Concerns in China push global markets down

China’s Shanghai Composite index saw the single largest one-day percentage loss since 2007 earlier today, shedding 8.5% of its value. Even as Chinese authorities allowed pension funds managed by local governments to invest in the stock market for the first time, potentially channeling hundreds of billions of yuan into the country’s market, concerns over the markets health persisted.

“It is a key moment for China, with the equity market in free fall, the banking system increasingly starved of liquidity, rising capital outflows, and a rapidly slowing economy,” IG’s market analyst Angus Nicholson said.

“The [7% growth] target is now looking overly ambitious and the most sensible way forward would seemingly involve further currency devaluation, further reserve requirement ratio (RRR) cuts and [elevated fiscal stimulus,” he added, reports CNBC.

China’s struggling stock market took global markets along for the ride, with the Dow Jones ending 588 points, or 3.6%, lower after trading. The S&P lost 3.9% of its value, with energy showing the largest decline, closing down 5.3%.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points. In the open, the index fell as much as 1,089 points, marking its biggest intraday swing in history.

“Fear has taken over. The market topped out last week,” Adam Sarhan, CEO of Sarhan Capital said to CNBC. “We saw important technical levels break last week. Huge shift in investor psychology.”

“The market is not falling on actual facets of a sub-prime situation. It’s falling on fear of the unload of China. That’s really behind this move,” said Peter Cardillo, chief market economist at Rockwell Global capital.

European stocks also felt pressure from events in China today, with the STOXX Europe 600 down more than 5%.

Oil prices follow larger market

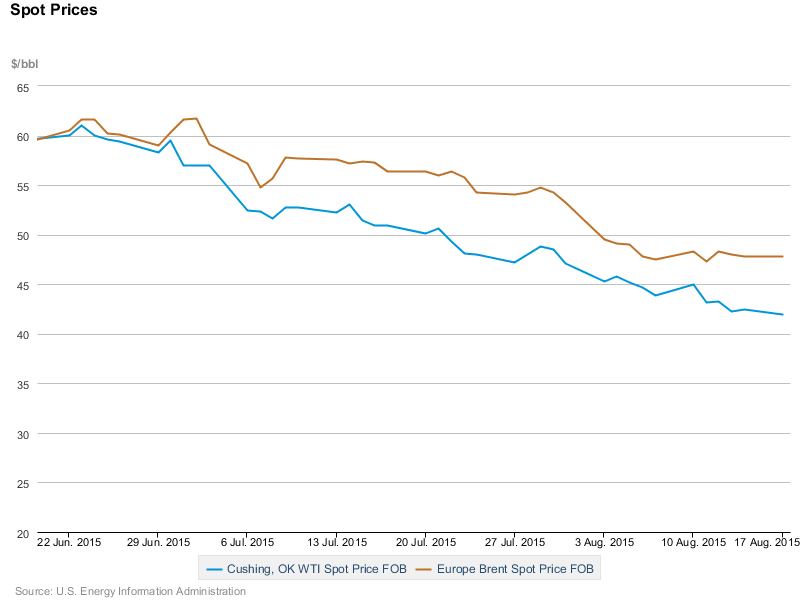

Oil prices hit a six-and-a-half year low today, shedding 5.8% of their value, with WTI breaking below the $39 per barrel mark. Brent oil hit an intraday low of $42.51 per barrel, down 6.5% from Friday’s close. It closed just one cent higher at $42.53.

“Today’s falls are not about oil market fundamentals. It’s all about China,” said Senior Oil Analyst at Commerzbank Carsten Fritsch. “The fear is of a hard landing and that things get out of the control of the Chinese authorities.”

China is not the only factor contributing to WTI and Brent losing 17% and 16% of their value since the beginning of August, however. Production continues to outpace demand growth, leading to historic builds in inventory levels.

Earlier today, the Energy Information Administration (EIA) announced that global liquids storage in the first seven months of the year was faster than at any other point in the last 17 years. Global liquids storage is estimated to have grown by 2.3 MMBOPD since the beginning of the year.

Most of the supply growth in 2015 has come from producers outside OPEC, with EIA estimates placing non-OPEC petroleum and other liquids production growth at an average of 2.0 MMBOPD in the first seven months of the year, while OPEC liquids production is estimated to have grown by 0.9 MMBOPD over the same period.

Combined with the likely addition of Iranian crude exports before the end of 2016, many different agencies have revised their price expectations down. Last week, the EIA lowered its 2015 and 2016 expectations for WTI $6 per barrel and $8 per barrel, respectively, to $49 per barrel and $54 per barrel. Similarly, Raymond James announced that it was lowering its price predictions $10 per barrel, to $50 and $55 per barrel for 2015 and 2016, respectively.