Schlumberger Creates “Pore to Pipeline” Business with $14.8 Billion Takeover of Cameron Intl.

While Halliburton (ticker: HAL) and Baker Hughes (ticker: BHI) labor over the fine print of their proposed merger, their top oil service rival is making moves of its own.

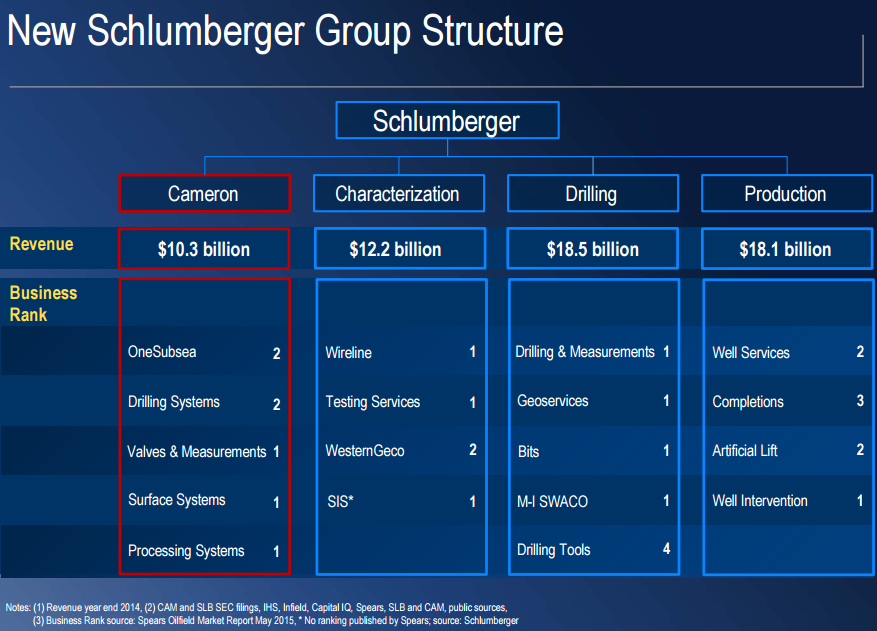

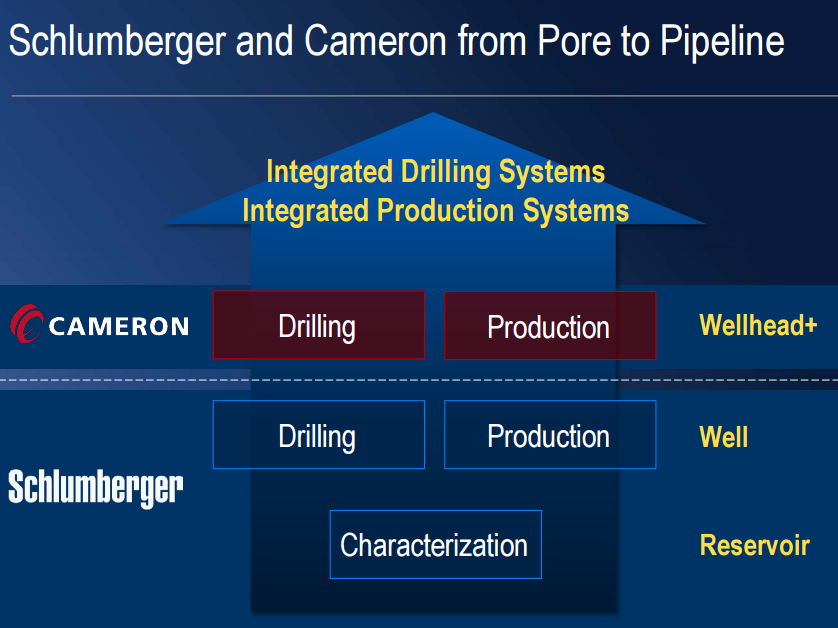

On August 26, 2015, Schlumberger (ticker: SLB) announced the $14.8 billion acquisition of Cameron International (ticker: CAM) in a joint press release. The merger combines SLB’s specialization in reservoir and well technologies with CAM’s expertise in surface, drilling, processing and flow control technologies. In a conference call following the announcement, Paal Kibsgaard, Chairman and Chief Executive Officer of Schlumberger, said the entity will “launch a new era of complete drilling and production system performance.”

The combined companies employ approximately 132,000 people and reported combined 2014 revenues of $59 billion, representing a 20% increase to SLB’s revenue base. A note from Global Hunter Securities expressed their surprise on the deal based on execution risks and a possible lower multiple for Schlumberger, but added that “SLB is one of the few companies that could tackle the challenges and successfully create a formidable technology force in the oilfield from the combination.”

Barclays chimed in, saying, “Over the last several years, Cameron has gone through an impressive internal transformation by reworking its supply chain, overhauling manufacturing processes, and improving internal controls…this is not a business that needs to be fixed, likely a consideration in SLB’s timing.”

Valuation Breakdown

Schlumberger’s reputation precedes itself, and its metrics on EnerCom’s Oilservice Weekly Benchmarking report reinforce why the world’s largest oilservice provider continues to lead the pack. Despite having a market cap greater than the nine next largest oilservice companies combined, SLB recorded an operating profit of 14% – well above the industry median of 4% and tenth overall among its 58 peers. Cameron Intl. was generally in-line with its eight equipment-based peers, reporting operating profits and return on invested capital of 7% and 24%, respectively. Its predicted value on a price to cash flow per share, however, had tremendous upside with its predicted value expected to be double compared to the current 9.9x P/CFPS multiple.

The Kickstarter: OneSubsea

Management from both sides acknowledged that with OneSubsea, a joint venture developed between the two companies in May 2013, played a significant role in the merger decision. The venture was intended to streamline offshore services and create efficiencies for its clients on both the cost and operating sides. OneSubsea currently has 17 projects in six continents worldwide.

“As we closely observed our OneSubsea joint venture, it became clear to us that the basis for a fruitful combination of our two companies was not only compelling, but also culturally very feasible,” said Kibsgaard. A note from Capital One Securities said the linking of an equipment company with a service provider isn’t a seamless match in terms of culture and process, but admits the price downturn has spurred some unique developments in the oil and gas industry. “What is clear is that this deal marks an acceleration of the collaborations… as the industry looks for step changes in trying to take out cost structure and improve efficiency to respond to the marked declines in commodity and subsequent pressure on activity and pricing,” the firm says. [The] ultimate goal of all of these ventures is earlier involvement in projects w/ a view to end-to-end life of field.”

SLB’s Heavyweight Takeout Bid

Per terms of the agreement, Cameron shareholders will receive 0.716 shares of SLB stock and a cash payment of $14.44 in exchange for each CAM share, amounting to a 78/22 stock/cash offer. Based on August 25, 2015 closing prices, the offer represents premiums of 37.0% compared to the average 20-day weighted price and 56.3% compared to its most recent closing price. CAM shareholders will own 10% of SLB, pending transaction approval. The consideration is 8.8x CAM’s EBITDA on a trailing twelve month basis.

The figures at face value certainly jump off the page and are consistent with values prior to the commodity downturn. If the transaction was made in November 2014, considering traditional 60-day weighted prices and the same metrics, SLB would be paying a 45% premium. In July 2015 from August 2014, shares of CAM declined roughly 33% on a monthly weighted basis while SLB shares dropped about 25% in the same period.

Schlumberger Acquisition History |

||||

| Announcement | Closing | Company | Specialty | Price (MM) |

| Feb. 21, 2010 | August 27, 2010 | Smith Intl. | Supplier |

$11,000 |

| M-I SWACO | Fluids | |||

| March 10, 2010 | Immediate | Geoservices | Mud-logging |

$1,070 |

| August 26, 2015 | TBD | Cameron Intl. | Well-head |

$14,800 |

Covering all the Oilservice Bases

In a statement, Kibsgaard reminisced on a previous industry event and realized the opportunities that repeatedly arise in the energy industry. He explains: “At our investor conference in June 2014, we highlighted how the E&P industry must transform to deliver increased performance at a time of range-bound commodity prices. With oil prices now at lower levels, oilfield services companies that deliver innovative technology and greater integration while improving efficiency, which our customers increasingly demand, will outperform the market.”

He continued: “As we seek new ways to drive total system performance in the areas of both drilling and production, it has become very clear to us that there is huge potential in a much closer integration between the surface and subsurface parts of both drilling and production systems.”

The combined company expects a total of $300 million in efficiencies in the first year followed by $600 million in year two, complemented by lower operating costs and simplified processes in manufacturing and supply chains. SLB management called the integration a “pore-to-pipeline” services company and expects the combination to be accretive to earnings per share within a year of closing.

A Tale of Two Mergers

The ongoing merger process with Halliburton and Baker Hughes is in its tenth month, and the proposed combination has encountered several obstacles from antitrust agencies throughout the globe. European Union regulators suspended their review on August 3, citing the need for additional information. The original deadline was supposed to be on August 27.

Schlumberger and Cameron, however, expect minimal regulatory resistance. Management for both sides said the technology offerings have practically no overlap, since the respective companies generally operate on different elements of the service process. The integration is so complementary that Kibsgaard said SLB does not plan on divesting any pieces of Cameron’s portfolio. Jack Moore, Chairman and Chief Executive Officer of Cameron, said the OneSubsea venture provides the companies a “roadmap” on how to fully integrate the two entities.

Halliburton and Baker Hughes, meanwhile, anticipated having to sell as much as $10 billion in assets to complete their merger, citing certain antitrust obstacles. The first $3.5 billion of intended divestures was announced in April 2015. In its most recent announcement, HAL said it is still “fully committed” to closing the deal in December 2015.

Halliburton and Baker Hughes, meanwhile, anticipated having to sell as much as $10 billion in assets to complete their merger, citing certain antitrust obstacles. The first $3.5 billion of intended divestures was announced in April 2015. In its most recent announcement, HAL said it is still “fully committed” to closing the deal in December 2015.

Schlumberger and Cameron, on the other hand, expressed confidence in Q1’16 closing date. Tomorrow, coincidentally, marks the five year anniversary of the day it closed on an $11 billion, all-stock merger with Smith International, another oilfield services provider. The transaction took six months to complete.

Who’s Next?

Analyst notes covering the merger were rampant on additional M&A speculation, but the two oilservice giants in Schlumberger and Halliburton were not part of the equation.

National Oilwell Varco (ticker: NOV) appeared in three separate notes (Capital One Securities, Baird Equity Research and Johnson Rice & Co.) as potential shaker in the M&A market. NOV stands out on EnerCom’s OilService Weekly Benchmarking Report as the largest equipment-focused company. On the acquisition side, equipment providers like FMC Technologies (ticker: FTI), Weatherford Intl. (ticker: WFT) and Dril-Quip (ticker: DRQ) were mentioned as potential targets. The companies currently hold enterprise values of $7.05 billion, $6.40 billion and $2.35 billion, respectively.

A note from Johnson Rice & Co. says: “Remember there’s been a perception that M&A in the space has been slowed by the pending HAL/BHI deal, with market participants and private equity awaiting those asset packages. We would think the transaction intensifies questions on how NOV responds, and would think FTI will react favorably to this announcement – both because of its overlap with some CAM lines and the perception of FTI as a high-quality name.”