Noble hopes to raise around $270 million with midstream MLP IPO

Ten months after postponing the IPO of its wholly owned subsidiary Noble Midstream Partners, Noble Energy (ticker: NBL) announced that plans for a public offering are back on the front burner.

The Houston-based company said that it plans to offer 12.5 million common units with the option for an additional 1.9 million units, representing a 39.3% and 45.2% limited partnership, respectively. Noble anticipates an offer price of $19.00 to $21.00 per unit in the MLP, which will trade under the ticker NBLX.

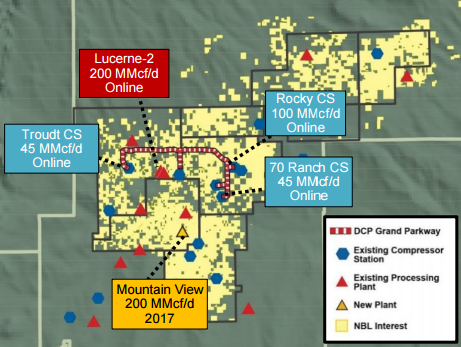

The IPO includes the company’s DJ Basin crude oil, natural gas and water-related midstream assets. Noble holds more than 500,000 net acres in northern Colorado’s DJ Basin, with the company’s largest onshore field located in the Wattenberg. NBL has invested approximately $600 million in DJ midstream infrastructure in order to meet the demand coming from the region according to a company investor presentation.

The company postponed an earlier IPO of its midstream assets in November, 2015, due to “unfavorable equity market conditions.” The original IPO had an estimated value of approximately $300 million, according to and SEC filing. Assuming that the company does the follow-on offer, net proceeds will be approximately $270 million, a research note from Stifel said today.

“Based on the mid-range price of $20/share and exercise of the underwriter option, our NBL YE16 net debt/TTM EBITDA estimate declines to 2.5x from 2.6x and our 2016 interest coverage (including cash) increases to 8.8x from 8.7x,” Stifel said in its note.