Occidental looks to add 2 rigs to the Permian in 2017

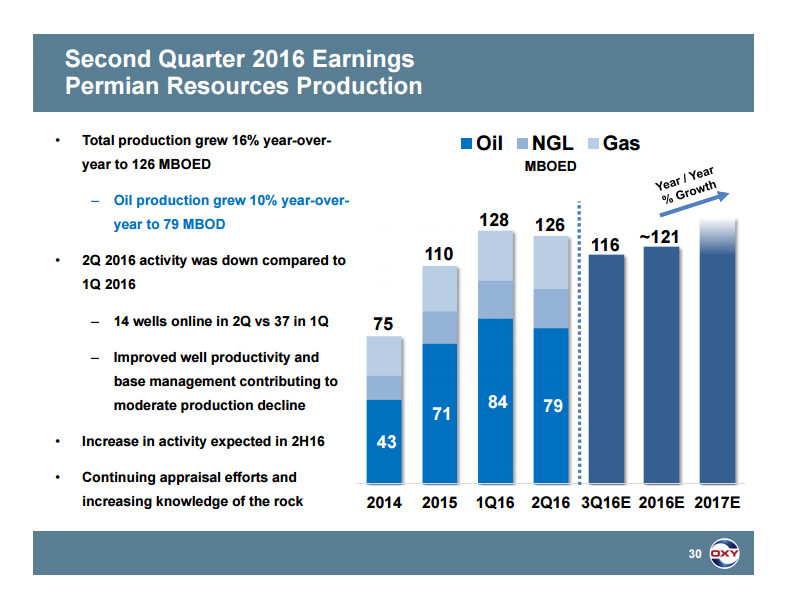

Occidental Petroleum (ticker: OXY) announced its second quarter results this week, reporting quarter-end cash balance of $3.8 billion, and Permian Resources production of 126 MBOEPD, up 16% year-over-year. OXY’s total company production increased to 609 MBOEPD due in large part to production in Abu Dhabi and Oman, but the Permian remained a main focus during the company’s conference call.

The company continues to focus on efficiencies, which have driven total spend per barrel down 3% quarter-over-quarter, and 37% from last year, according to the company’s press release. This was especially apparent in the Permian, where OXY CEO Vicki Hollub said the company can realize “the same amount of productivity with half the number of rigs,” as compared to when Occidental had 25 rigs operating in the basin.

Occidental plans to add two rigs to its Permian operations in 2017, according to the company’s investor presentation. When asked what the company’ operating capacity in the basin was, Hollub said Occidental has the capability to operate as many rigs in the Permian, but said there was no reason for so many rigs.

“At one time, we were running over 25 rigs, and if prices were in the range that would warrant that, we could get back to that,” commented Hollub. “But bearing in mind now that back when we were running 25 rigs, we were not as efficient as we are today. We’ve significantly improved our efficiencies, so we could get actually the same amount of productivity with half the number of rigs that we were at then.

“So I don’t see us going back to a 25 rig count in the Permian unless we expand our operations in our footprint. But we could easily go back to – to somewhere in the neighborhood of up to 15 rigs reasonably and still have the capacity to do it. I think we could get ahead of it with our infrastructure as well.”

Occidental looking at M&A in the Permian

On the M&A front, Hollub said Occidental is looking to expand its footprint in the Permian, and that the company could issue equity to make a deal. “We are certainly looking at acquiring and expanding – acquiring assets and expanding our position in the Permian, and we would be for the right project, for the right opportunity, certainly be willing to use our equity to do that,” she said.

“Our goal in acquiring additional EOR assets is to blend development of long-life, low decline production with our faster growth unconventional development,” Hollub said in her prepared remarks on the call. “While we continue to evaluate potential opportunities, we are staying return focused. And note that asset prices appear excessive when one considers the current product price environment.”