It’s time to overstate the obvious: the wide range of uses for natural gas makes it a critical resource for the United States and world economies.

Natural gas is used in an amazing number of ways. Although it is widely seen as a cooking and heating fuel in most U.S. homes, natural gas has many other energy related and raw material uses. It can be used as a vehicle fuel, it can power pipelines and infrastructure for the purpose of transporting natural gas or oil, and is widely prevalent in industrial use as a raw material. Natural gas is an ingredient used to make fertilizer, antifreeze, plastics, pharmaceuticals and fabrics. It is also used to manufacture a wide range of chemicals such as ammonia, methanol, butane, ethane, propane and acetic acid.

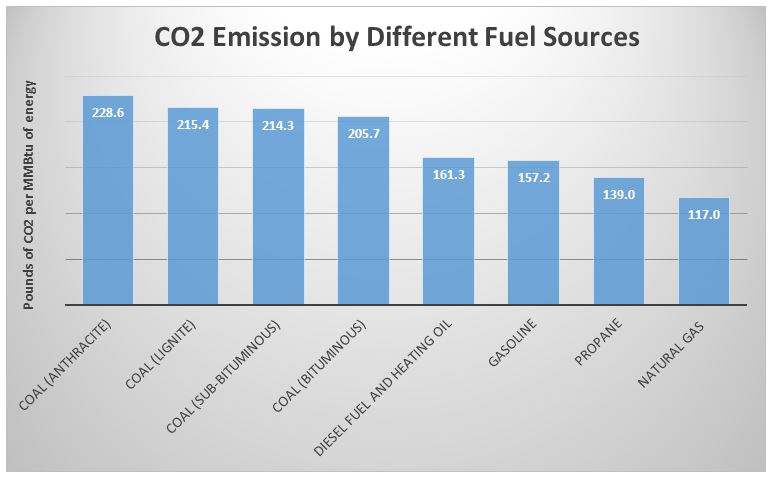

Despite the ubiquity of natural gas through many aspects of our life, natural gas has been likened to a “bridge fuel” for years, a source of electrical generation that can tide us over until renewables are ready to carry the full load. When it is burned natural gas emits about half of the CO2 as coal, making it a preferred alternative to coal, which has long dominated U.S. power grids.

Environmentalists have criticized natural gas because although it is cleaner than coal, it still is a fossil fuel that emits greenhouse gases. Methane is released during production and transmission, a particularly potent greenhouse gas. Moreover, the idea of a “bridge fuel” is a not as neat as is often claimed, environmentalists argue, because investing billions of dollars into long-lived assets – pipelines, power plants, processing facilities – will leave us locked into that infrastructure for decades.

In January 2016, The America Petroleum Institute (API) published its annual report The State of American Energy. America’s oil and natural gas industry supports approximately $1.2 trillion in U.S. gross domestic product and provides tens of millions of dollars a day to the federal government in the form of royalties and bonuses paid at lease sales and taxes. With the right energy policies, the oil and natural gas industry could support as many as an additional 1 million American jobs in 2025 and 2.3 million by 2035 according to a 2015 study by Wood Mackenzie.

However, natural gas has a multitude of beneficial employment and financial aspects that may keep the wheels turning. From a 2013 PwC report prepared for the API, the accounting firm said: “At the national level, each direct job in the oil and natural gas industry supported approximately 2.8 jobs elsewhere in the US economy in 2011. Counting direct, indirect, and induced impacts, the industry’s total impact on labor income (including proprietors’ income) was $598 billion, or 6.3 percent of national labor income in 2011. The industry’s total impact on US GDP was $1.2 trillion, accounting for 8.0 percent of the national total in 2011.” Common sense suggests that at $1.2 trillion, politicians would be stupid to over-regulate the industry.

| Direct Impacts | Operational Impacts | Capital Investment Impacts | Total Impacts | % of U.S. Total | |

| Employment* | 2,590,700 | 5,854,500 | 1,388,100 | 9,833,200 | 5.6% |

| Labor Income $B** | $203.6 | $311.8 | $82.2 | $597.6 | 6.3% |

| Value Added $B | $551.0 | $522.5 | $135.8 | $1,209.4 | 8.0% |

Source: PwC calculations using the IMPLAN modeling system (2011 database). Note: Details may not add to totals due to rounding. * Employment is defined as the number of payroll and self-employed jobs, including part time jobs. ** Labor income is defined as wages and salaries and benefits as well as proprietors’ income.

Regulatory Landscape

The final version of the Clean Power Plan (CPP) was unveiled by President Obama on August 3, 2015, legislation that was first proposed by the Environmental Protection Agency in June 2014. The final version of the plan aims to reduce carbon dioxide emissions from electrical power generation by 32% within twenty-five years relative to 2005 levels. The plan is focused on reducing emissions from coal-burning power plants, as well as increasing the use of renewable energy, and energy conservation. White House officials also hoped that the plan would help persuade other countries that emit large amounts of carbon dioxide to officially pledge to reduce their emissions.

Eliminating (or significantly reducing) the use of coal in power generation has the potential to reduce CO2 emissions from power generation, which is among the largest contributors to the global increase in atmospheric CO2. Environmental activists will point to the fact that natural gas is still a fossil fuel and still emits CO2 as a byproduct, but the emissions from natural gas consumption have the potential to be reduced, if not eliminated by new technology (more on this shortly).

The CPP plans to reduce carbon emissions by 32% will get a big boost as the switch from coal to natural gas takes hold, and moves toward the diminishing use of coal as an energy source.

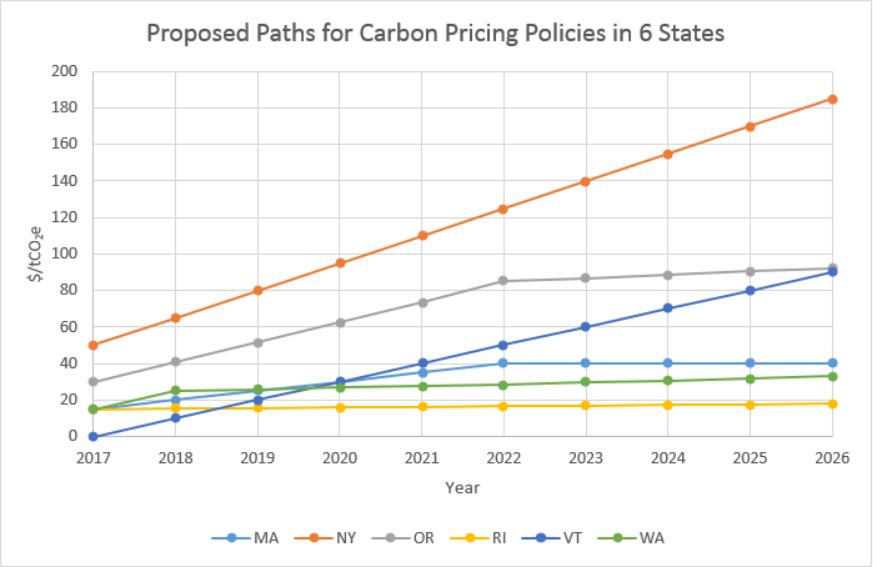

In response to the Clean Power Plan in the U.S., the Paris Agreement, and the U.S. House of Representatives’ resolution to condemn any tax on carbon, Exxon Mobil has launched an offensive to promote a carbon tax among U.S. energy producers. The plan calls for a simple tax charged on extracted carbon (such as oil and gas) in place of other regulations that are overcomplicated. Exxon CEO Rex Tillerson also promoted his desire for the tax to be revenue neutral, with the funds from the tax being returned to consumers to offset the increased cost to them. Exxon first proposed this plan in 2009.

“Allow market forces to drive solutions. In other words, if you put a price on carbon that is transparent and predictable and visible, the market will find ways to advantage lower-carbon energy sources, like it has with natural gas,” said Alan Jeffers, spokesman for Exxon Mobil.

“The industry is coming under increasing pressure on carbon. It’s extremely important that the industry recognize the issue at hand — the global issue — and not get too defensive. We need to ask what can we do as an industry to change the mindset on this and to find solutions. And what can we as an oil and gas company do in terms of operations and emissions and energy efficiency? Basically we are supporting what the U.N. is trying to do. A cost on carbon is something we need to get in place globally. These issues go together: low carbon and low cost. Low costs support carbon efficiency,” Said Statoil CEO Eldar Saetre, in an interview with Forbes.

“For many states, a carbon tax could be the most easily administrable and cost-effective compliance approach” to meet the EPA’s emissions limits by 2030, writes Brookings Institute Senior Fellow Adele Morris, “and they should start taking the idea seriously.” Morris notes that British Columbia is the first North American government to implement a carbon tax, and it has reduced its emissions “7.1 times faster than analysts expected, in part because the transparent and predictable price signal allowed business and consumers to invest efficiently and with foresight.”

Yesterday, European lawmakers began debating Europe’s carbon-tax, which represents a signal that the region’s cap-and-trade program will come under intense debate between now and 2020 when the program can be overhauled. “Paris has changed the debate in terms of climate ambition,” Ian Duncan, a British member of the committee responsible for steering the reform through the Parliament, told Bloomberg News before the debate. “There is a desire across the political spectrum that the EU Emissions Trading System should deliver on the pledges made in Paris last year.”

In the U.S., companies have bought solar and wind power under long-term contracts in anticipation of a carbon tax. And many — including such names as Wal-Mart, Microsoft, Walt Disney, Wells Fargo, General Electric and at least nine major energy firms — have officially factored the likelihood of a carbon tax into their business plans.

British Columbia introduced a tax on the carbon emissions of businesses and families, cars and trucks, factories and homes across the province in 2008. Many people in Canada opposed the tax initially (some still do), but the tides have shifted to garnering more support than dissent for the legislation.

“It performed better on all fronts than I think any of us expected,” said Mary Polak, British Columbia’s environment minister. “To the extent that the people who modeled it predicted this, I’m not sure that those of us on the policy end of it really believed it.”

The tax was initially slated at C$10 Canadian in 2008, and had risen to C$30 by 2012, which is roughly the equivalent of US$22. According to a study from the University of Ottawa, the legislation reduced emissions by 5% to 15% with “negligible effects on aggregate economic performance.” The tax made fuel more expensive: A gallon of gas, for example, costs US$0.19 more in Canada. The result? British Columbia’s economy did not collapse. In fact, the provincial economy grew faster than its neighbors’ even as its greenhouse gas emissions declined. Four other provinces have carbon prices either pending or in place, though they are generally much lower.

The new Canadian government, headed by Justin Trudeau, seems ready to come on board, imposing some pan-Canadian minimum price. If the United States embraced a carbon tax as part of a comprehensive overhaul of its tax system, the path would be much easier. Adding a carbon tax won’t benefit the general populace, but a revenue neutral approach will eliminate the downside for citizens. According to the World Bank, about 12% of the world’s global emissions of greenhouse gases are subject to a carbon price — either a tax or, more commonly, a levy under a regime of cap and trade like that in California and Europe, in which permits to emit are auctioned among companies. With few exceptions, British Columbia’s tax is the steepest and broadest in existence.

The Switch from Coal to Natural Gas

The coal-to-gas switch is officially underway, largely due to increased regulation and legislation, but also due incredibly low natural gas prices after a boom in shale gas production. U.S. natural gas production has increased from 49.5 Bcf/d in 2005 to 73.9 Bcf/d in 2015, a jump of 49.3% over 10 years. The increased production has driven prices down, but has also made the fuel far more accessible. The ubiquity of natural gas has proliferated the building of natural gas fired electrical plants to replace coal burning pants. The long term benefit is that once the switch to natural gas is made, the chance of switching back is limited. It is far more difficult to restart a coal plant than a natural gas plant. In EnerCom’s monthly report from July of 2015, the company reported that April 2015 was the first month where natural gas had overtaken coal as a source of power generation. That trend failed to hold through the year, but the effects of the switch have become more apparent in 2016 as natural gas usage has topped coal in two of the first three months and is expected to retain the advantage.

Companies that produce natural gas are reaching agreements to provide natural gas to power plants for the use in the generation of electricity. Cabot Oil & Gas Corp. signed a 10-year sales agreement to become the sole supplier to a 1,500-megawatt plant planned for Lackawanna County, Pa. Billed as one of the most efficient power plants in the country, the Lackawanna Energy Center power plant will start full-scale operations by the end of 2018. But what about all those coal plants expected to be forced offline? Won’t gas be needed to replace them? Indeed, the EIA sees about 45 gigawatts of coal knocked offline through 2021, following a massive 15 GW of coal retirements in 2015.

However, instead of natural gas replacing coal, renewables are already starting to capture most of the new market demand. In 2016, the U.S. could add 26 GW of new electricity capacity, but gas will only make up 8 of those GW. The rest will come from solar and wind. The extension of solar and wind subsidies through the end of the decade as part of an 11th hour budget deal passed by the U.S. House and Senate at the end of 2015 will ensure renewables continue to make up most of the new additions.

The switch from coal to solar and wind power will likely increase the cost of electricity to the consumer. The cost of conventional coal to the utility company is below the cost of offshore wind and solar power. The utility company will most likely pass this cost on to the consumer, raising electrical bills for everyone as the switch is made to a more costly form of energy.

The good news for natural gas is that as excess coal plants retire, gas plants will continue to increase in capacity and fulfill some of the needs, and natural gas won’t be as sensitive to price fluctuations. In other words, if natural gas prices rise, there will be fewer coal plants around to force gas plants to throttle back on generation.

Another key element is the benefits received by renewable energy companies in the form of government subsidies. Of the $16.4 billion doled out in government tax subsidies in 2013, 45% went to renewable energy companies. Yes, the fossil fuel industry does receive subsidies, but only 20%, well below renewable energy.

Zero Emissions Natural Gas Plant

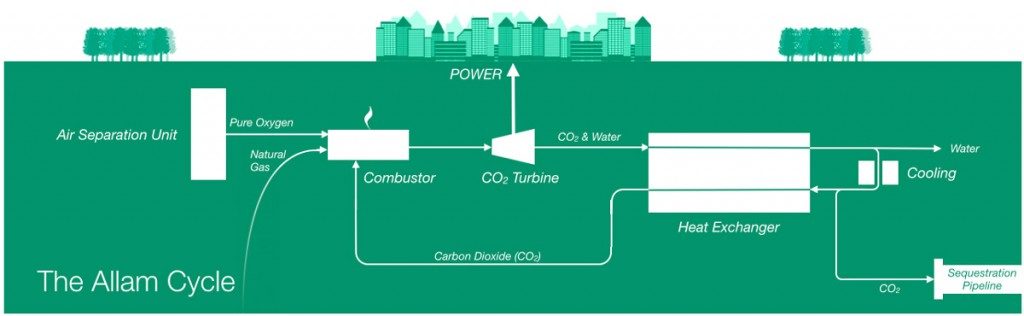

A new advancement in technology has the potential to alter the landscape of what types of energy generation increase carbon dioxide output. A collaborative effort between Exelon Generation, CB&I, 8 Rivers Capital and Toshiba, if it succeeds, will be the first fossil fuel-powered generation plant to avoid putting any emissions into the atmosphere, including carbon dioxide. The company’s claim is to be able to provide low-cost energy to customers without any of the environmental side effects.

The Durham, North Carolina-based company has designed what its engineers call Allam Cycle technology (named for its lead inventor, Rodney Allam) – which it describes as a “patented thermodynamic cycle.” In plain English, it’s a unique and innovative way to burn natural gas and spin a turbine to make electricity without using steam, or creating carbon emissions.

It’s contrary to the way most coal or combined cycle natural gas plants have made electricity for many decades, but if successful the NET Power technology has the potential to significantly decrease the carbon dioxide emitted from using natural gas for electrical generation. The process would become carbon neutral and the byproducts of power generation would become reusable.

Walker Dimmig, spokesman for NET Power, said the technology’s “oxy-fuel, supercritical carbon-dioxide power cycle” burns natural gas with oxygen, rather than air, and uses high-pressure CO2, rather than steam, to drive a turbine.

“This means no carbon dioxide, particulate matter, mercury, SOX or NOX is released to the atmosphere,” the NET Power website says. NET Power plant’s only major byproducts are liquid water and a high-pressure, high-purity stream of carbon dioxide that is sent into a pipeline for sequestration or utilization in industrial processes.

The plant will only produce electricity, water, and pipeline-ready carbon dioxide. The CO2 will be trapped and transferred for future use in industrial applications such as enhanced oil recovery from legacy fields. Additionally, the NET Power system has the capability to function without the input of water, making it a net water producer.

Power from NET Power’s plant will be consistent in efficiency with current natural gas plants and provide power to the grid. By reducing the need for expensive carbon capture equipment, the plant will operate at a portion of the cost of typical natural gas plants. Commissioning for the demonstration plant is expected to begin in late 2016 and is slated to be completed in 2017.

The potential for a carbon neutral power plant increases the weight of the argument towards the use of natural gas. Maintaining the efficiency of operations while simultaneously reducing costs, on top of the benefit of being carbon neutral is a win/win/win for natural gas, the natural gas industry, and the environment.

If, or more hopefully when, this technology reaches fruition, the shift towards natural gas will gain even more steam. The assault on coal is under way, and the elimination of carbon byproducts from the use on natural gas can only further the substitution effect.

Coal Royalties Diminish, What is the Financial Impact?

As the U.S. and the rest of the world moves toward the use of natural gas, the aftermath of the switch is likely to leave a wake, or so one would assume. An area where this wake would likely be felt is the loss of royalties from coal production. By implementing the CPP, regulators are pushing for the move away from coal to the cleaner burning natural gas. However, the switch from coal to natural gas has another impediment in reaching full realization, the royalty costs associated with fossil fuel production.

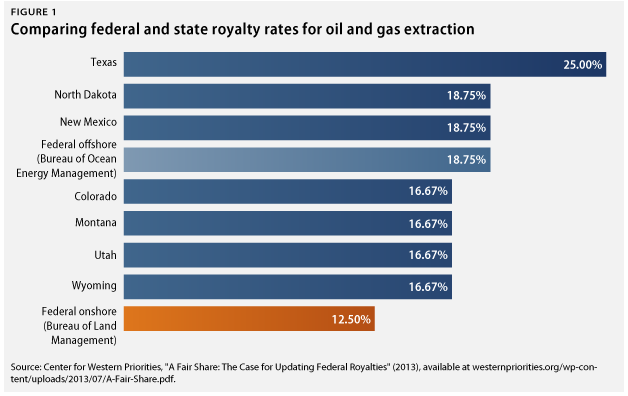

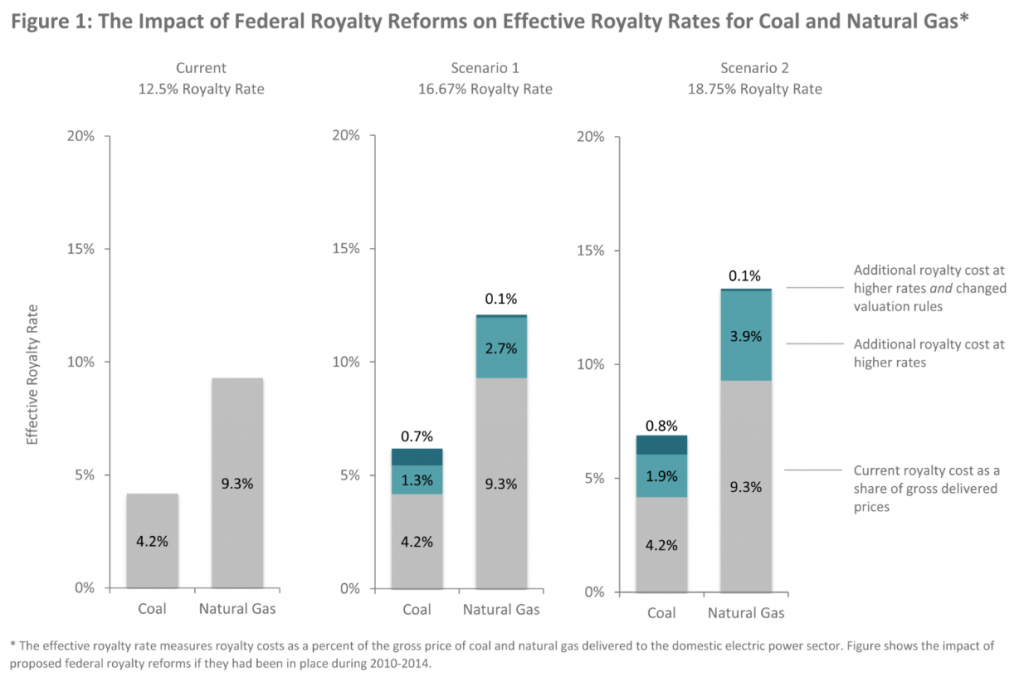

The switch from coal to natural gas might actually be a boon for the government in the U.S. The Department of the Interior has issued royalty rates for natural gas that is more than double the rate for coal, and there are plans in place to raise that rate.

The switch from coal to natural gas might actually be a boon for the government in the U.S. The Department of the Interior has issued royalty rates for natural gas that is more than double the rate for coal, and there are plans in place to raise that rate.

U.S. federal oil and gas royalties are payments made by companies to the federal government for the oil and gas extracted on public lands and waters. With a royalty, owners of the resource—in this case, U.S. taxpayers—collect a share of the profits based on the value or volume of the oil and gas extracted. On taxpayer-owned federal lands such as those managed by the U.S. Forest Service and BLM, oil and gas companies pay royalties to the U.S. Treasury, making royalties one of the federal government’s largest nontax sources of revenue.

With the exception of Alaska, the revenue is split with about half going to the Treasury and half going to the state where the federal lease is located. While all taxpayers have a financial interest in ensuring that royalties on federal lands deliver a fair return, oil and gas producing states, primarily in the West, have a particular high stake, as this money goes to fund schools, roads, and other priorities.

When the federal government last changed its royalty rate for oil and gas production on America’s public lands, Standard Oil’s monopoly had only recently been broken, Ford’s Model A still had not rolled off the assembly line, and the 20s had just begun to roar. In the 95 years since the Mineral Leasing Act first set the federal royalty rate for oil and gas at 12.5%, the federal government’s oil and gas revenue policies have remained firmly fixed in the past while state governments and private landowners have, time and again, updated the terms for development on their lands.

As a result of the federal government’s failure to modernize its oil and gas program, U.S. taxpayers are losing out. At the same time, oil and gas companies are stockpiling leases and sitting idle on the rights to drill on tens of millions of acres of public lands.

On April 17, 2015, the Obama administration signaled that it would undertake much-needed reforms to bring the federal government’s oil and gas program into the 21st century. Through what is known as an Advanced Notice of Proposed Rulemaking (ANPR) the Bureau of Land Management (BLM) is accepting ideas on how to reform its royalty rates, bonding requirements, minimum bids, and rental rates. These reforms will ensure that taxpayers are fairly compensated for the development of their resources.

The concept of setting a new floor for the royalty rate while allowing discretion to increase the rate above that floor is similar to the policies governing the surface mining of coal on public lands. This rule change would also represent an expansion of the authority of the secretary of the Interior to implement a sliding-scale royalty on particular oil and gas leases in limited circumstances.

In response to changing market dynamics and to better reflect modern drilling practices, state and private landowners have updated their royalty rates. Drilling in the Permian Basin sits on large portions of land owned by the University of Texas, and the royalty rate for drilling on University land is 25.0%, the royalty income going to financially support state institutions. Other states have taken it upon themselves to raise royalty rates. North Dakota, New Mexico, Colorado, Montana, Utah and Wyoming have all raised the royalty rate on state owned leases. Lease documents from Texas and Louisiana show private landowners charging oil and gas companies a 25% royalty on resources extracted from their land.

A discrepancy from the chart that comes to attention is the difference between the two levels of federal royalty rates, the royalty rate for Federal offshore is 18.75%, a full 6.25% higher than onshore. During the George W. Bush administration, federal offshore royalty rates were raised to 18.75%.

According to the Center for Western Priorities, if the onshore federal royalty rate were the same as the offshore rate, the U.S. government would collect an additional $730 million every year. The move to natural gas for the benefit of a cleaner burning fuel also comes with the added benefit of increased revenue for the Federal government.