The IEA sees continued pressure on oil potentially pushing prices down further

In its first Oil Market Report of the year, the International Energy Agency painted a pessimistic picture for the outlook of oil prices. Even as the IEA expects 600 MBOPD of non-OPEC production to fall off during the year, “this will inevitably be largely offset by higher production from Iran,” it said in its release.

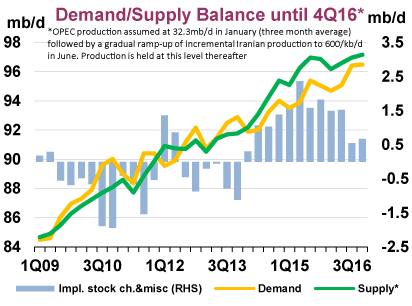

Oil demand growth flipped from a near five-year high of 2.1 MMBOPD in Q3’15 to a one-year low of just 1.0 MMBOPD in the final quarter of the year. Mild temperatures in the early part of the winter in Japan, Europe and the U.S., combined with weak economic growth in emerging markets like China, Brazil, Russia and other commodity-dependent economies gave little support to further demand growth.

During Q4’15, OPEC’s production eased by 90 MBOPD, but the IEA anticipates that this will be more than offset by the return of Iran to global oil markets. With the official announcement from the International Atomic Energy Agency, sanctions are set to be removed from Iran, which plans to add 500 MBOPD of production to the market immediately.

Many analysts have said that the market has already priced in Iran’s return to the market, but uncertainty around the actually quantity and quality of the crude oil Iran will bring back to the market still leaves room for prices to fluctuate, said the IEA.

Assuming all other OPEC members maintain current levels of production, and that Iran adds 600 MBOPD to the market by mid-year, the IEA forecasts that global oil supply could outstrip demand by 1.5 MMBOPD for the first half of 2016. “While the pace of stock building eases in the second half of the year as supply from non-OPEC producers falls, unless something changes, the oil market could drown in oversupply,” the IEA’s release said.