Noble plans to form an MLP out of its midstream assets in the DJ Basin

Houston-based Noble Energy (ticker: NBL) announced today that its wholly owned subsidiary Noble Midstream Partners has filed with the U.S. Securities and Exchange Commission (SEC) to perform an initial public offering of common units for a master limited partnership formed from the company’s DJ Basin crude oil, natural gas and water-related midstream assets. The new MLP will list on the New York Stock Exchange under the ticker NBLX, according to the Noble’s press release.

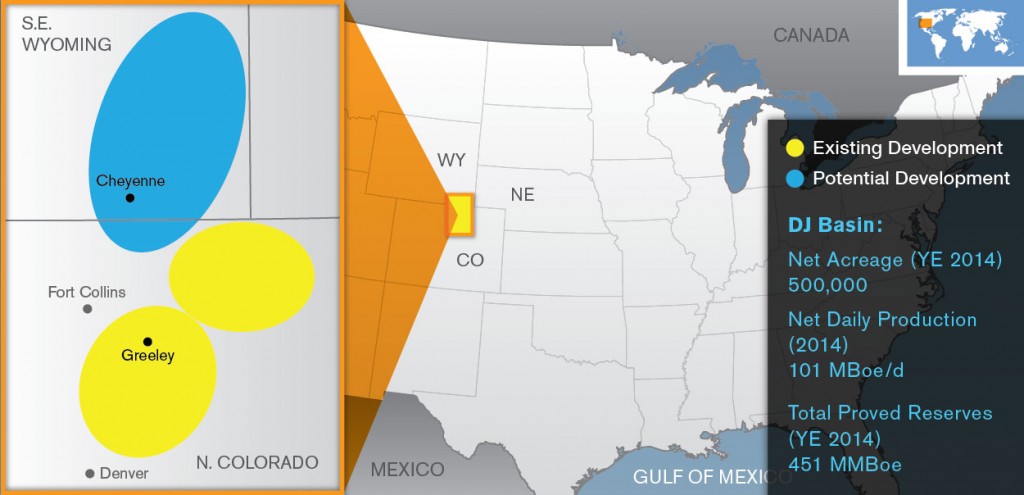

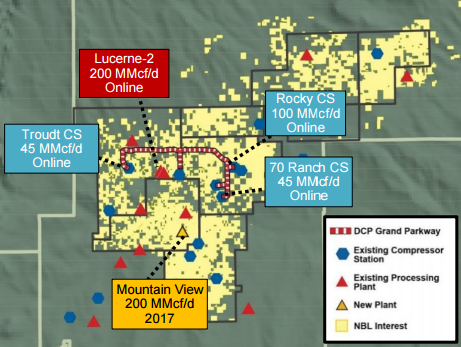

Noble holds more than 500,000 net acres in northern Colorado’s DJ Basin, with the company’s largest onshore field located in the Wattenberg. According to Noble, production from the DJ represents over a third of the company’s production, which according to EnerCom’s E&P Weekly, was 307 MBOEPD over the trailing twelve months. The company has invested approximately $600 million in DJ midstream infrastructure in order to meet the demand coming from the region according to a company investor presentation.

The number of common units to be offered and the price range for the offering have not been determined yet, Noble said in its release. Noble will own the general partner of Noble Midstream, all of its incentive distribution rights and expects to retain a majority of Noble Midstream’s limited partner interests.