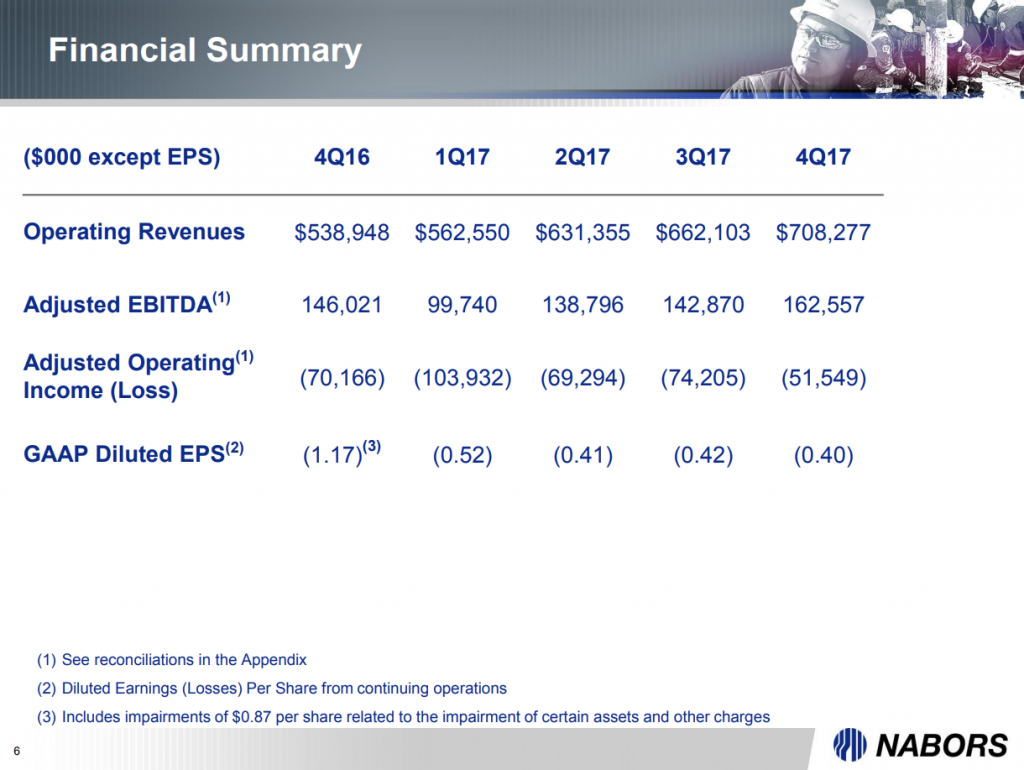

Drill rigs, equipment and software provider Nabors Industries Ltd. (ticker: NBR) reported full-year 2017 operating revenue of $2.6 billion, compared to operating revenue of $2.2 billion in the prior year. Net income from continuing operations attributable to Nabors for the year was a loss of $503 million, or $(1.75) per share, compared to a loss of $1.0 billion, or $(3.58) per share, in FY 2016.

Operating revenue for the fourth quarter increased by 7% or $46.2 million to $708 million, reflecting growth in all segments. Net income from continuing operations attributable to Nabors for the fourth quarter was a loss of $116 million, or $(0.40) per diluted share.

Segment results

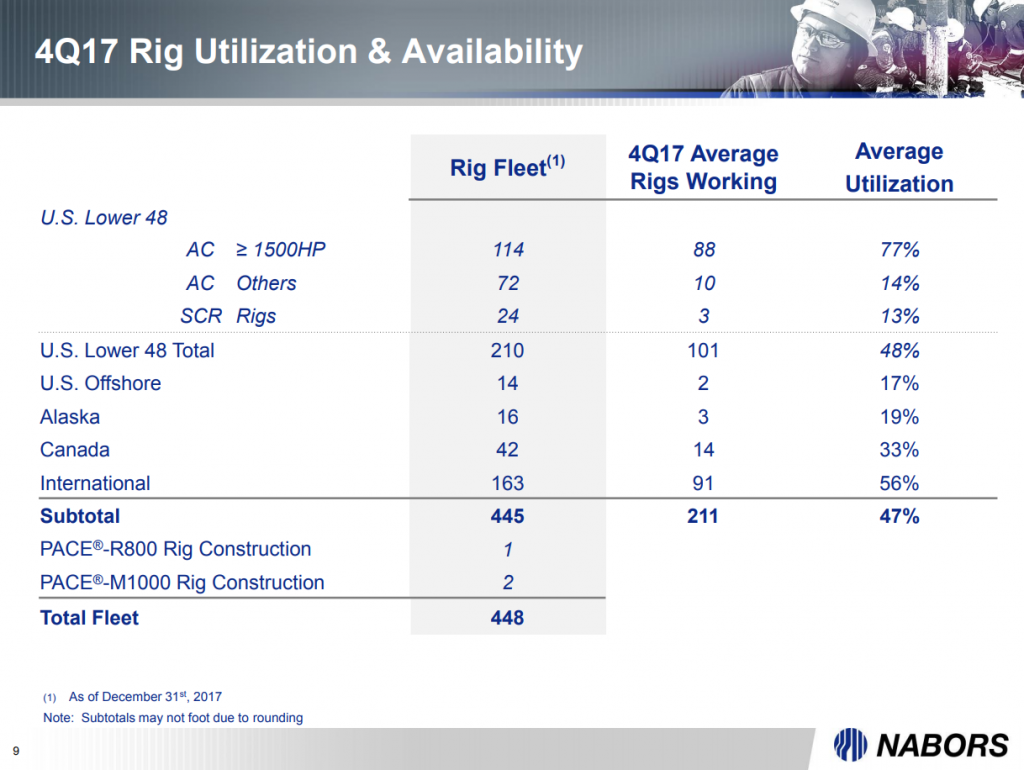

The U.S. drilling segment posted a 24% increase in adjusted EBITDA, at $54 million. This reflected a $1,147 increase in daily average margins despite a one rig drop for the quarter to 106.3 average rigs working, Nabors said. This segment has 114 rigs working with increasing margins. These increases resulted in average daily margins of approximately $5,000 in the fourth quarter.

International adjusted EBITDA for the quarter was $129 million, as compared to $137 million in the prior quarter. The decrease was attributable to a lower than expected rig count from delays in commencement of certain rig deployments and the return to more normal average margins compared to the third quarter. Average daily rig margins declined by $1,020 to $17,213 per rig day in the fourth quarter. The average number of rigs working was 90.7, one fewer than the third quarter average. The international operation has 96 rigs working and Nabors expects this to increase as the year progresses.

Executive commentary

CFO William Restrepo commented, “Our adjusted EBITDA continued to increase, driven mainly by higher pricing in the U.S. The improved financial results, together with our continued capex discipline, allowed us to deliver essentially breakeven cash flow, even before the impact of net cash inflows from our strategic transactions.

“We expect our U.S. Lower 48 daily margins to improve by approximately $1,000 in the first quarter, as we add several more rigs to our working fleet. Our International segment will benefit from incremental rigs, however, margins will diminish in the near term as a result of mix and rate adjustments on numerous multi-year contract extensions. During the second half of 2018, we expect daily margins in this segment should revert to their long-term levels as our rig count increases and we benefit from additional high margin work.

“We will remain focused on cash flow generation and capex discipline. As our margins in the US continue to expand, our global rig count increases and drilling solutions delivers incremental cash flow, we are targeting a slight reduction in net debt during 2018 followed by material increases in cash flow generation during 2019 and beyond.”

Conference call Q&A excerpts

Q: I just have one question on the U.S. Lower 48. It feels like if the U.S. Lower 48 market ends up adding, call it, 90 rigs between now and the end of the year, you’re going to have more E&P operators looking to term out super-spec rigs. And so, I realize we’re starting from a relatively low base in terms of your rigs that are term contracted six-plus months out on the horizon, but how do you weigh the pros and cons of terming out rigs, call it, in the one to two-year range? I mean, might we see a return to those multiyear contracts that we saw in the last cycle? How do you think about it?

Chairman, President and CEO Anthony G. Petrello: I think given that the portfolio is now only 15%, I think as we move it from the low to mid-teen number, and I think the prospect and the advantages of terming out a portion, I think probably we’d like to double our percentage. And I think as we all – all the players march down the path of terming out, I think it actually will probably cause some tightening of the numbers as well. So, I think that that’s one of the advantages we have given where our portfolio is, assuming the market develops the way you just said, which is what we’ve planned for. Which is why we’re in the situation we’re in. But that’s exactly the plan.

Q: You were talking about getting up to $8,000 cash margins towards the end of the year on your premium rigs. Is that inclusive of the NDS services? Or is that just a standalone day rate cash margin?

CEO Petrello: Yeah. Let me be clear about this because when you look at our numbers, there’s two things about our margins and our revenues on our rigs you have to be aware of. The first one is our rigs, the number is the basic rig that we reported, which means – and when we give you the indications of rates that we’re talking about, we mean a basic rate without any extra stuff, no extra services, no NDS services. Other competitors of ours run some casing, they run some trucking and other things. The numbers I’m giving you is pure base rate, ex-the NDS, which is now – I think the marketplace was a little confused. Now that we’ve split it out, I think it ought to be very clear that the rig numbers are all base rate only.

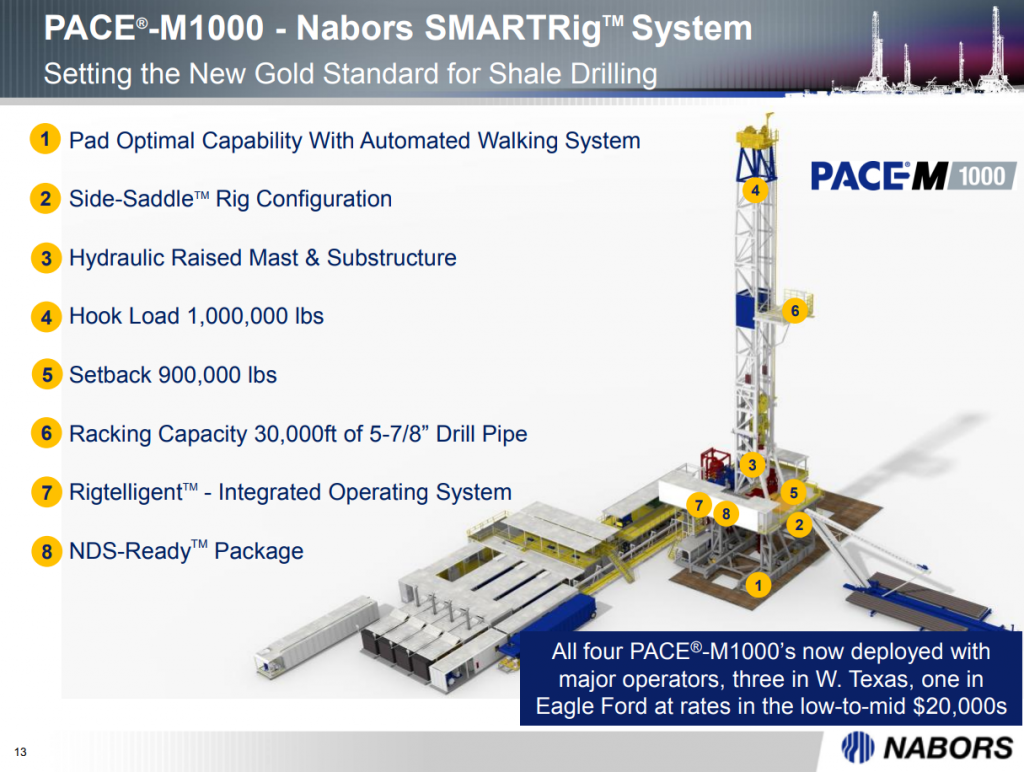

In terms of how we get there, on the base rate, as we mentioned on the rig, we have 13 super-spec rigs rolling over from term contracts this quarter. Their average day rate is under $18,000, and so you see the leverage when they move to the low to mid-20s, and then you have the two additional newbuilds. But also, on the cost side, we’ve implemented some initiatives that we’re beginning to realize in the first quarter.

You’ve got to remember, a lot of the costs that we have in the system was because of the gear-up to get to the 91 SmartRigs we have today. And included in our costs today is still some start-up amortization, which is about $5 a day, which will roll off by midyear. But the combination of that and cost focus as well as rolling up rates, that gives us a path that we’re talking about to get to $8,000 by the end of the year. And as we already said, for the first quarter, we’re targeting $6,000.

CFO Restrepo: Let me clarify as well. It’s not just for our super-spec rigs. It’s for the whole Lower 48 fleet, which includes a dozen or so legacy rigs and smaller rigs, SCR rigs and so forth.

CEO Petrello: Now, that’s absolutely true. And so, when you compare our average margins per rig to somewhat – some people call us pure-play rig companies with all 1,500 AC rigs, then you have to bear that in mind that’s the other issue. So normalized, the numbers on that stuff, the base would probably be higher.

Q (continued): Yes. So those are very strong cash margins. So, I guess backing into the other elephant in the room… $8,000 a day cash margins – is that enough to justify building new rigs? Or does it need to be higher?

CEO Petrello (continued): Well, with respect to newbuilds, I think right now our top priority remains paying down debt and generating attractive returns. To commit to new builds in the Lower 48 I think we’d have to see first customer commitments for term contracts probably close to three years.

We have to see leading edge pricing, say in the upper mid 20s or mid to upper 20s, and it would have to make sense vis-a-vis our other investor alternatives. I mean, when I look at incremental capital as a company, I have to look at where it’s best served. Is it best served NDS, the robotics, International or domestic and so we’re actually making the guys kind of compete for the capital to increase returns.

I think overall the mission this year is to attract more for our assets. If I had to use a phrase, I’d say this is the year of squeezing the orange. In other words, I want to get more juice out of what we have in the company and I want to get as much juice out of everything I have. I’m very proud of the asset base we now have. I’m proud of the technology portfolio we’ve put together, but now what we have to do is make hay with it, make money with it. And what we really want to do is squeeze as much as we can out of everything we have. So, I’m not saying it’s not possible, I’m saying, though, there’s a bunch of preconditions to get there.