New legislation set to allow LNG export to WTO members without DOE approval

Congressman Mike Turner (R-OH) reintroduced legislation, titled the “American Job Creation and Strategic Alliances LNG Act,” yesterday in order to lift trade restrictions on the export of liquid natural gas (LNG). Under Turner’s bill, companies would be able to export LNG to any of the 160 members of the World Trade Organization (WTO) without getting approval from the Department of Energy (DOE) beforehand, streamlining the process of exporting LNG.

According to a press release from Rep. Turner’s office, the goal of this legislation is to create economic benefits in the United States through job creation and greater export revenues, while simultaneously enhancing energy security for U.S. ally countries. Speaking about the European Union’s dependency on natural gas from Russia, Turner said, “Putin’s functional monopoly on natural gas exports in Europe has left our allies vulnerable and without options… [This bill will] provide our allies with an alternative and reliable source of energy.”

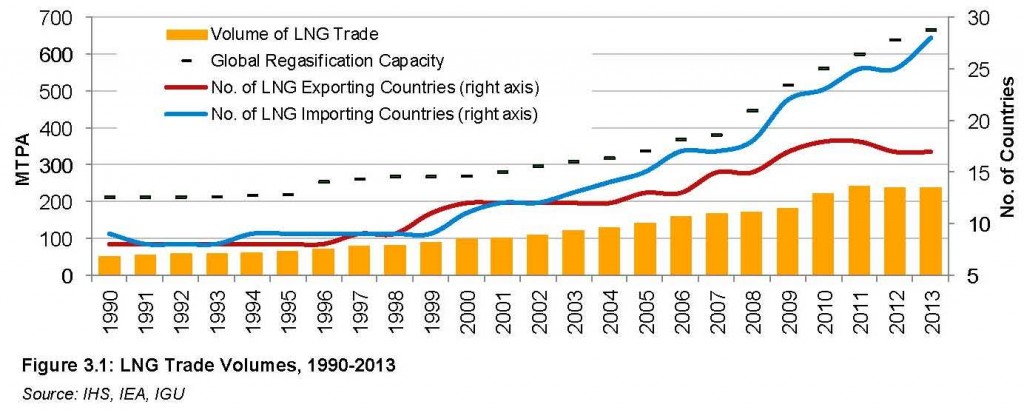

Markets for LNG abroad are growing, India Planning Terminals

Turner’s LNG bill comes at an opportune time as several members of the WTO look to increase imports of LNG. The WTO’s 160 members include the fastest growing markets for LNG. Based on information from BG Group (ticker: BG), China, South Korea and Mexico are the largest areas of rising demand, with a market beginning to emerge in Israel, all of whom are WTO members.

Also among the ranks of the WTO is India, who is looking to increase imports of LNG in order to meet sharp increases in demand. The Energy Information Administration (EIA) expects that India’s natural gas consumption will grow on average by 1.5% annually until 2020, while the country’s production decreases by 1.1% annually during the same time period, creating even greater demand. Narendra Taneja, co-chairman of the  Hydrocarbons Committee of the Federation of Indian Chambers of Commerce and Industry, said yesterday that the country plans to construct seven new LNG terminals over the next ten years in order to help meet this demand. A total investment of $5 billion is expected to bring the terminals online.

Hydrocarbons Committee of the Federation of Indian Chambers of Commerce and Industry, said yesterday that the country plans to construct seven new LNG terminals over the next ten years in order to help meet this demand. A total investment of $5 billion is expected to bring the terminals online.

“The countries with the highest potential for commodities development are China and India,” according to Morgan Stanley’s Commodity Trading Group’s Commodity Strategist Jeremy Friesen. “These two countries, one third of the world’s population, are still developing,” he said. As already large markets continue to grow, a LNG bill targeted at streamlining hydrocarbon exports from the U.S. is timely.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.