United States leans away from coal as natural gas powers up to 20 gigawatts in 2018

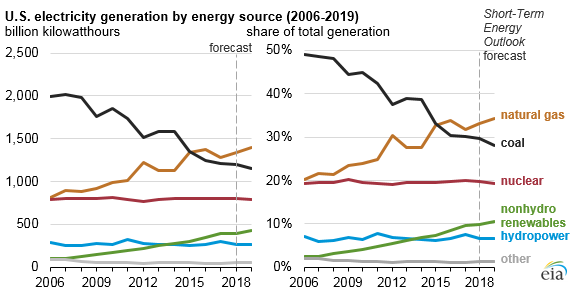

The EIA’s January 2018 Short-Term Energy Outlook (STEO) forecasted that natural gas will remain the primary source of U.S. electricity generation for at least the next two years. The share of total electricity supplied by natural gas-fired power plants is expected to average 33% in 2018 and 34% in 2019, up from 32% in 2017. Additionally, the EIA expects the share of generation from coal, which had been the predominant electricity generation fuel for decades, to average 30% in 2018 and 28% in 2019, compared with 30% in 2017.

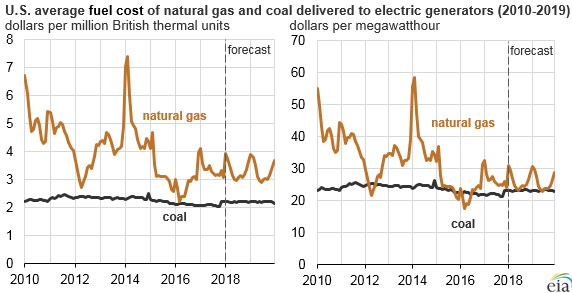

The mix of energy sources used for producing electricity generation continues to shift in response to changes in fuel costs and the development of renewable energy technologies, the EIA said. Since 2015, the cost of natural gas delivered to electric generators has generally averaged $3.50 per million British thermal units (Btu) or less, and it is expected to remain near this level through 2019.

13 gigawatts of coal-fired capacity to be retired in 2018

NatGas costs to generators expected to fall 2% in 2018, cost of delivered coal to rise 5%: EIA

The EIA expects the cost of natural gas for electricity generation to remain relatively competitive with coal-fired electricity over the next two years. The average cost of natural gas delivered to generators in 2018 is forecast to fall 2%, while the forecast delivered cost of coal rises 5%. These relative price changes should increase the share of natural gas generation in 2018. The costs of both natural gas and coal in 2019 are expected to remain relatively unchanged from this year’s forecasted prices, the EIA said.

20 GW of gas power plant capacity coming online in 2018 will be largest increase in 14 years

Power plant operators are scheduled to bring 20 gigawatts (GW) of new natural-gas fired generating capacity online in 2018, which, if realized, would be the largest increase in natural gas capacity since 2004. Almost 6 GW of the capacity additions are being built in Pennsylvania and more than 2 GW are being built in Texas.

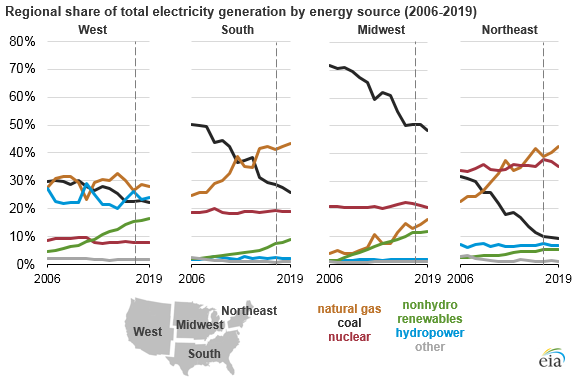

In contrast, about 13 GW of coal-fired capacity are scheduled to be retired in 2018. These changes in the generating capacity mix contribute to the continuing switch from coal to natural gas, especially in southern and midwestern states.

Nonhydro renewables to exceed 10% in 2019, natural gas usage continues to uptick

Compared with the rest of the country, the use of natural gas for electricity generation is not expected to increase as much in the west, where natural gas largely competes with hydropower. Natural gas generation in the west should rise from 27% in 2017 to 29% in 2018, the EIA said, primarily as a result of a decline of the region’s hydropower generation share, which is expected to fall from 26% in 2017 to 23% in 2018. In 2017, hydropower generation in the west benefitted from atypically wet conditions.

Generation from renewable energy sources other than hydropower has grown rapidly in recent years. The EIA expects the average annual U.S. share of total utility-scale generation from nonhydro renewables to exceed 10% for the first time in 2019.