Despite the surprise moderate build in U.S. crude oil stockpiles, analysts are worried of an impending price spike to $150 or more.

Prices Today

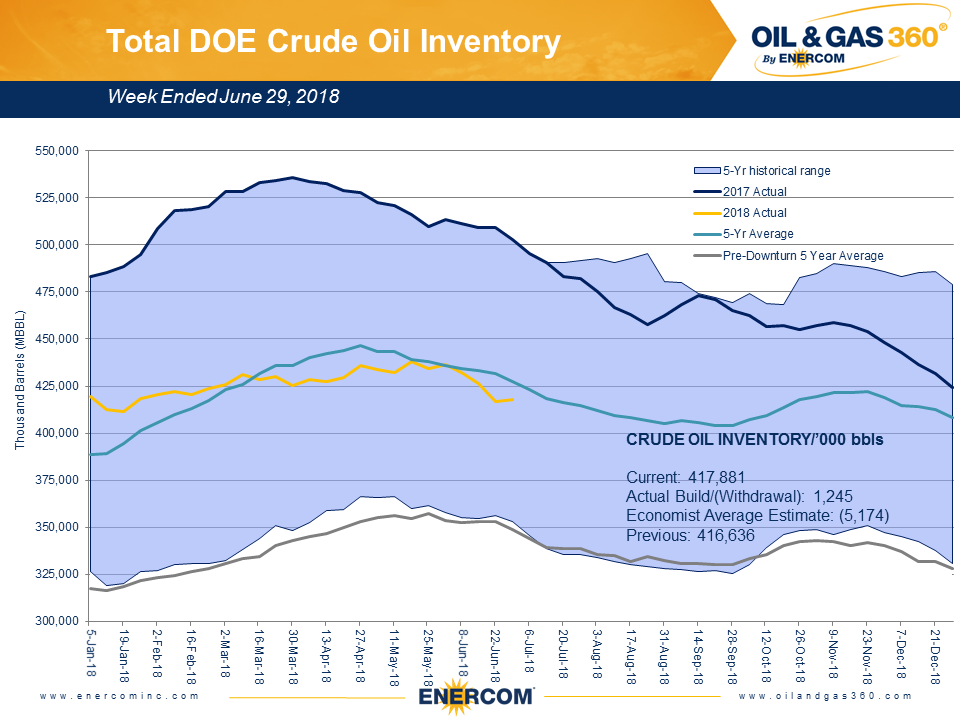

Crude oil stocks rose by 1,245 MBBL last week to 417,881 MBBL from 416,636 MBBL. This is 17% below the 502,914 MBBL that was in storage at this point last year, and is 2% below the five-year average. This week’s build was a surprise, as the average analyst prediction called for a draw of 5,174 MBBL.

WTI is currently hovering around $74, which marks an approximately 17% increase in price since March this year and a 63% increase since 2017.

Syncrude Remains Offline

Syncrude’s oil sands facility near Fort McMurray shut down in June for repairs, cutting off a major source of oil production. A power transformer failed, forcing the entire complex offline.

The facility, which has a capacity of 360 MBOPD, was expected to be offline until July, but now it looks like it won’t be back until the end of August.

Syncrude is a joint venture majority owned by Suncor Energy, with minority stakes held by Imperial Oil, Sinopec and Nexen.

Saudi Arabia and Russia are Pivotal

Saudi Arabia and Russia will prove to be critical during the coming months with increased production that could help cool oil prices down amid a tight oil market.

Saudi Arabia and Russia came to an agreement during June that would equate to a likely increase in production of as much as 1 million barrels a day. Falling right in line with this agreement, Saudi Arabia reported an increase of 500,000 barrels per day last month.

No more Iranian exports

South Korea has reportedly suspended all buying of Iranian crude and condensate after further U.S. pressure. This marks another step toward the State Department’s goal to reduce Iran’s crude oil exports to zero and yet another crucial move in this Present Day Middle Eastern Game of Thrones.

The OPEC Monopoly must remember that gas prices are up & they are doing little to help. If anything, they are driving prices higher as the United States defends many of their members for very little $’s. This must be a two way street. REDUCE PRICING NOW!

— Donald J. Trump (@realDonaldTrump) July 4, 2018

Following President Trump’s tweet on July fourth calling for OPEC to reduce pricing, Iranian OPEC Governor Hossein Kazempour Ardebili said, “The responsibility of paying unnecessary prices for oil by all consumers of the whole world, especially in U.S. gas stations, is solely upon your (Trump’s) shoulders and the price of over $100 per barrel is yet to come.”

The possible upcoming spike

In the longer term, a significant increase in oil prices may be on the horizon. According to Sanford C. Bernstein & Co, companies have been compelled to focus on boosting returns and shareholder distributions at the expense of capital expenditures aimed at finding new supplies. Supermajors are not replacing reserves at standard rates, and the industry’s reinvestment ratio has hit its lowest point in a generation.

This means there is a shortage of large projects being developed, meaning natural field decline may not be entirely replaced by new production. If this trend holds, a significant supply shortage is coming.

“Any shortfall in supply will result in a super-spike in prices, potentially much larger than the $150 a barrel spike witnessed in 2008,” according to Bernstein.

If demand peaks before 2030, pulling back investment in new production will pay off. But if oil consumption is still growing at that point, CEOs will look “foolish,” Bernstein said.