Iran lays out new IPC framework in Tehran

Over the course of last weekend, Iran outlined the contractual terms on its new Iranian Petroleum Contracts (IPCs). Iran hopes to use the new contract terms to attract international investors to its oil and gas industry as it seeks to draw in $280 billion in foreign investment. Iran hopes the substantial amount of foreign investment will help it revitalize its oil and gas sector with the goal of taking its production to 5 MMBOPD.

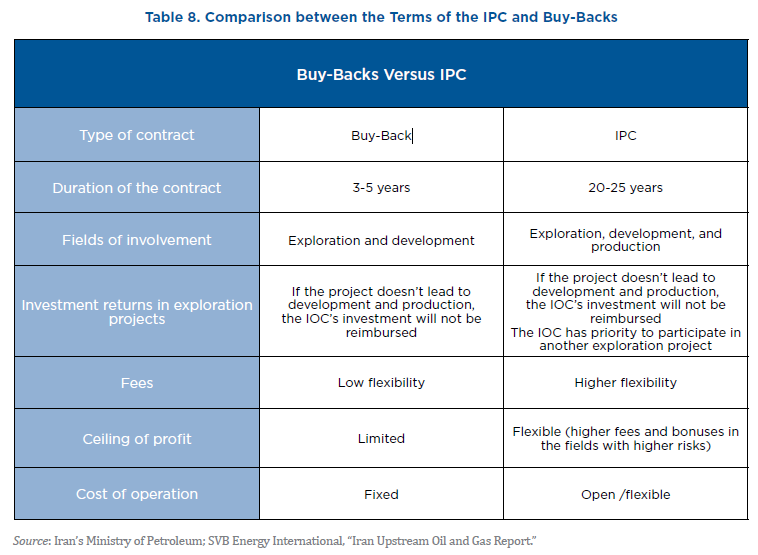

The contracts are meant to replace the old buy-back contracts previously used by Iran, which have not remained competitive due to their low flexibility and the fixed profit margins. The duration of the old contracts was three to five years, which only allowed IOCs to take part in the exploration and development phases of projects. IOCs were also unable to recoup their investment if the project did not lead to production, adding more risk to developing a new field.

The IPC was developed to offer more flexibility to international companies, making Iran a more attractive target for foreign investment. The IPC requires that international companies form a joint venture with an Iranian partner, usually the National Iranian Oil Company (NIOC), with the Iranian party acting as the owner and supervising the planning and operations. The IPC will last 20-25 years, allowing foreign companies to take part in the production phase of projects and see better returns on their initial investments. The IPC also gives priority to foreign companies that did not see previous projects developed in future bids, allowing them to make back losses.

In addition to the provisions to the IPC that allows for more involvement of international companies throughout the project, the new contracts also offers a more flexible fee system. Previously, specific geographical differences or reservoir challenges in new projects was not taken into consideration for individual projects. To address this, the IPC has a risk-reward system which offers the international companies a higher fee on every barrel of oil produced from riskier projects.

The longer-term contracts, along with the more enticing returns on projects seems designed to keep companies in Iran for longer, helping the country build the expertise and production necessary to reach its goal of revitalizing its industry.

This new model offers an attractive option to companies looking for projects in the Middle East, Dr. Sara Vakhshouri, president of SVB Energy International and Senior Energy Fellow with the Atlantic Council Global Energy Center, told Oil & Gas 360®.

“It’s difficult to attract investment anywhere right now with low oil prices, but low production costs mean Iran is still competitive,” said Vakhshouri. “The IPCs are very similar to the contracts offered by Iraq’s central government, but without some of the security issues associated with groups like ISIS.”

More value in long term contracts – for IOCs and Iran

Under the terms of the IPCs, international companies will initially have a four year contract for development, which can be extended for a further two years, according to Iranian Oil Minister Bijan Zanganeh. The minister said during the conference detailing the IPCs that Iran will have between five and seven years to pay back initial sums invested by foreign companies, but production cooperation could go on for as long as 25 years, reports Tribune.

“NIOC hopes to increase the quality of work and protect its oil and gas reservoirs by engaging international companies for longer periods of time,” said Vakhshouri. “This will give the investors a more vested stake in the field and could create political advantages for the country, as investing companies would have long-term interest in Iran.”

During the conference, Zanganeh said that $25 billion of foreign investment during the initial round of bidding on nearly 50 projects would constitute “success.”

Concerns remain

While several changes have been made to make the IPCs more appealing to international companies, there are still some points in the new contracts that cause some concern. Because the Iranian constitution does not allow for outside ownership of national assets, IOCs cannot book the projects under their reserves. However, the new investment model does allow investors to include their revenue from projects in Iranian oil and gas fields in their annual monetary and financial reports, a change from the old buy-back model.

Another major concern for companies looking to invest in Iranian oil and gas fields are their options for arbitration should problems arise during the project. “Companies with bilateral agreements with Iran can go through international arbitration if problems arise,” said Vakhshouri. “Otherwise, they will need to go through the Iranian court system.”

Having only domestic courts to rely on for arbitration should a problem arise may cause pause for some international companies. Companies may be worried that they will not receive fair treatment in the Iranian court system, according to NAFT Energy, an upstream strategy and investment house.

A possible need for amendment

During the conference held in Tehran to discuss the IPC structure, Zanganeh said there was a potential for future changes to the contract, though he did not specify which portions of the new contracts may need adjustment.

“Like any other human creation, it may need amendment and development,” he said.

The IPCs were developed with input from some international companies, but soliciting help while sanctions remained made it difficult to gain full insight into how to develop contract terms that were attractive to IOCs.

“[Zanganeh] is trying to leave the door open for more input from countries as Iran prepares for sanctions to be lifted,” said Vakhshouri, when asked about the oil minister’s comments.

No U.S. involvement

While 1,700 participants, including some 230 IOCs, were present in Tehran for the conference unveiling the IPCs, no U.S. companies participated. U.S. companies remain cautious about investing in Iran, particularly while sanctions remain in place.

When asked about the lack of attendance from U.S. companies, Zanganeh said there was no bar on them considering Iran’s energy market, but that it would not likely happen until after the official lifting of sanctions.

“The atmosphere and climate is ready for the presence of these companies in development of Iran’s oil industry, but they themselves have problems for being in Iran,” he said.