EERC falls to 2,755

EnerCom has released its latest Effective Rig Count, examining the state of drilling activity correlated to production in major shale basins.

The Effective Rig Count fell to 2,755 in August, continuing the decline seen last month. The drop in total EERC was due to declining efficiencies, as reported rig counts rose slightly in August.

These two months represent the only declines seen in the Effective Rig Count since May 2016, when the downturn bottomed out. An Effective Rig Count of 2,755 means it would take 2,755 rigs from January 2014 to achieve the current growth seen in the major U.S. shale basins.

2018 can generate the same production with 944 rigs

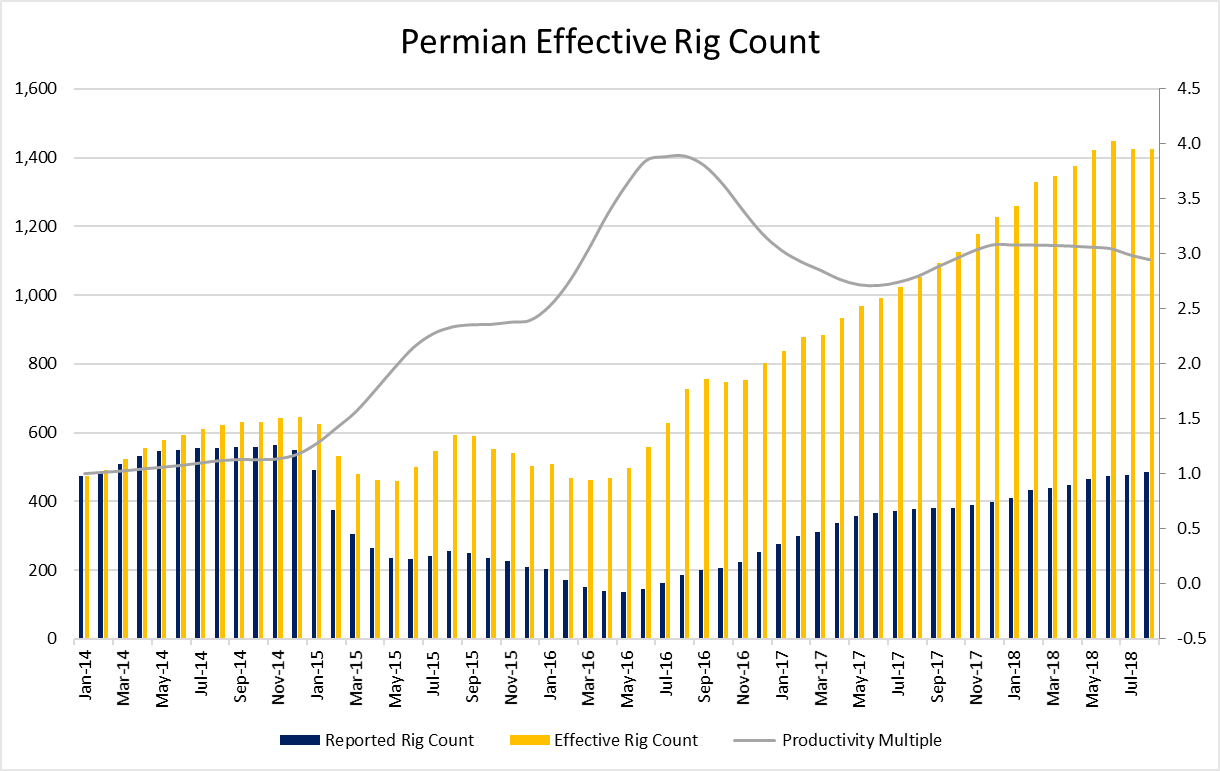

Modern operations have become so efficient that this level of activity only requires 944 rigs, meaning rigs in the major shale basins have become nearly three times as productive as rigs from 2014.

Productivity is declining; thanks to Permian takeaway constraints

However, productivity is on the decline, with the EERC productivity multiple falling from 2.94 in June to 2.92 in August. This is entirely due to the Permian, where takeaway capacity impediments are impacting operations. The pace of completions in the basin is slowing slightly, as companies consider redirecting capital.

This has combined with constrained production to decrease the productivity multiple in the basin by 0.1 in the past two months, a relatively sharp decline for a major basin where techniques and practices are mostly state-of-the-art and continuously improving.

Production growth is slowing, but Permian still leads

Production growth continues to slow in the Permian, as the punishing Midland-WTI differential affects operations. The EIA predicts the basin will see oil production grow by 31 MBOPD from September to October. While this is a very large increase, it is a significant slowdown from the 75.7 MBOPD of oil production growth seen each month in the first half of 2018. Despite the slowdown, however, the Permian will still show the largest oil production growth from September to October.

Gas production growth is also slowing slightly, as the major shale basins are expected to add only 961 MMcf/d of production from September to October. This is well below this year’s average monthly production growth of 1.18 Bcf/d. Appalachia continues to dominate in gas growth, as the EIA predicts the basin will add just under 300 MMcf/d in the month.

Niobrara DUC count down to 427

The Niobrara continues to work through its DUC inventory, completing an estimated 200 wells while drilling 180 in August. The regional DUC count is falling, but at a lower rate than in previous months. An average of 45 DUCs have been completed in the Niobrara since March. While completions activity has been relatively constant over the period, drilling has accelerated. The EIA estimates companies drilled 180 wells in the Niobrara in August, the highest activity level since February 2015.

One reason for the acceleration in drilling activity may be the progress of Colorado’s Proposition 112, which, if passed by voters, will essentially ban drilling in much of the state. Firms may be wise to acquire as many permits as possible before Nov. 6 in the event the veto-proof citizen led legislation change prevents future activity while the statute is in force.