Global Demand for Electricity Expected to Double over the Next Two Decades

- Asia accounts for a 45% increase in additional new power units being planned or under construction that are currently active.

- The global collective push for cleaner fuels is driving a push for more natural gas amid a future wave of gas supply and expected low prices.

- Coal is still in favor: it’s easy to transport, easy to store, cheap and abundant, and has low geopolitical risk.

- Projects related to global power generation present more than $3 trillion worth of active planned spending for the next 24 months.

Those were some of the findings of Industrial Info Resources in its “Global Power” webcast today which focused on global spending for coal- and gas-fired power generation.The analysts looked at global power plant coverage and future projected plant builds. North America held the top spot for most plants in current operation at 6,588. Europe was second with 5,864. East Asia had 4,213 and South Asia had 3,191.

The power plants that are being planned tell a different story.

East Asia leads with 4,633 plants in the planning stage. Europe was second with 3,563; South Asia was third with 3,116; and North America had 1,346. Other growth areas for electricity were Latin America with 1,778 planned power plants and Southeast Asia with 1,616, 82% more than the 890 power plants now operating in the region. There is a strong demand for electricity in Southeast Asia.

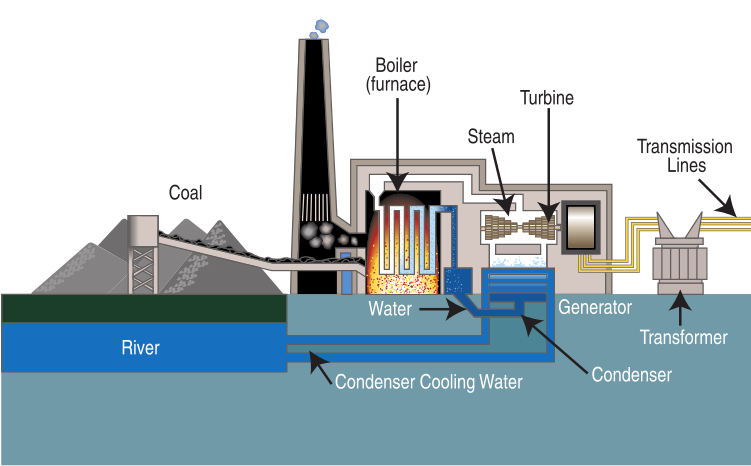

For New Build, Coal Dominates

With growing public and government sentiment against coal heavily covered by media outlets, it was interesting to see the number of globally planned new generating units by fuel type (units defined as separate generating units at power plants). On a global basis, coal is the most popular fuel as far as planned capacity, with 3,019 units planned which would deliver 1,554 Gigawatts (GW) of capacity.

By comparison, 7,000 planned new units for wind are slated to deliver just 504 GW of capacity; solar has 4,174 units planned with 208 GW of capacity. Natural gas had 3,682 units planned, slated to deliver 568 GW of capacity. Globally there are 11,120 planned hydroelectric units, representing 762 GW of capacity.

Regionally, North America and Europe are not as plentiful with new power generation builds as other areas of the globe, but they’re in the top group for spending, the analysts said. IIR pointed out that natural gas is more dominant but renewables are growing due to extension of tax credits.

With North America and Europe in the very mature markets category, IIR’s analysts said that new power plant builds in those regions were mostly driven by the move to replace coal plants that were closed or decommissioned in the current push for clean energy.

IIR’s analysts said that the choice to use coal and natural gas are dependent on their availability and price. “Coal is in the areas where we expect to see it—India, China and Southeast Asia. A lot of growth will come in emerging markets in the form of new coal and new natural gas-fired facilities,” the analysts said.

$3 Trillion in Power Plant Spending is Coming

IIR made the point that 195 countries met in Paris and agreed to limit global temperature increases to 1.5 degrees Celsius, but said they see a large coal spend on the horizon.

“What’s driving that? It’s demand in parts of the world where coal is abundant. When you look at India with 300 million people who still do not have access to electricity, there is an abundance of coal, it is available and it’s affordable,” IIR said.

More than $1 Trillion of Power Generation Spending Activity Planned for the Next 24 Months—Mostly Coal-Fired

The analysts’ looked at global projects by fuel type – comparing construction starts in 2016-2017. Coal soared above all the others with $954 billion. Wind was second with $595 billion, hydro with $496 billon, followed by natural gas with $330 billion. Solar came in fifth with $255 billion.

“In China some of the coal plant development has slowed and scaled back.” The analysts said the activity in China with respect to coal was largely to replace older subcritical plants with supercritical and ultra-supercritical generation technology. China also has plans to build 100 GW of solar capacity.

The analysts said Western Asia is a region where demand is soaring and driving much of the new build activity for coal. Turkey has 4.5 GW of coal capacity now under construction. They also pointed out that new nuclear capacity is a key factor in Turkey and the Middle East.

In Southeast Asia, coal, hydro and natural gas-fired power are in the outlook—coal with $116 billion of projects, hydro with $84 billion and natural gas with $41 billion.

Is there a Window for More Natural Gas Generating Plants in Southeast Asia?

“Yes, as they try to move away from oil-fired facilities. Parts of the region have natural gas available; others import natural gas. What is plentiful in the area is coal. I believe we’ll continue to see development of coal there,” the analysts said.

North America

“In the United States we see natural gas and coal running neck and neck, but natural gas is becoming the dominant fuel of choice,” was the conclusion of the IIR analysts.

North America is a market that is defined by lower electricity demand growth and a wave of environmental mandates that are underway.

How is Fuel Mix Changing in the U.S.?

As for coal generating capacity in the U.S., there are no new plants in development moving forward, the analysts said.

This has opened the window for natural gas to become more widely used; and the long range projection for natural gas prices make it very attractive. Renewables are also priced more attractively because of the extension of the tax credits.

But baseload generation is heavily dependent on coal and natural gas in the U.S. power grid.

The CPP

In the U.S., the Clean Power Plan is the big unknown at present. IIR pointed out that the CPP has been stayed by the Supreme Court, but it could have a big impact coming out of the court – causing one of two things: (1) another round of coal plant closures, or (2) throwing the door open to more coal plant development if it is struck down. “It’s just wait and see.”

Europe

The build out of natural gas plants is not as aggressive in Europe as it is in the U.S. Because of the availability of shale gas in the U.S. it’s prime for natural gas plants. “That is not something that is taking place in Europe … and Europe is more aggressively decarbonizing than the U.S. There is stronger development of renewables—wind and solar—in the UK for instance, along with some nuclear energy. There are areas of Eastern Europe that have coal development underway but as time moves forward I don’t think coal will be a part of the mix. It will more likely be natural gas.

The analysts pointed out that natural gas-fired plants have public opposition as well. There are hurdles to permitting, challenges to getting financing – all the same challenges apply. But compared to coal, natural gas projects have more of an opportunity to move forward. They are faster to permit, faster to build than coal plants.