Words pushed prices higher, but for how long

Oil prices have staged a recovery over the last few weeks as members of OPEC and other large producers like Russia discuss the possibility of a production freeze. News that the world’s largest producers would stop adding new production to the market was warmly welcomed as oil prices climbed above $40 per barrel for both WTI and Brent crude, but as inventories continue to build, prices are beginning to give back gains as the market waits for actual changes, not just words.

Neil Atkinson, head of the IEA’s oil industry and markets division, last week called the production freeze “rather meaningless,” ahead of a meeting of OPEC and non-OPEC members to discuss limiting production on April 17.

“Amongst the group of countries [participating in the meeting] that we’re aware of, only Saudi Arabia has any ability to increase its production,” said Atkinson. “So a freeze on production is perhaps rather meaningless. It’s more some kind of gesture which perhaps is aimed … to build confidence that there will be stability in oil prices.”

Iran is expected to continue increasing production and adding to the global glut of crude oil. The country’s oil ministry said that, while it supports the freeze, it will not join the group in limiting production until it has reached at least 4 MMBOPD of production.

The market waits for action

“Verbal intervention, which has obviously helped the market greatly over the past two months, combined with a production slowdown in the U.S., has probably taken [oil] as far as it can. Now the market really wants to see some action,” Saxo Bank senior manager Ole Hansen told Reuters.

“We’re seeing more and more commentators raise the flag and saying ‘have we seen too much, too soon?’ in terms of the rally across the sector.”

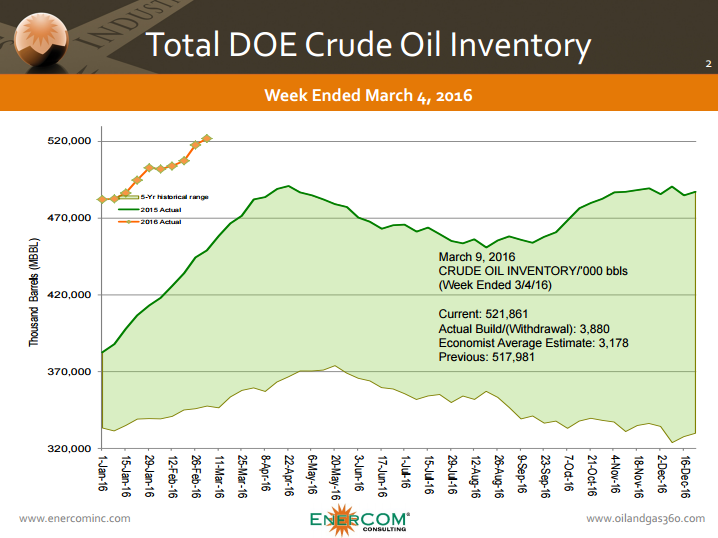

Last week, crude oil inventories showed a build more than three-times larger than what economists were expecting. Oil prices fell as reports from the DOE showed inventories increased by 9.4 MMBO, rather than the expected 2.5 MMBO.

Intervale Capital’s Managing Partner Charles Cherington told CNBC’s Squawk Box that he believes prices will go lower. Cherington said there’s a 17:1 ratio of underlying derivatives to the underlying commodity that’s lead to a tremendous amount of short-covering. And he believes the supply fundamentals remain unchanged – the world is still producing between 1.0 million and 1.5 million barrels per day more than it needs and crude oil inventories are at record highs.

Prices are expected to fall further this week, with economists estimating an average build of 2.8 MMBO for the week ended April 1, 2016, according to information from Bloomberg. Both WTI and Brent crude prices were down more than 3% as of 11:15 a.m. EST.

Adding to concerns of rising U.S. stockpiles, members of OPEC appear to be bringing more production back online. Kuwait and Saudi Arabia agreed to resume production at the jointly operated Khafji field, which shut down in October 2014 for environmental reasons, reports Reuters. The field was producing 280-300 MBOPD while online.

“There is a rebalancing on the way, but we are still running a surplus and stocks are building up as far as we can see,” SEB commodities analyst Bjarne Schieldrop said.

“There is a clear risk for a pull-back in Brent crude oil with a return to deeper contango again. Long positioning in Brent is at record highs and vulnerable for a bearish repositioning.”