Survey of Energy Industry Executives and Investment Professionals Focused on the Oil & Gas Industry

In December, Oil & Gas 360® conducted a survey of industry executives and investors. We asked respondents to predict commodities pricing for 2016, as well as U.S. CapEx, global demand and U.S. production for the year ahead.

Who are the respondents?

- 50% are executives from E&P, OilService, integrated majors and midstream energy companies

- 16% are executives from buy-side, sell-side financial institutions and private equity firms

- 4% are commercial bankers serving the energy sector

- 6% are brokers/financial advisors

- 14% are energy investors

- 10% “other” category included engineering firms, oil and gas attorneys and other consultants to the oil and gas industry

Here is what the industry and financial executives that we surveyed had to say with respect to what the industry would look like in 2016:

Here is what the industry and financial executives that we surveyed had to say with respect to what the industry would look like in 2016:

In the arena of natural gas prices, most of the industry and financial executives we surveyed expect natural gas to be in the range of $2.00 to $2.50 per Mcf in 2016. But there were some interesting differences. Half of the E&P executives who responded said gas would be $2.00 to $2.50 per Mcf, but almost half of the OilService executives put natural gas at $1.50 to $2.00 per Mcf in 2016. The only agreement at the lower price level as from the brokers/financial advisors, who threw in with the service providers, saying in 2016 that natural gas would average $1.50 to $2.00 per Mcf.

When it comes to the price of oil in 2016, the clear winner for all but one category was the $40 to $50 per barrel price level for WTI. More than 60% of the E&P executives, buy-side, sell-side and commercial bankers put oil between $40 to $50 per barrel in 2016.

Again, the OilService side diverged from the E&P execs. Oilservice was split between $40 to $50 per barrel (40% of the group) and $30 to $40 per barrel (also 40%). But more on the OilService side foresee prices returning to higher levels in 2016. 18% of OilService respondents had $50 to $60 per barrel WTI coming in 2016, compared to only 9% of the E&P crowd.

For a view of the Brent/WTI differential, the E&P, OilService, sell-side, commercial bankers, brokers/financial advisors and individual investors all put the spread at +$3.00 for 2016. The buy-side and private equity executives overwhelmingly said the differential would be only +$1 in 2016.

For natural gas liquids, all but one group had the price for NGLs at 20% to 30% of WTI. The lone wolf was the buy-side, where 50% of the respondents had NGLs at 30% to 40%.

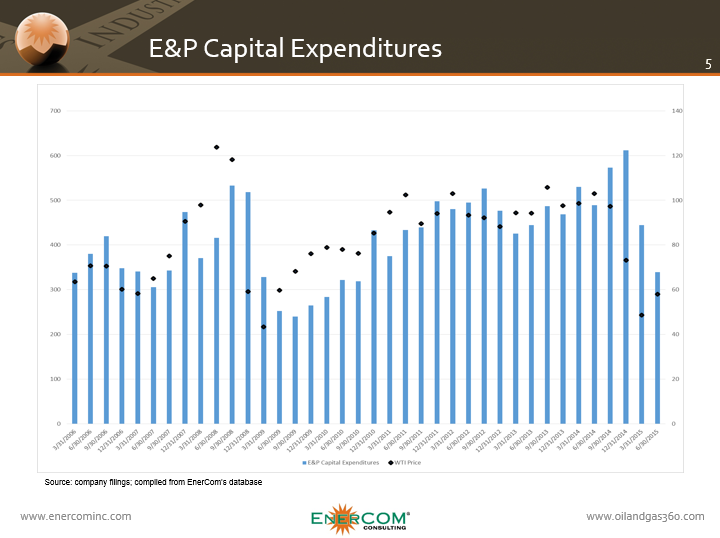

Moving on to predicted levels of capital expenditures by E&Ps in 2016, a clear majority in every industry category predicted that CapEx would be reduced by 10% to 30% in 2016. Only 18% of all respondents said companies would establish the bare minimum (maintenance only, no new drilling or field development).

Moving on to predicted levels of capital expenditures by E&Ps in 2016, a clear majority in every industry category predicted that CapEx would be reduced by 10% to 30% in 2016. Only 18% of all respondents said companies would establish the bare minimum (maintenance only, no new drilling or field development).

The one group that was more bearish was OilService executives. 37% of the OilService respondents said that the E&Ps would establish bare minimum CapEx with no new drilling. As a side note, only 7% of E&P respondents said they expected the industry to place a large emphasis on completing DUCs in 2016, while 10% of the OilService group said completing DUCs would be an emphasis in 2016.

With one exception, the majority of every industry group said they believed global demand for oil would increase slightly in 2016. The exception was commercial bankers, whose majority group said oil demand would stay about the same in 2016.

Regarding the level of U.S. oil and gas production in 2016, all groups were in agreement that production would decrease slightly in 2016, with a second highest tally given to “decrease significantly” by all but one group.

A full breakdown of the survey results follows:

Natural Gas Prices

Where do you see the average price of Henry Hub natural gas in 2016?

- Total responses:

- 47% of all respondents said $2.00 to $2.50 per Mcf

- 30% said $1.50 to $2.00

- 13% said $2.50 to $3.00

- 6% said $1.00 to $1.50

- E&P executives:

- 50% of the responding E&P executives said $2.00 to $2.50

- 28% said $1.50 to $2.00

- 16% said $2.50 to $3.00

- 7% said $1.00 to $1.50

- OilService executives:

- 46% of the responding OilService executives said $1.50 to $2.00

- 37% said $2.00 to $2.50

- 12% said $2.50 to $3.00

- Buyside financial executives:

- 85% of the responding buy-side executives said $2.00 to $2.50

- 15% said $1.50 to $2.00

- Sellside financial executives:

- 45% of the responding sell-side executives said $2.00 to $2.50

- 36% said $1.50 to $2.00

- Private equity executives:

- 55% said $2.00 to $2.50

- Commercial bankers:

- 50% said $2.00 to $2.50

- Brokers/financial advisors:

- 50% said $1.50 to $2.00

- Individual investors:

- 52% of responding individual investors said $2.00 to $2.50

- 24% said $1.50 to $2.00

Oil Prices, NGLs

Where do you expect oil prices (WTI) to spend most of 2016?

- Total responses:

- 56% of all respondents said $40 to $50 per barrel

- 25% said $30 to $40

- 14% said $50 to $60

- 4% said $20 to $30

- E&P executives:

- 67% of the responding E&P executives said $40 to $50

- 13% said $30 to $40

- 9% said $50 to $60

- 7% said $20 to $30

- OilService executives:

- 40% of the responding OilService executives said $30 to $40

- 40% said $40 to $50

- 18% said $50 to $60

- Buyside financial executives:

- 62% of the responding buy-side executives said $40 to $50

- 23% said $50 to $60

- 15% said $30 to $40

- Sellside financial executives:

- 64% of the responding sell-side executives said $40 to $50

- 27% said $50 to $60

- Private equity executives:

- 45% said $40 to $50

- 36% said $30 to $40

- Commercial bankers:

- 63% said $40 to $50

- 37% said $30 to $40

- Brokers/financial advisors:

- 42% said $40 to $50

- 33% said $30 to $40

- 25% said $50 to $60

- Individual investors:

- 59% of responding individual investors said $40 to $50

- 21% said $30 to $40

- 14% said $50 to $60

What do you expect the Brent/WTI spread to average in 2016?

- Total responses:

- 49% of all respondents said the Brent/WTI spread would be +$3

- 37% said +$1

- 11% said +$5

- 3% said ~$0

- E&P executives:

- 53% of the responding E&P executives said +$3

- 42% said +$1

- 5% said +$5

- OilService executives:

- 56% of the responding OilService executives said +$3

- 23% said +$1

- 15% said +$5

- Buyside financial executives:

- 69% of the responding buy-side executives said +$1

- 31% said +$3

- Sellside financial executives:

- 45% of the responding sell-side executives said +$3

- 36% said +$1

- Private equity executives:

- 64% said +$1

- 36% said +$3

- Commercial bankers:

- 63% said +$3

- 25% said +$1

- Brokers/financial advisors:

- 58% said +$1

- 42% said +$3

- Individual investors:

- 50% of responding individual investors said +$3

- 30% said +$1

- 17% said +$5

What do you expect NGLs prices to be in 2016 as a percentage of WTI?

- Total responses:

- 50% of all respondents said NGLs would be priced at 20% to 30% of WTI

- 26% said NGLs would be priced at 30% to 40% of WTI

- 14% said 10% to 20% of WTI

- 8% said 40% to 50% of WTI

- E&P executives:

- 54% of the responding E&P executives said 20% to 30%

- 25% said 30% to 40%

- 13% said 10% to 20%

- 7% said 40% to 50%

- OilService executives:

- 43% of the responding OilService executives said 20% to 30%

- 22% said 10% to 20%

- 19% said 30% to 40%

- 14% said 40% to 50%

- Buyside financial executives:

- 50% of the responding buy-side executives said 30% to 40%

- 25% said 20% to 30%

- Sellside financial executives:

- 40% of the responding sell-side executives said 20% to 30%

- 30% said 10% to 20%

- Private equity executives:

- 67% said 20% to 30%

- Commercial bankers:

- 71% said 20% to 30%

- Brokers/financial advisors:

- 40% said 20% to 30%

- Individual investors:

- 52% of responding individual investors said 20% to 30%

- 28% said 30% to 40%

CapEx

Based on your oil price estimate in Question 2, what do you believe E&P CapEx will do in 2016?

- Total responses:

- 68% of all respondents said CapEx would decrease by 10% to 30%

- 18% said companies would establish the bare minimum (maintenance only, no new drilling or field development)

- 9% said CapEx would remain within 5% of 2015’s spending levels

- 7% said they expected the industry to place a large emphasis on completing DUCs in 2016

- E&P executives:

- 72% of the responding E&P executives said CapEx would decrease by 10% to 30%

- 17% said establish the bare minimum CapEx, no new drilling

- 7% said they expected to see the industry place a large emphasis on completing DUCs

- OilService executives:

- 56% of the responding OilService executives said decrease by 10% to 30%

- 37% said establish the bare minimum CapEx, no new drilling

- 10% said they expected the industry to place an emphasis on completing DUCs

- Buyside financial executives:

- 92% of the responding buy-side executives said decrease by 10% to 30%

- No buy-side executives said there would be an emphasis on completing DUCs in 2016

- Sellside financial executives:

- 82% of the responding sell-side executives said decrease by 10% to 30%

- No sell-side executives said there would be an emphasis on completing DUCs in 2016

- Private equity executives:

- 60% of private equity executives said CapEx would decrease by 10% to 30%

- Commercial bankers:

- 50% said decrease by 10% to 30%

- Brokers/financial advisors:

- 75% said decrease by 10% to 30%

- Individual investors:

- 64% of responding individual investors said decrease by 10% to 30%

- 18% said remain within 5% of 2015 CapEx levels

- 14% said establish the bare minimum CapEx, no new drilling

Demand

Where do you see global demand for oil in 2016?

- Total responses:

- 58% of all respondents said demand would increase slightly in 2016

- 23% said demand would remain about the same in 2016

- 11% said demand would decrease slightly in 2016

- 8% said global demand for oil would increase significantly in 2016

- E&P executives:

- 66% of the responding E&P executives said oil demand would increase slightly in 2016

- 17% said demand would stay about the same in 2016

- 10% said demand for oil would increase significantly

- 7% said demand would decrease slightly in 2016

- OilService executives:

- 49% of the responding OilService executives said demand for oil would increase slightly in 2016

- 32% said demand would stay about the same

- 12% said demand would decrease slightly in 2016

- Buyside financial executives:

- 54% of the responding buy-side executives said demand would increase slightly in 2016

- 31% said demand would stay about the same

- Sellside financial executives:

- 45% of the responding sell-side executives said demand would increase slightly in 2016

- 36% said demand would stay about the same

- Private equity executives:

- 73% said demand would increase slightly in 2016

- Commercial bankers:

- 50% said demand would stay about the same

- Brokers/financial advisors:

- 58% said demand would increase slightly in 2016

- 25% said demand would decrease slightly in 2016

- Individual investors:

- 60% of responding individual investors said oil demand would increase slightly in 2016

- 20% said demand would stay about the same

- 13% said demand would decrease in 2016

Production

Where do you see total U.S. oil and natural gas production in 2016?

- Total responses:

- 50% of all respondents said U.S. production would decrease slightly in 2016

- 28% said U.S. production would decrease significantly in 2016

- 14% said production would remain about the same as 2015

- 6% said production would increase slightly in 2016

- E&P executives:

- 43% of the responding E&P executives said production would decrease slightly in 2016

- 33% said production would decrease significantly in 2016

- 15% said production would remain the same as 2015

- 5% said production would increase slightly in 2016

- OilService executives:

- 51% of the responding OilService executives said production would decrease slightly in 2016

- 32% said production would decrease significantly in 2016

- 10% said demand would decrease slightly in 2016

- Buyside financial executives:

- 54% of the responding buy-side executives said production would decrease slightly in 2016

- 38% said production would decrease significantly in 2016

- Sellside financial executives:

- 64% of the responding sell-side executives said production would decrease slightly in 2016

- Private equity executives:

- 45% said production would decrease slightly in 2016

- Commercial bankers:

- 75% said production would decrease slightly or stay about the same

- Brokers/financial advisors:

- 42% said production would decrease slightly in 2016

- 33% said production would decrease significantly in 2016

- 25% said production would remain the same

- Individual investors:

- 57% of responding individual investors said production would decrease slightly in 2016

- 17% said production would decrease significantly in 2016

- 10% said production would remain the same in 2016

When it comes to predicting what the global economy is going to do that will affect commodities supply and demand and pricing, sometimes a fresh approach that’s apart from the numerical predictions can shed an interesting light on a possible future.

Harvard’s famous historian offers geopolitical projections to ponder as we enter 2016

This week Barron’s published a Q&A with Niall Ferguson, Harvard professor, historian, Kissinger biographer and author of “more than a dozen books on the nexus of economics, finance and geopolitics.”

The Scottish-born Ferguson’s worldview is filtered by the lenses of geopolitical events and history, and he succinctly expresses how recent and historical events affect the global economy. He has some striking views as to how the geopolitical chess game has been played in recent years and how actions taken and those not taken by the U.S. are likely to affect the world’s economy and security in 2016 and beyond.

Barron’s asked Ferguson why the U.S. economy isn’t firing on all cylinders.

Ferguson’s response, in part, was: “I’m attracted to a … geopolitical [argument] that says [economic] growth in modern American history has tended to be high at times of national strength and low at times of national weakness, because our weakness has ramifications for the world as a whole.

“We find ourselves in a deflationary version of the 1970s, marked by stagnation, not stagflation. Putin is doing his best to give us reasons to man up. But we’re not really doing so.

“The global economy needs a strong hegemonic power to reduce conflict, ensure freedom of the seas, and so forth. In the 19th century, it was Great Britain, and for much of the 20th, the U.S. But in 2013, President Obama said there was no global policeman. There are deleterious consequences if the leading power in the world abdicates its leadership role.

Barron’s asked Ferguson if the U.S. ought to be the world’s policeman.

“Somebody’s got to do it. It better not be the Chinese or Russians. The market system requires an effective state that enforces the rule of law. That is true internationally as well. As the world becomes less secure, it becomes a less safe place to do business.

“A world in which the U.S. yields regional power to China or Russia is one in which the rule of law is driven back. We underestimate the extent to which the age of globalization depended on an American underwriting, and that is gradually unraveling.”

“The resources that go into producing radicalism aren’t about to disappear. Networks are difficult to decapitate. … The president has failed to understand this because his model is decapitation. You think, let’s take out the boss. Then you are amazed to find the network grows. We won’t see this go away in the next 10 years. The threat of violent instability in the region will go up, and probably will affect Saudi Arabia. Support for the Islamic State is high among the Saudi population.

“An Islamic state can credibly argue that the Saudi royal family is corrupt, Westernized, and hypocritical. The family itself is divided. Saudi Arabia is a weak link, the way Iran was in 1979. If you had to ask what headline would move markets tomorrow morning, a revolution in Riyadh, especially a messy one, would be a pretty good answer. You could see a big terrorist attack on Saudi facilities, and markets would move the price of oil up.”

To gain his views on China, regulation, taxes, India, Brazil, Russia and Europe, the full interview with Niall Ferguson may be read in Barron’s.