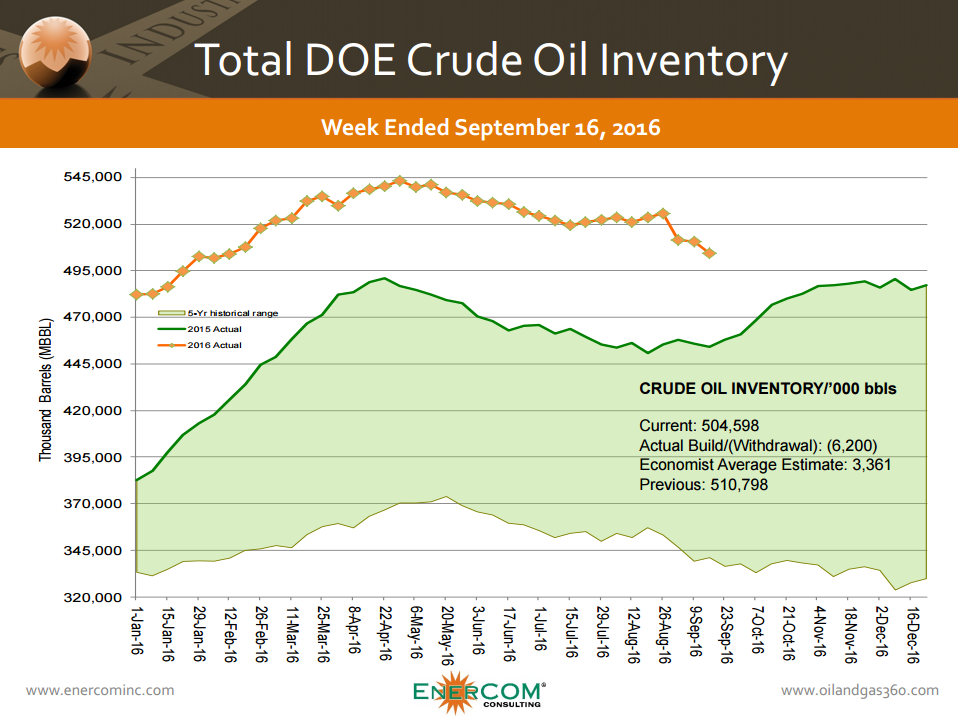

Crude oil stocks fall 6.2 million barrels

Oil prices shot up more than 3% today as U.S. crude stockpiles record the third straight inventory draw for the week ended September 16, 2016. WTI was trading above $45.50 in the afternoon, after opening at $44.50.

U.S. stockpiles fell by 6.2 million barrels to 504.6 MMBO, the lowest level since February 12, 2016, surprising markets today. Reuters forecasted a 3.4 MMBO build.

Oil prices were also helped today by a weakening U.S. dollar. The dollar fell against other major currencies Wednesday after the Federal Reserve left short-term interest rates unchanged. The weaker dollar makes dollar-denominated commodities like crude oil more affordable for purchasers with different currencies.

The bullish inventory draw was contrasted by steadily increasing production from OPEC, however. Saudi Arabia, Iran and Iraq continue to increase output, while exports from Libya’s closed ports resume after violent struggles for control over the facilities last weekend. Libya’s envoy to OPEC, Mohamed Oun, said the country would not join a production freeze with the rest of the organization as it tries to increase lost production, reports The Wall Street Journal. His comments echo the sentiments of fellow OPEC member Iran during the previous attempt to freeze the group’s production.

“Regardless of the weekly inventory reports in the U.S., all the signs point clearly to an oversupply given the high level of production that is under way everywhere,” said Commerzbank in a note.

Some market participants were confused by the crude draw last week as imports rose and refinery throughput fell. U.S. imports of crude imports increased 77 MBOPD, while refinery runs fell 143 MBOPD. Refinery utilization rates remained high at 92%, but were down 0.9% from the previous report released by the EIA.