Will spend 24% less than in 2015; dividends are ‘No. 1 priority’

Chevron Corp. (ticker: CVX), the second-largest energy company in the U.S. by revenue, announced its capital budget for 2016, saying it plans to spend 24% less than it has this year. Chevron said that it expects to spend $26.6 billion in capital and exploratory investments next year, with $4.5 billion of the total budget set aside for planned expenditures by affiliates.

CVX anticipates approximately $9 billion of capital spending for existing base producing assets, with roughly $11 billion to go toward major capital projects currently underway, and $3 billion set aside for projects yet to be sanctioned, according to a company press release.

Approximately 80% of the affiliate expenditures, or $3.6 billion, are associated with investments by Tengizchevroil LLP in Kazakhstan and Chevron Phillips Chemical Company LLC in the United States, according to the company.

Chevron Chairman and CEO John Watson said the capital plan would allow the company to focus on short-term, high-yield investment projects, while still preserving options for long-term projects. “Given the near-term price outlook, we are exercising discretion in pacing projects that have not reached final investment decision,” he said.

Watson expects price to move higher next year

Chevron is hardly alone in cutting capital budgets, a trend that spread through the whole industry last year following the steep decline in crude oil prices that began in 2014, but Watson expects oil prices to recover next year.

“We’ve got a slight imbalance in demand and it’s going to take some time to work that off,” he told CNBC.

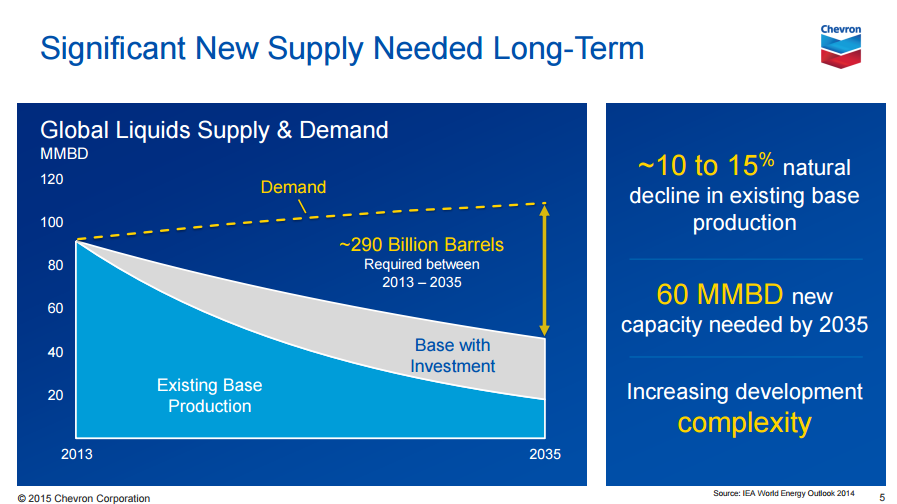

In a recent investor presentation, Chevron said it will need “significant” sources of new supplies in order to meet its long term goals. With increased development complexity, and a 10%-15% natural decline in its existing base production, CVX believes it will need 60 MMBD of new capacity by 2035.

The reduction in capital expenditures brought on by the lower price of oil will make meeting that demand even more difficult. Watson did not give a price forecast for 2016, but if markets begin to balance themselves out, more capital could become available for finding sources of new supply.

Chevron will “live with whatever prices the market gives,” said Watson. “This is a very turbulent time in our business.” Chevron’s CEO went on to stress that the lower capital budget would not affect the company’s ability to pay dividends, which he called the “number 1 priority.”