BMI Research forecasts 2.5% increase in oil and gas capex for 2017

The oil and gas industry is expected to increase spending next year for the first time following the crash in oil prices at the end of 2014, according to BMI Research.

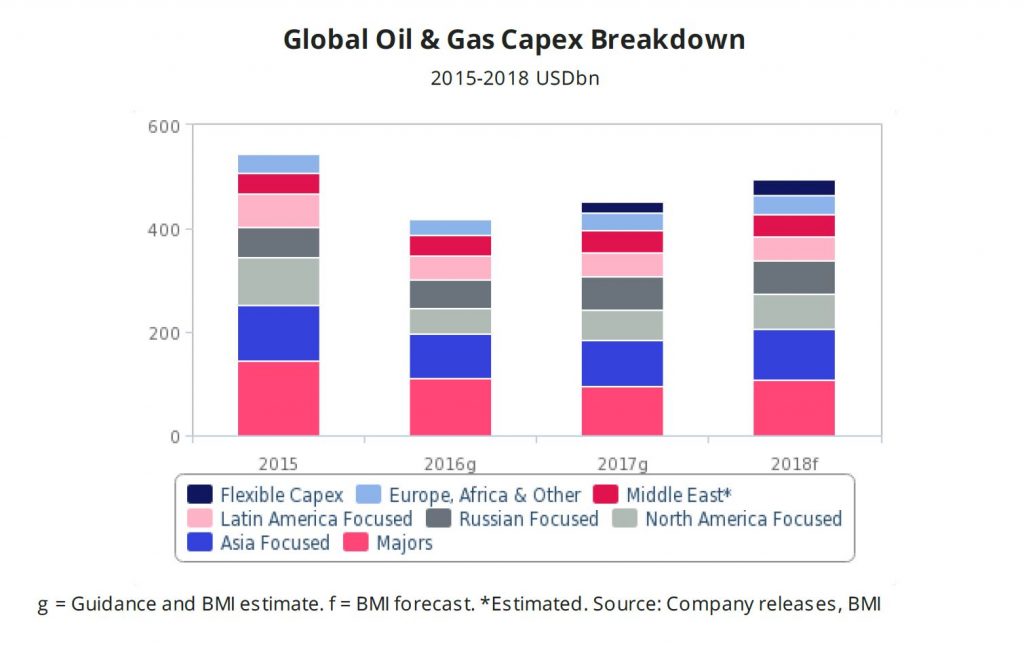

The research group, which is affiliated with Fitch Ratings parent company Fitch Group, believes oil and gas companies will increase capex 2.5% in 2017. Spending will increase by another 7% to 14% in 2018 as companies reinject capital into the market after the worst down cycle since the ‘80s.

North American independent producers, Asian state-run oil companies and Russian firms are prepared to boost investments next year, outweighing continued cuts from global oil majors such as Exxon Mobil Corp. and Total SA, BMI said, based on company guidance and its own estimates. Spending will increase to a total of $455 billion next year from $444 billion this year, BMI said.

Companies like Synergy Resources (ticker: SYRG) are planning on increasing their capital budget even as oil prices remain below $50 per barrel. During 2017, Synergy expects to drill 68 gross mid-length laterals and 34 gross long length laterals, spread across all three benches of the Niobrara as well as the Codell formations. During the same period Synergy expects to complete 52 gross mid-length laterals and 43 gross long length laterals. The company projects an average working interest of 80% and an average net revenue interest of 64% for all wells drilled and completed in 2017.

Spending still down significantly from 2014

Despite the study’s happy prediction that oil and gas companies are planning on spending more this coming year, the downturn prompted a 41% cut in capital expenditures in 2015 compared to 2014, according to EY’s U.S. Oil and Gas Reserves Study 2016. Even if North America is expected to help fuel renewed capital spending in oil and gas, the projections being made by BMI fall short of levels seen in 2014.

Agencies like the IEA also have a more pessimistic outlook on the future. The IEA said last week that the oil and gas industry might cut spending in 2017 for a third year in a row as companies continue to struggle to finance their projects.

U.S. rig count up by five this week

As U.S. operators continue to increase the efficiencies of their operations, many have been putting rigs back to work despite oil price finding a ceiling below $50 per barrel. The total number of active rigs in the U.S. reached 511 for the week ended September 16, 2016, according to data from Baker Hughes Industries. The rig count remains 327 rigs below where it sat at this time last year, however.

The majority of the rigs that were added last week are targeting gas, according to Baker Hughes, but the oily Permian remains the most active basin with the only triple-digit rig count in the United States. The Permian reported 201 active rigs last week, down one from the week ended September 9, 2016. The next most active basin is the Eagle Ford which reported 37 rigs last week.