-

Are we in the Middle of a V-Shaped Recovery that’s N-Shaped?

-

“Prices are too low for everybody”: Saudi Oil Chairman

Oil prices have been beaten down enough.

“Notorious” is an accurate descriptor of the oil and gas industry. When business is good, business is good. When it’s not… well, the ugly side of the industry rears its head. As earnings season gets underway, it is becoming clear that not many companies are seeing any kind of relief. Additional budget cuts, dividend suspensions and more layoffs plague the newswires.

ExxonMobil’s (ticker: XOM) Q2’15 revenues for oil and gas production was $2 billion – the lowest level posted since 2002, just before the shale revolution began. West Texas Intermediate prices closed at $45.17 on August 3, down 24% since hitting $59.47 on June 30.

Dave Lesar, chief executive officer of Halliburton (ticker: HAL), provided his opinion during his company’s Q2’15 conference call: “This is a damn tough market, one of the toughest ones that I ever been through, and I don’t believe anyone can accurately predict when commodity prices will rebound and rig counts will recover in the U.S. or the international markets, and neither can I.”

Industry icons like T. Boone Pickens and Harold Hamm remain adamant that oil prices will rebound. OPEC does not – the cartel said in May 2015 that $100 oil won’t return for the remainder of the decade. Saudi princes say $100 oil will never happen again, even though the former CEO, now chairman, of the kingdom’s oil company admitted in January that prices are “too low for everybody.”

Industry icons like T. Boone Pickens and Harold Hamm remain adamant that oil prices will rebound. OPEC does not – the cartel said in May 2015 that $100 oil won’t return for the remainder of the decade. Saudi princes say $100 oil will never happen again, even though the former CEO, now chairman, of the kingdom’s oil company admitted in January that prices are “too low for everybody.”

The United States shale revolution has turned the global oil and gas industry into a half-priced cash grab for market share, and companies and countries alike are watching debt rates rise and sovereign wealth funds dwindle while oil prices remain at their lowest level since the Great Recession. An oil price recovery has to be in the cards, but the question is… when?

The Case for a V-Shaped Recovery

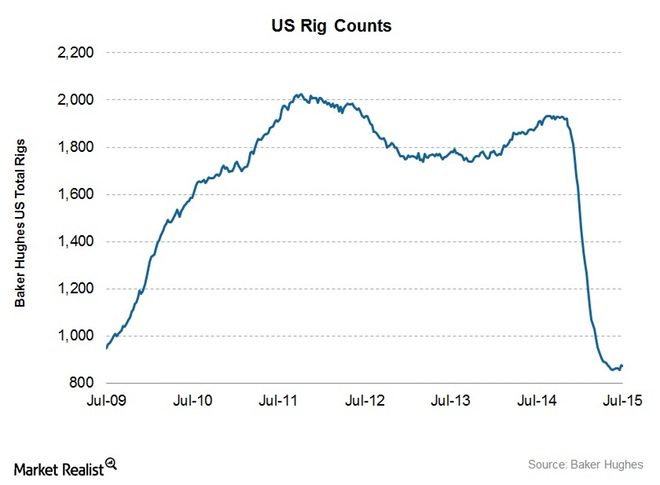

The North American oil and gas industry responded remarkably fast to the price downturn, dropping more than half of its rig fleet in five months after OPEC’s fateful Thanksgiving Day announcement. The idled machines tragically had a spillover effect on the people of the industry, as an estimated 150,000 layoffs have occurred to date.

“Since we haven’t seen a price recovery yet, people are concluding that we won’t see it at all,” said Mike Smolinski, President of Energy Directions, Inc., in an interview with Oil & Gas 360®.

“There are 1,055 rigs not running now compared to October, and 832 of those are directional/horizontal, so they’re mostly high powered rigs. In Canada, there’s 195 fewer rigs now (about 51%) as opposed to a year ago.”

Shale Production Growth Rate Starting to Wane

The slowdown in the field is finally catching up to domestic production. Production growth is slowing and the Energy Information Administration (EIA) projects volumes have been dropping in major oil plays for a handful of months, with the Permian being the lone exception. Rig counts appear to have troughed and are slowly adding more to the fleet, but that doesn’t necessarily mean activity is increasing. North Dakota went weeks without a well completion earlier in July.

At some point, activity will have to pick up. Models from EnerCom, Inc. estimate a Bakken well produces 30% of its estimated ultimate recovery in the first two years, creating a decline curve of 65% in the first year alone. Studies from Core Laboratories (ticker: CLB) say the U.S. annual decline curve rate of 10.5% is the highest of major production area in the world, and four times greater than those in Russia.

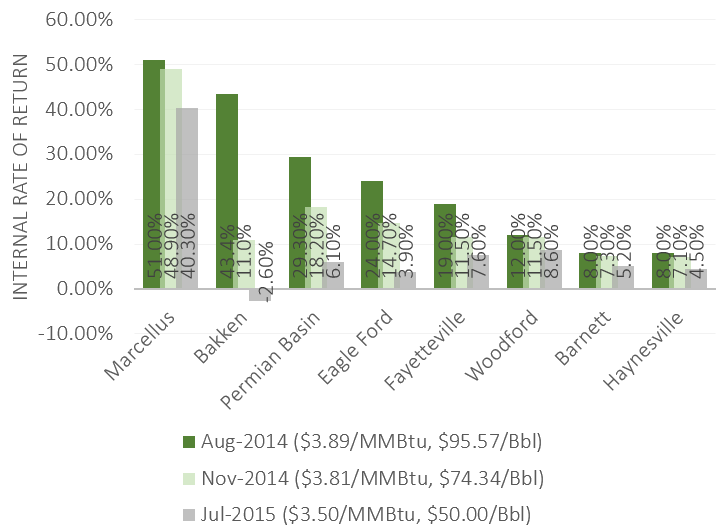

But the rapid decline curve is just one element of the production cycle. Another is the massive change in year-over-year capital expenditures. EnerCom found 2015 capex was approximately 35% below 2014 numbers, based on guidance from 65 E&Ps. And why? Because operations are generally not economical at current prices, based on the information below.

The Production Decline has Already Begun: Raymond James & Associates

Pointing to what they believe is demand overstatement from the EIA, Raymond James & Associates in a research report on July 10, 2015, says “U.S. oil supply probably started rolling over in March… After sequential monthly declines of 75 MBOPD to 100 MBOPD in May-July, our model suggests slowing rates of decline through the rest of 2015.” The firm believes a “reasonably quick” rebound will occur in 2016 with year-over-year growth of 70 MBOPD.

Smolinski says the backlog of uncompleted wells has, temporarily at least, stymied any meaningful production drops. However, that backlog will only last so long. “Once there is a decline, it’s going to show up,” he said. “And once it shows up, it will take a while before you ramp up and get more production rising.”

The World Uses Energy: Demand Will Increase

There’s no arguing that the supply/demand balance leans towards the former, but plateauing production will eventually restore order as the consumption levels increase. The International Energy Agency’s (IEA) take in its July 2015 Oil Market Report says: “After expanding by a massive 2.4 MMBOPD in 2014, non-OPEC oil production growth is expected to ease to 1.0 MMBOPD in 2015 before grinding to a halt in 2016, as lower oil prices and spending cuts take a toll on output. The Americas, led by the US, Canada and Brazil will continue to expand through 2016, offsetting declines in other regions.”

There’s no arguing that the supply/demand balance leans towards the former, but plateauing production will eventually restore order as the consumption levels increase. The International Energy Agency’s (IEA) take in its July 2015 Oil Market Report says: “After expanding by a massive 2.4 MMBOPD in 2014, non-OPEC oil production growth is expected to ease to 1.0 MMBOPD in 2015 before grinding to a halt in 2016, as lower oil prices and spending cuts take a toll on output. The Americas, led by the US, Canada and Brazil will continue to expand through 2016, offsetting declines in other regions.”

The IEA also estimates current OPEC output at 31.7 MMBOPD, which far exceeds its traditional volumes of around 30.3 MMBOPD. Any reductions will obviously lean in favor of the supply side. “On the face of it that makes for a tightening market next year” says the IEA. On the flip side, the EIA believes domestic production will contract by 0.2 MMBOPD in 2016, potentially adding to a more balanced market.

IEA demand growth, meanwhile, is expected to reach 1.4 MMBOPD in 2015, an increase of 0.3 MMBOPD spurred by oil affordability for consumers. Another 1.2 MMBOPD is expected to be added in 2016.

U.S. Consumers are Buying Cars; Cars Burn Gasoline/Diesel

As an added bonus to oil producers, United States car sales continue their ascent. J.D. Power & Associates predicted back in October 2014 that domestic auto sales would hit a record in 2015. Consumers are aided by the low prices, which are expected to save them about $750 on the year. The Federal Highway Administration said in its May 2015 report that cumulative road travel is up 3.4% compared to the same period in 2014.

Oil and the Global Energy Scene

The international markets, meanwhile, are pumping volumes at full blast.

Saudi Arabia’s rig count and Iraq’s export volumes are both at record levels, while Russia’s production is among the highest in its history. The amount of overseas production is so high that some experts, including the professionals at Core Laboratories (ticker: CLB), believe it cannot go any higher.

OPEC Prices Needed to

|

|

| Country | Price |

| Libya | $184.10 |

| Iran | $130.70 |

| Algeria | $130.50 |

| Nigeria | $122.70 |

| Venezuela | $117.50 |

| Saudi Arabia | $106.00 |

| Iraq | $100.60 |

| Angola | $98.00 |

| Ecuador | $79.70 |

| U.A.E. | $77.30 |

| Qatar | $60.00 |

| Kuwait | $54.00 |

| *info compiled by The Wall Street Journal | |

“If we look at just production levels in the Middle East, you have all countries producing at what we would think would be maximum amounts, so there’s very little spare capacity,” said David Demshur, Core Lab’s chairman and CEO, in a recent conference call.

He added that the countries are producing from carbonate reservoirs, and a characteristic of the play is that maximum volume capacity can lead to greater amounts of water. The increased water volume is irreversible, explains Demshur, who said, “once you start producing larger amounts of water (from carbonate reservoirs), you always produce larger amounts of water, even at reduced production levels.”

Half Priced Oil = Half the Revenue = Double the Pain

We’ve heard the pleas from smaller OPEC members to boost prices (Nigeria, Venezuela, etc.), but what about the larger, more impactful producers?

The world’s largest oil producers are temporarily sacrificing revenue to save market share, but the half-price oil is clearly leaving its mark on its top exporters. Bloomberg reports that Saudi Arabia averaged losses of $10 billion per month from January to May, and WealthInsight says the country’s economic growth slowed to 3.5% in 2014 (down from 10% in 2011). In addition, the unveiling of its Tadawul stock exchange to foreign investors on June 15 was a general disappointment in terms of turnout. The Tadawul has dropped 5% since the event.

The pain for Russia is much more apparent. The ruble has weakened to 60 against the dollar (meaning 60 rubles equals one U.S. dollar) and Tom Levinson, chief strategist at Sberbank of Russia, believes it will reach 65 against the dollar once the United States Federal Reserve hikes interest rates. Alexander Novak, Russia’s finance minister, estimates annual losses of $140 billion considering the depreciation of both its currency and oil reserves. Novak met with OPEC officials in June for what he described simply as “an exchange of information.”

The economy minister told Bloomberg in January that its $170 billion in government reserves would cover three years of $45 oil, but Ezekiel Pfeifer of the Institute of Modern Russia is not convinced. He writes:

“[Russia] is using the Reserve Fund to cover an estimated budget deficit of 3.7% of GDP this year (2.68 trillion rubles), while more than 500 billion rubles from the National Wealth Fund have been earmarked for investment projects and to help struggling state-owned companies. Requests by government corporations for money from the National Wealth Fund far exceed the actual total in the coffers. (Putin decided at a meeting in February that he personally would choose which projects get support.) And the current 2016 budget envisions a deficit of about 2.4% of GDP—meaning that if there is another deficit in 2017, the Reserve Fund could become tapped out.”

Declining investment due to sanctions will also slow Russian hydrocarbon development and ultimately impact production. A LukOil executive said in March that Russia’s output could slide by 800 MBOPD by year-end 2015, and a Moscow-based study in April found that 95% of Russian regions are unattractive to foreign investment.

Marginal Cost of Producing

|

|

| Region | Cost |

| Arctic | $115 – $122 |

| Brazil Ethanol | $63 – $69 |

| Central and South America | $29 – $35 |

| Deepwater Offshore | $54 – $60 |

| EU Biodiesel | $106 – $113 |

| EU Ethanol | $98 – $105 |

| Middle East Onshore | $10 – $17 |

| North Sea | $46 – $53 |

| Oil Sands | $89 – $96 |

| Former Soviet Union Onshore | $18 – $25 |

| Russia Onshore | $15 – $21 |

| US Ethanol | $80 – $87 |

| US Shale Oil | $70 – $77 |

| West Africa Offshore | $38 – $44 |

*compiled by Reuters

|

|

“Oil Prices: The Case for a V-Shaped Recovery Part Two – The Wild Cards and the Two Step Rebalance” may be read here.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.