U.S. missile strike on Syria has some wondering about the return of a risk premium

Crude futures jumped as much as 2% after the U.S. military attacked the Shayrat air base near Homs with Tomahawk missiles in response to Syria’s alleged use of chemical weapons during an air attack Tuesday on a rebel-held area. The attack was the most significant U.S. military action in Syria during the country’s now six-year civil war and has some in the market wondering if political risk might push oil prices higher.

Oil, gold and foreign exchange and bonds all reacted strongly immediately after the attack, but gains were dampened by weaker than expected U.S. employment figures.

“Oil markets are back in bullish mode after the setback of the previous weeks. This news flow seems to bring geopolitical risks back on the radar,” said Frank Klumpp, oil analyst at Landesbank Baden-Wuerttemberg, told Reuters.

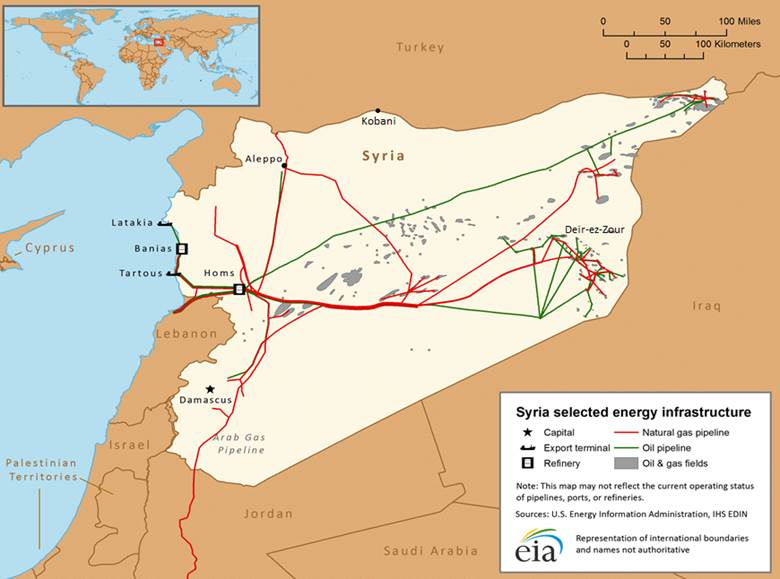

Prior to Syria’s civil war, the country produced 383 MBOPD of oil and 316 MMcf/d of natural gas making it the eastern Mediterranean’s leading oil and gas producer, according to the EIA. The conflict has dramatically reduced the country’s ability to produce oil, but its location and alliances with other major producers in the region mean any escalation has the potential to increase supply-side fears.

The missile strikes “signal a change” in President Donald Trump’s “approach to Syria and with that, his efforts to mend fences with Russia,” Ole Hansen, head of commodity strategy at Saxo Bank, told CNBC. “[Russian President Vladimir] Putin’s response, therefore, has to be watched closely.”

The surge also reflected fears that an escalated conflict might disrupt tanker traffic in regional choke points like the Strait of Hormuz in the Persian Gulf.

“This is a short-term spike as traders price in a possible supply route disruption,” said analyst Jonathan Chan of Phillip Futures. “However, if this conflict prolongs or escalates with Russia possibly intervening on the Assad regime’s side, there may be a further upward adjustment on the geopolitical risk premium.”

Oil price rally on Syrian fears could lose steam quickly

Despite the spike in oil prices following the U.S. military action, many analysts said the rally would likely lose steam. Crude oil inventories above the five-year average and Syria’s relatively small output amidst a civil war mean conflict in the region could have minimal effects on supply.

“The world still awash in oil,” Hansen said. “The risk of this developing and impacting oil supplies from the region, especially from Iraq is very limited.”

UBS commodity strategist Giovanni Staunovo added: “Syria is a tiny oil producer and there are no key oil pipelines which could be hit. Today’s oil rally might lose steam or even reverse during the day unless the airstrike heightens tension between Russia, Iran or Iraq and the U.S.”

A note from Bloomberg pegged Syria’s contribution to global oil supplies at just 0.04% of total supplies – less than Cuba, New Zealand or Pakistan – highlighting the minimal effect a disruption in the country would have on fundamentals.

“The strike, at least for now, appears retaliatory rather than the indication of the beginning of direct involvement by the U.S. in Syria,” said commodity strategist Harry Tchilinguirian of BNP Paribas. “Pending the next developments, the recent oil price move may start to shift back. It is too early to tell at this juncture.”