Noble Energy, Inc. (ticker: NBL) started off 2018 by reporting first quarter net income of $554 million, or $1.14 per share. Adjusted net income and adjusted net income per share attributable to Noble for the quarter was $172 million, or $0.35 per share.

The company has poured $671 million into its upstream operations, with 75% deployed to U.S. onshore plays and 22% spent in Israel for the Leviathan development. Noble also funded $110 million for U.S. onshore midstream assets. Consolidated capital included $139 million organic expenditures and $206 million for a pipeline acquisition, related to Noble Midstream Partners LP.

Accounting Standards Codification Standard 606 (ASC 606)

The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) have been working on new revenue recognition guidance rules for about 12 years. In 2014, the two boards finally issued a converged standard on the recognition of revenue from contracts with customers.

For public companies, the new revenue recognition rules began in fiscal year 2018, after December 15, 2017, and according to Forbes, private firms will adopt the rules a year later.

The FASB said that the new guidance:

- Removes inconsistencies and weaknesses in existing revenue requirements

- Provides a more robust framework for addressing revenue issues

- Improves comparability of revenue recognition practices across entities, industries, jurisdictions and capital markets

- Provides more useful information to users of financial statements through improved disclosure requirements and

- Simplifies the preparation of financial statements by reducing the number of requirements to which an organization must refer

Ultimately the objective of the new guidance is to “establish principles to report useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue from contracts with customers,” the FASB said.

Noble benefits from ASC 606

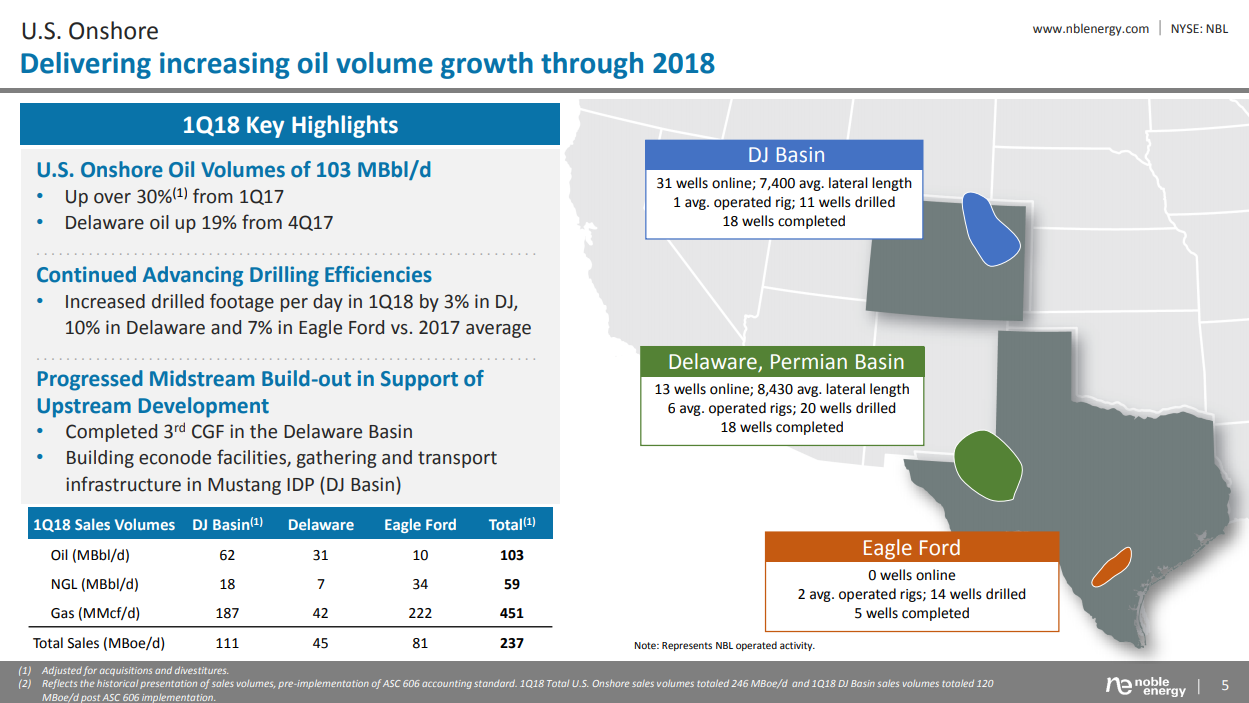

Noble reported that its company sales volumes for Q1 2018 were 361 MBOEPD (pre-ASC 606 implementation), an increase of 18% over Q1 2017. Noble said that its onshore assets contributed to the increase.

Post-ASC 606 implementation, Noble’s Q1 2018 sales totaled 370 MBOEPD. Unit operating expenses for the first quarter 2018 totaled $10.06/BOE.

Noble updated its guidance in accordance to the adoption of ASC 606 and the timing of the closing of the Gulf of Mexico transaction. The close of the Gulf of Mexico transaction, which occurred one month earlier than anticipated, Noble said, impacted prior second quarter expectations by an estimated 7 MBOEPD and full year expectations by nearly 2 MBOEPD.

According to the company, the implementation of ASC 606 has resulted in an uplift to second quarter and full year volumes of approximately 9 MBOEPD, compared to prior estimates. Accounting for only these specific items, full year 2018 sales volumes have been increased to range between 350 and 360 MBOEPD. Sales volumes for the second quarter of 2018 are expected to range between 340 and 350 MBOEPD (post-ASC 606).

- West Africa sales volumes are expected to be slightly higher than the first quarter as a result of lifting schedules

- U.S. onshore oil volumes are expected to be higher than the first quarter, driven by the Delaware Basin

Divesting and reinvesting

The divestitures of the Gulf of Mexico and the 7.5% Tamar interest in Israel account for nearly 30 MBOEPD reduction (20 MBOEPD Gulf of Mexico, 10 MBOEPD Israel) from the first quarter 2018 to the second quarter, Noble said. However, the Gulf of Mexico sales volumes are included through the April 12, 2018 closing date.

The company said its full year capital expenditure range of $2.7 to $2.9 billion remains unchanged. For the second quarter, Noble Energy expects organic capital expenditures between $750 million and $850 million, with the majority to be spent in the DJ and Delaware basins and to progress Leviathan development. The second half of 2018 capital expenditures are expected to be lower than the first half, reflecting front-end loaded infrastructure spending in the Mustang IDP and the Delaware Basin.

Conference call Q&A excerpts

Q: Speaking to the DJ, three of the wells at Kona were at the highest proppant load that you’ve done so far and at 3,600 pounds per foot. Can you comment on the results of those and does that indicate that that may be then the design going forward?

EVP of Operations Gary W. Willingham: The reality is I can’t tell you how good those wells are yet, because they’re still inclining after 65 days. So, they’re obviously very productive wells.

We’ve brought on seven that range from almost 3,000 to closer to 4,000 pounds per foot, and those seven wells are producing over 9,000 barrels equivalent right now and still inclining after 65 days and it’s 70% oil. So, very happy with them. Is that going to be a design going forward? I don’t know yet. With them still declining, again, we don’t know how good they are.

For the Mustang, as we’ve said, our initial plans are to maintain our 1,800 pound per foot design. That’s a design that we’ve developed over several years of testing in the DJ Basin and we believe is probably the optimum design. But in certain areas, we’ll continue to test both higher and lower concentrations. And again, it’s all targeted to how can we create the most value per section and the highest capital efficiency in our operations. So, stay tuned. Next quarter, assuming they’re on decline after another 90 days, we’ll see. But next quarter, we can talk a little bit more about it.

Q: How does the proppant concentration affect your acceleration, incremental EUR and flowback with the Kona wells?

Willingham: Given the amount of fluid that we’ve pumped in these things with the proppant concentrations that we’ve pumped at, as well as the fact that they’re over 10,000-foot laterals on average, we’re flowing them back fairly slow, which again, is part of the reason they’re inclining, but obviously very good oil rates already. I think as far as your question around incremental EUR and acceleration and – that’s always an interesting question – and it’s something that we try and get to every time we look at different completion techniques.

For me, at the end of the day, whether it’s incremental or acceleration, it still comes back to value and how can we create the most value from a section. So, obviously, we’d like to get our recovery factors as high as we possibly can, get every bit of oil out of these sections that we can, but it comes back to value at the end of the day. And if we can get more value by pumping 1,800 pounds in a certain well spacing versus a higher concentration in fewer wells, then that’s what we’re going to do. If the inverse is true, we’ll do that. But it really comes down to value at the end of the day.

Q (continued): So, you’re passive to where you are today, achieving or optimizing that value. Has it been more by adding EUR or has it been more by accelerating what you think is there?

Willingham: Well, I think it’s going to be a little bit different depending on where you are potentially and which zone we’re talking about. Remember, we’ve got multiple Niobrara zones, we’ve got Codell zones. So, it’s not as easy as one uniform answer across the field. I think obviously, if you have 8 wells per section, 10 wells per section, you’re going to recover a lot more resource than you would if you were only at four wells per section even probably at higher proppant concentration.

So, we continue to work the science. You’ll recall we’ve done a lot of work over the years gathering real-time data from downhole as we’re flowing back wells. We’re continuing to do that. These larger concentration jobs that we’ve recently pumped is a continuation of those efforts, and as we learn more, we’ll share it.