Cabot Oil & Gas CEO says ConEd’s moratorium on new gas hook-ups beginning in March will create ‘significant calamity’ for New York

By Richard Rostad, analyst, Oil & Gas 360

Cabot Oil & Gas’s (stock ticker: COG, $COG) conference call offered a chance for Chairman, President and CEO Dan Dinges to give his thoughts on the company’s position and the overall U.S. natural gas market.

Dinges comments on New York’s natural gas policies

“I would point out that in the New York Post today there was an interesting article on Cuomo and the results of his crusade against natural gas and the beginning of some of the issues that New York is experiencing up there, experiencing in the form where it is starting to hurt small businesses. It’s starting to hurt the development of new housing. I think it’s clear that businesses are going to be turning away from New York. And with all of this, including the largest utility in New York representing that they will no longer accept applications for natural gas hook-ups, and that’s ConEd, beginning March 15, I think these are all the early signs of a policy that is creating significant calamity in New York. And I think it’ll continue to have companies evacuate from doing business there.”

[EDITOR’S NOTE: The following excerpts are from ConEdison’s Announcement of the moratorium.]

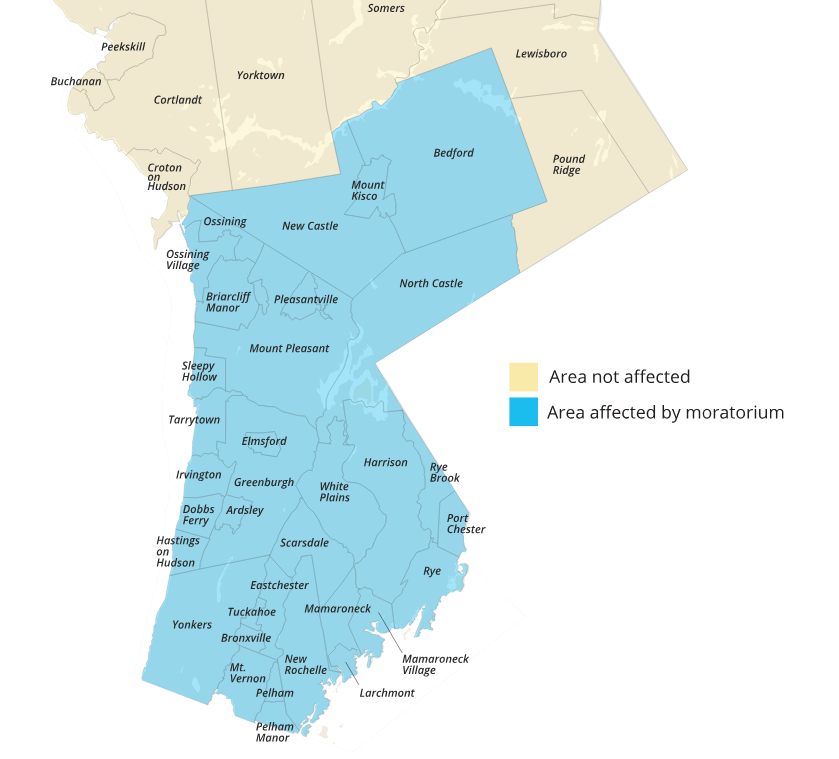

The moratorium applies to:

- New residential, and commercial and industrial customer gas service connections.

- Incremental firm gas load on existing residential, and commercial and industrial customer gas accounts.

- New gas usage for heating, hot water, laundry, and cooking.

In partnership with our customers, stakeholders, and regulators, we have made great improvements to the air quality in our service area with customers converting from oil to natural gas for their heating needs. The demand for natural gas, however, is outpacing supply on the coldest days due to those conversions, preference for natural gas use in new building construction projects, and constraints on interstate pipelines that bring natural gas to customers in Westchester County. These interstate pipeline constraints do not affect our existing customers, but limit our ability to serve new customers on the coldest days, when demand for natural gas is at its peak.

To address the supply-demand imbalance, and help existing customers reduce the amount of gas they use, we are pursuing non-pipeline solutions that will reduce our reliance on fossil fuels through innovative, clean-energy technologies. On February 7, the New York State Public Service Commission approved our portfolio of innovative solutions aimed at lowering the demand for natural gas through energy efficiency and demand response programs, along with programs to help customers with alternative technologies that reduce natural gas usage, such as heat pumps. In addition, the Commission encouraged us to pursue more non-pipeline solutions, noting that the approved measures are the “early stages of a long-term, comprehensive approach.”

We will continue to explore opportunities for projects that increase capacity on interstate pipelines that will meet federal, state, and local requirements. However, after March 15, 2019 we will no longer accept applications for new natural gas connections in most of our Westchester service area until we can align demand with available supply. New applications for interruptible service and natural-gas-fueled emergency generators will continue to be accepted.

Read the full posting from ConEdison here.

Comments on Cabot’s 2019 plans

“For the full year we updated our 2019 capital budget to $800 million, resulting in production growth of 20% or 27% on a debt-adjusted per share basis. Our decision to target the lower end of our preliminary capital guidance range is the direct result of current market conditions, feedback from shareholders and the broader investment community, and our continued strategic focus on returns and free cash flow over top line production growth. We believe that we have been an industry leader in de-emphasizing growth for the sake of it and for prioritizing return of and on capital while maximizing free cash flow.”

“Our updated program for the year reaffirms our commitment to this philosophy and echoes our commentary from the third quarter earnings call last October. We’ve certainly heard data points from the Appalachian peers that imply a more rational approach to capital allocation in 2019, and Cabot fully supports the rationalization of capital to bring stability to the market.”

“With that said, we have actually witnessed a slight increase in rig count in the Marcellus, Utica, and Haynesville since our call last October. Meanwhile, despite early winter-related rally the NYMEX strip remains in backwardation. While we’re cautiously optimistic on the supply/demand outlook for the next 24 months due in large part to significant demand growth and material base declines across the U.S., we believe it is prudent for us to plan more conservatively and utilize an incremental free cash flow resulting from higher prices for additional returns of capital to shareholders as opposed to funding additional outsized production growth. As a result, we’re using a $2.75 NYMEX assumption for budgeting purposes in 2019.”

“I think it’s also important to highlight that we’re going to generate this type of free cash flow while continuing to reinvest in the disciplined growth of our assets via the drill bit. We have seen numerous 2019 budgets released across the sector that imply significant reduction in capital spending year-over-year in order to target free cash flow neutrality. However, for some the limited capital investment, there could be a day of reckoning in 2020. In contrast, assuming price realizations are flat to 2019, our program for 2020 is designed first and foremost to deliver an improving return on capital employed and to generate strong free cash flow for the fifth consecutive year from a capital program that is lower than 2019 all while maintaining a pristine balance sheet. We expect to continue to deliver growth in cash flow and earnings per share in 2020 driven by disciplined capital allocation resulting in measured production growth.”

On new company messaging

COG: I appreciate everybody’s interest in Cabot. I think it is interesting. And I reflect on the release we’ve made and looking at not only our press release but the comments in this morning’s report, it’s interesting to have an E&P company make a report that does not talk about how much a particular pad has come on or what a zone has done, what a yield is on the well but talk strictly about what type of financial performance we can deliver to the shareholders. And I think that is – certainly what we’re hearing is the shareholders are very interested in value and value creation and I hope it is, getting a little bit agnostic, that just because we do it with natural gas does not mean that we have a flawed company.

On midstream opportunities

Q: Great, thanks. And then my follow-up is on the midstream front. I don’t know if you or Jeff are teed up for just the latest and greatest update on the various timing of projects and anything that’s new that’s coming onto the chalkboard, but that’d be great if that’s a possibility.

COG: I think on the midstream, it’s relatively quiet as we await some additional rulings with PennEast. I can tell you there are some new projects that have been laid out in front of us over the last few months that we’re interested in. I don’t think a lot of those has reached out into the public domain yet, but still a lot of movement on midstream projects.

Additionally, I think even maybe more importantly, is the additional in-basin demand projects that we’re viewing. There’s quite a bit of activity not just in Susquehanna County but in that northeast corner of Pennsylvania with additional projects that are being developed to keep gas in the basin, and that’s been exciting to watch as well.

Q: Can I ask on the new projects that you’re talking about, are those to move gas to the New Jersey/New York markets, to the southeast markets or, dare I ask, to the northeast markets?

COG: So I think a couple of them will do both and I don’t think anyone has given up on building pipe out of Pennsylvania into either Jersey or New York and, additionally, moving gas back down into the south. But I think the pipelines, we’ll be talking about those in the next few months.

COG: I’d like to add also on that point that not only would gas move out of basin, like Jeff is referring to, there are also a number of in-basin projects that he alluded to that we continue to work on that we think would not have it on the long-haul pipes, but would have it from the tailgate of our gathering system. And we think that is meaningful, just simply from the standpoint of how it assists in balancing the basis up there.

On the Upper Marcellus and developing the cube

Q: If I could also ask, Dan, back on the Upper Marcellus. What would you guys need to see in terms of well productivity, or whatever the relevant metric is for you, what would you need to see from those Upper Marcellus completions before you decided to perhaps co-develop those with Lower Marcellus locations and save on the surface and mob costs and things of that nature?

COG: Well, I’ll make a couple comments. First, I’ll make a comment regarding our comfort level since we received a couple questions regarding our Upper Marcellus and how do you know it’s distinctive, and I will just give one example. We have a number of examples that we could give to you but I’ll give you one example that most people are not going to have any problems understanding how we have the conviction we do.

Just recently, we laid two Upper Marcellus wells in an area that we had prior completions in the Lower Marcellus. And in this specific example I’ll give you, we had two Lower Marcellus wells that had been producing for an extended period of time. We put two Upper Marcellus wells 400 feet. And to get that context, 400 feet from two Lower Marcellus wells that had produced a long time and we completed those two Upper Marcellus wells that were 400 feet from these two Lower Marcellus wells. It just so happened to be the two Lower Marcellus wells that we chose to do this experiment on had each cumed over 20 Bcf, okay? So we laid two Upper Marcellus wells 400 feet from two wells that have cumed each 20 Bcf.

Those Upper Marcellus wells came on normally as you might expect. The early time production from those Upper Marcellus wells have actually fit a curve. And again, I’m going to caution the comment here on curve fit with very little data, but those two Upper Marcellus wells came on fitting a curve of 3.3 Bcf per thousand and 3.7 Bcf per thousand. I’m not saying that that’s what we’re going to go to so don’t take it and I hope nobody comes and asks about what about the 3.3 Bcf, 3.7 Bcf-type thousand EUR. That might be our poster child from this point forward. I’m just giving you an example of our confidence level of if there’s any place we would’ve seen some issues it would’ve been where we had produced over 40 Bcf 400-something feet away from a couple of Upper Marcellus. So that’s that soap box commentary on that.

COG: But I think back to the at what point would you go to – taking a word out of the West Texas – the Encana playbook, the cube kind of concept, the other thing that plays into that is what is the takeaway capacity in that part of our field at this point in time. What we wouldn’t want to do is do all of the Lowers and the Uppers and then be constrained because we wouldn’t be able to get that gas to market and why – in addition to being most efficient to do the Lowers than the Uppers and come back and do the Uppers later, and Dan’s example right now highlights that there’s no degradation when we came back. That’s still the primary focus of how we’re going to do it.

The really only downside is the mob costs you mentioned because we’re building the pads where we can come back on them and all that kind of stuff, so there’s not a lot of lost efficiency. What we don’t want to do is instruct Williams to put a huge pipe out there that will never be filled again after the initial production. That’s just not efficient from that side of the equation. So that’s kind of the dynamic.

We will do some science tests, like Dan highlighted earlier, where we got 10 or 15 that we think – I think that’s the latest number in the 2019 program. We did nine in the 2018 program. We’ll continue to do a few handfuls of these as part of the science project going forward. But in terms of full development of the full pad outside of maybe one or two for science purposes, it’s still most efficient to do what we’re doing.