Oil rig counts climb for third straight week

The total number of rigs actively drilling in the United States rose by ten this week, reaching 884, according to the latest rig count from Baker Hughes (ticker: BHI). The number of rigs drilling for oil rose for the third straight week to 670 while rigs drilling for gas increased by four to 213. The continued growth of rig counts put pressure on the price of West Texas Intermediate, pushing prices of WTI down below the $44 mark today, despite a larger than expected draw on crude oil inventories.

The value of the dollar increased to a three and a half month high against a basket of currencies after strong U.S. jobs growth in July, reports CNBC, making oil and other commodities sold in dollars more expensive for holders of other currencies.

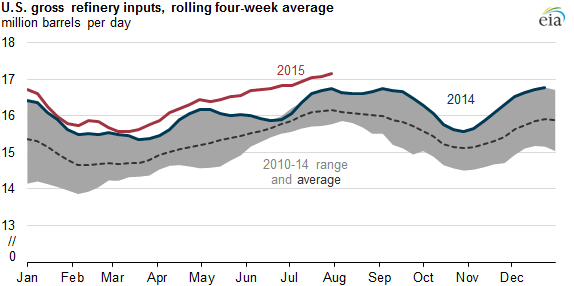

Analysts said seasonal refinery maintenance and stock builds in key oil products such as distillates, which include diesel, could drag heavily on crude futures in coming months. Inputs to refiners exceed 17 million barrels per day in each of the past four weeks, the highest level of refinery inputs seen by the Energy Information Administration (EIA) since the organization began publishing weekly data in 1990. As demand for gasoline declines in the coming months, refining margins may not support the same levels of inputs.

“The summer driving season is fading and we could see a quick ramp up in gasoline stocks,” said Chris Jarvis, analyst at Caprock Risk Management. “We’ve had record refining heading out of the driving season that should translate into higher stocks of refined products in fall and winter.”

Gasoline sank by more than 1.4% to five and a half month lows today, and ultra-low-sulfur diesel traded not far from six-year lows set earlier in the week.