Positive. $191 billion lower national debt (as estimated by the Tax Foundation) |

| Impact on Wages | Positive. +6.5% wage growth (as estimated by the Tax Foundation) | Negative. -0.8% wage growth (as estimated by the Tax Foundation) |

| Biggest Beneficiaries | High-income earners | Low-income earners |