EnerCom Analytics recently analyzed oil and gas companies through the lens of the 5 Factor Model (5FM), with an eye to providing a snapshot of the state of company valuations.

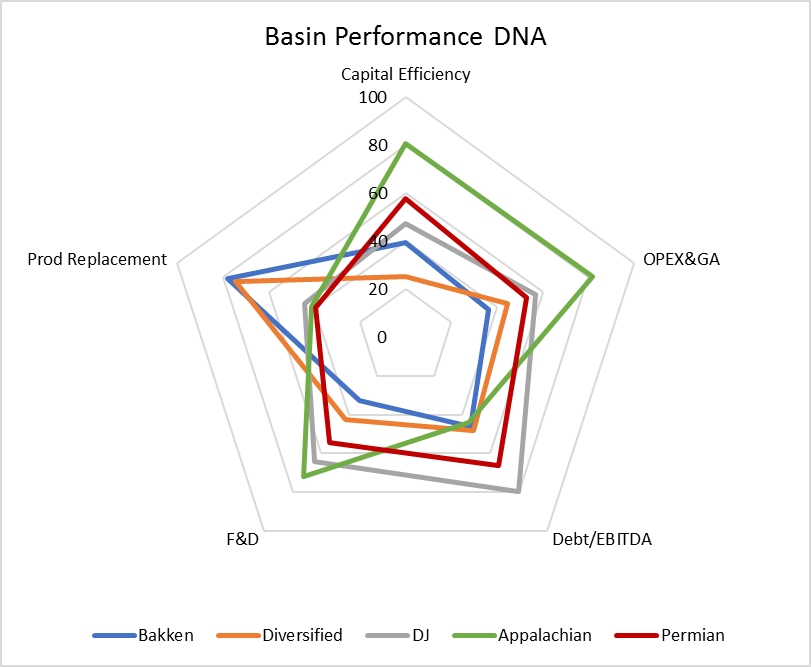

The 5 Factor Model examines a company’s three-year finding & development (F&D) costs per unit, its capital efficiency, operating and general & administrative expense per unit, three-year production replacement, and debt to trailing 12-month EBITDA.

These five factors measure some of the most important considerations affecting an oil and gas company by looking at efficiencies, growth performance and the balance sheet. Importantly, each of these metrics is a lever that management has at least partial control over.

To compare companies using the full 5FM, EnerCom Analytics indexes each component of the model from 0 to 100. A company with a very low relative debt load, for example, would receive a score near 100, while a company with a high debt load would receive a score near 0. When these normalized scores are plotted it shows the relative merits of firms operating in each basin, what EnerCom calls the Performance DNA.

This shows that firms operating in Appalachia have, on average, the strongest operational metrics, with capital efficiency and operating costs that significantly outperform competing basins. The play also has superior F&D costs, though several other basins are close behind. The country’s most popular shale basin is something of a jack of all trades in terms of Performance DNA. The Permian has above-average ranks in four metrics, but it is never the best in any specific area.

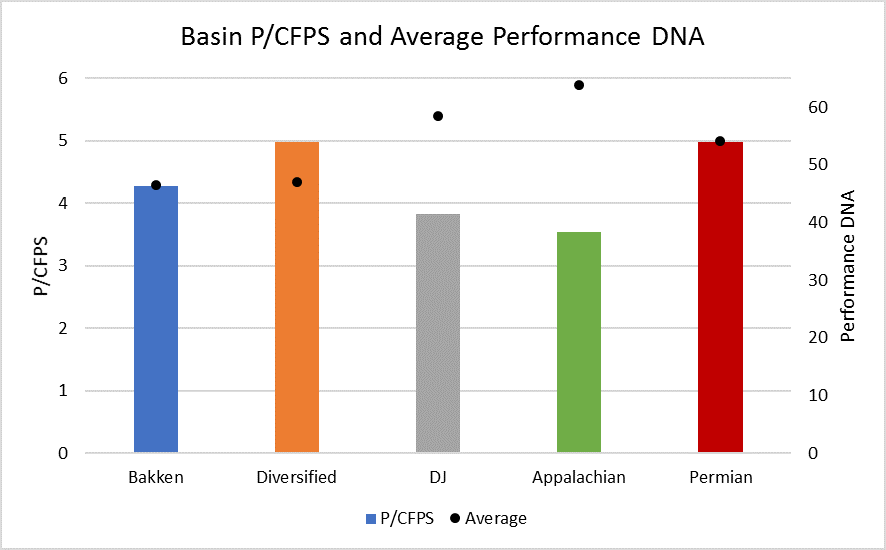

When Performance DNA is combined with current valuations, the degree to which markets examine fundamentals when valuing a company can be observed. On average, diversified and Permian companies are receiving the highest valuations at present, while firms operating in Appalachia receive the lowest valuations.

While some basins appear to be valued in line with fundamentals, others show a significant disconnect. The Bakken and Permian show average valuations that are dead on with what would be suggested by their Performance DNA, suggesting markets are primarily fundamentals-focused in these plays. There is a moderate disconnect in the valuations of diversified firms, these companies are receiving valuations beyond what their Performance DNA would indicate. This is likely the result of the current focus in equity markets on cash flow generation, as has been investigated in previous reports. Most diversified companies have large market caps and are in the portion of their lifecycle where they are able to generate significant cash. This ability is likely what is driving the disconnect with large diversified firms being rewarded because they can produce the free cash that markets currently crave.

Appalachian companies also see a significant disconnect in valuations, and are valued well below what fundamentals would suggest. This is a historic problem among Appalachian companies, and was also noted when EnerCom Analytics generated the Performance DNA of different firms in 2017. However, the reason for the disconnect may have changed.

Appalachian operations have historically been constrained by pipeline capacity, which has weighed on valuations for years. Numerous new pipelines are on the way, though, and several are already beginning operations. In theory, this development should allow Appalachian companies to see higher valuations, as firms are able to move their gas out of flooded local markets. However, the overall U.S. gas market is not supportive of more supply, and the new pipelines in Appalachia contribute to the overall glut. Significant supply growth in gas is expected, which prevents any major commodity price growth. This situation is likely what is holding back Appalachian firms at present, in short, equity markets have an unfavorable view of gas, due to looming supply growth.

The value disconnect in the DJ is more than likely transitory. Operators in the basin recently dealt with significant takeaway problems, primarily related to gas gathering. Extraction Oil & Gas CEO Mark Erickson mentioned facing “an extremely difficult midstream operating environment impacted significantly by both high line pressures and freeze-offs on a third-party system” in the company’s recent Q1 call. Executives at PDC Energy and SRC Resources made similar comments, gas takeaway is a problem in the basin at present. However, several gas processing plants are coming down the pike, with the first major plant beginning operations in Q3 2018. Further expansion will come online in Q2 2019 and in 2020. This buildout should allow DJ companies to see valuations more in line with their fundamentals. Additionally, while gas is a major component of DJ production, oil drives the economics of most locations. In an environment where oil is viewed more favorably than gas by equity investors, this should prevent the DJ from suffering from the level of disconnect seen in Appalachia.

Political risk in the basin is significant, however, as initiative 97 poses an existential threat to oil and gas firms in the DJ. This risk will likely weigh on firms operating in the basin until the election in November.

For details on EnerCom’s 5 Factor Model and the current state of valuations for oil and gas companies, see EnerCom’s May and June Energy Industry Data & Trends reports.