Transaction Expected to Simplify Long-term Development in Basin

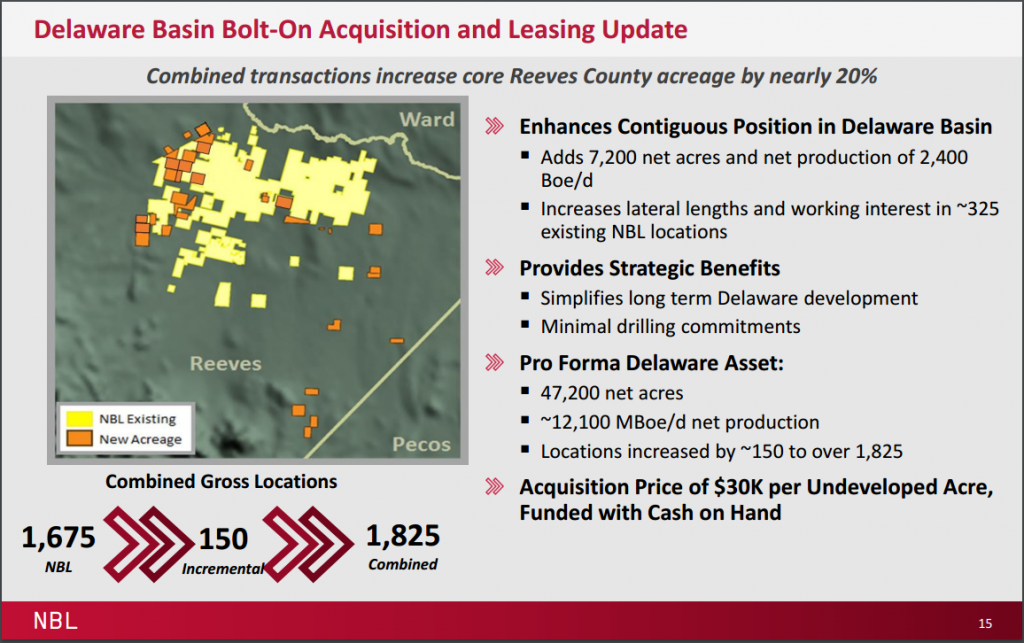

Noble Energy (ticker: NBL) recently announced the closing of a bolt-on acquisition of 7,200 net acres and 2,400 BOEPD of net production in Reeves County, TX. The transaction was announced at the Jefferies 2016 Energy Conference on November 30 and was funded with cash on hand.

The transaction increases the company’s net acreage position in the red-hot Delaware by 18% and adds approximately 150 gross locations to existing inventory.

The total acquisition value has not been disclosed but the company reported a price of $30,000 per net acre, implying a total value of $300 million to $325 million after adjusting for flowing production. This is in line with other recent Delaware transactions from Centennial and Concho.

| Transaction Details | |

| Third Quarter 2016 Average Production (BOEPD) | 3,076 |

| Liquids | 58% |

| Proved Reserves (MMBOE) | 12.1 |

| Proved plus Probable Reserves (MMBOE) | 22.1 |

| Transaction Metrics | |

| Production ($/BOEPD) | 26,008 |

| Proved Reserves ($/BOEPD) | 6.95 |

| Proved plus Probably Reserves | 3.62 |

“We think the acquisition makes sense given the fact that the acreage is mostly contiguous to NBL’s existing Reeves County asset, allowing the company to extend lateral lengths and increase working interest in existing locations,” said David Tameron, Senior Analyst with Wells Fargo Securities.

Acquisition Addresses Development Pace Concerns in Delaware

Wells Fargo’s note on the transaction stated that both investors and Street have raised concerns recently about the company’s cautious pace of development and relatively light inventory in the Permian.

“The recent announcement of a 3rd rig in Reeves County has begun to address the issue of pace of development and these transactions help to bolster inventory in the basin,” Tameron said.

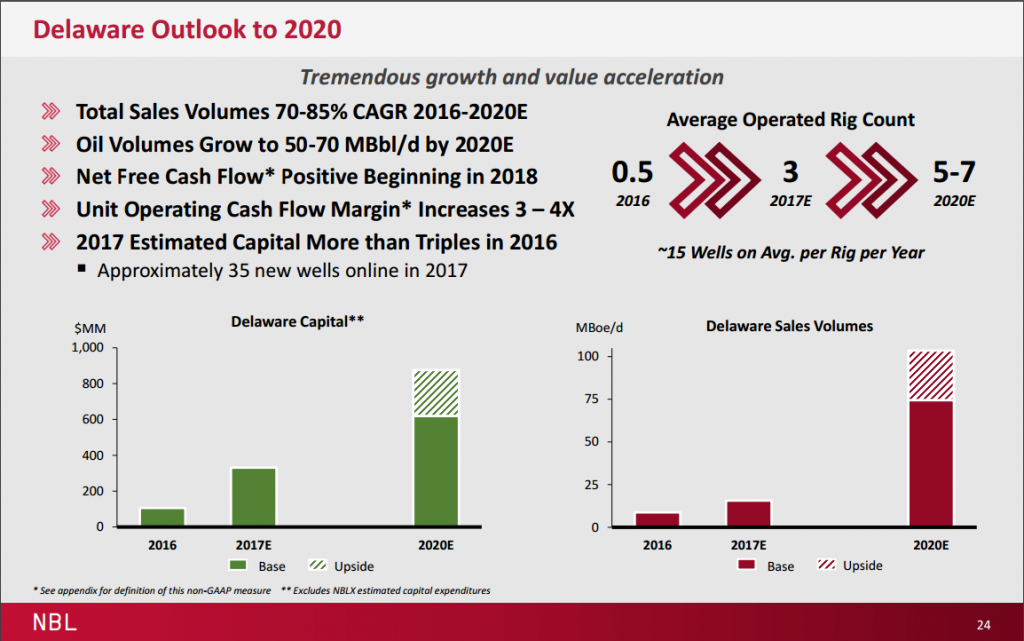

In its Longer-Term Outlook presented on November 16, the company laid out its plans to accelerate development in the Delaware. Capital spending, production volumes, and rig counts are all expected to more than triple over the next four years.

Onshore in the U.S., Noble has over 700,000 acres between DJ-Basin and Marcellus, as well as 75,000 in the Delaware and Eagle Ford. Through 2020, the company will focus 90% of its onshore capital on the DJ Basin, Delaware, and Eagle Ford, according to the Onshore Outlook.