Revises Price Assumptions Down in the Interim

A Moody’s Investors Service report out today has lowered pricing assumptions for Brent and WTI and examines how a sustained period of lower oil prices would affect certain industries in producing and non-producing countries.

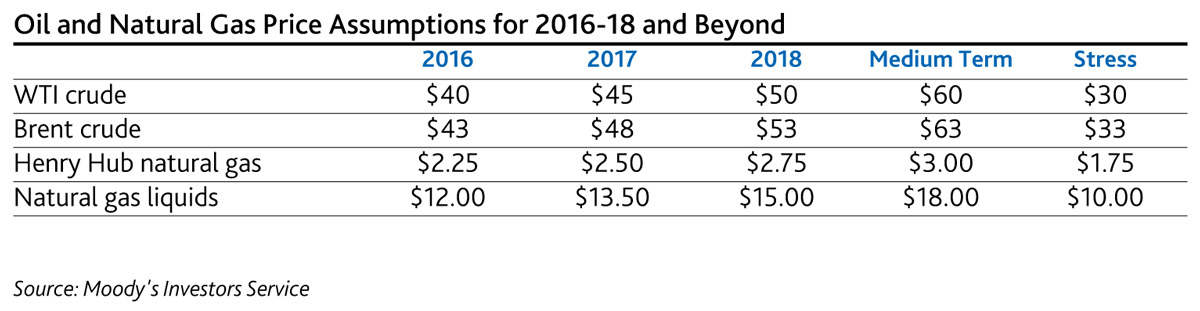

Moody’s revised its crude oil spot pricing assumptions as follows:

The report sums up the situation as follows: “Ongoing increases in OPEC oil production have offset growing global demand of about 1.2 million barrels per day and led to a rapid build-up of oil inventories. In October, inventories in the Americas, Asia and Europe stood at 4.4 billion barrels according to Energy Intelligence, compared with 3.8 billion-3.9 billion barrels in the last five years. The excess inventories compared with previous typical levels is equivalent to 1.5-1.8% of annual global oil demand.

“Although capital spending has dropped substantially and the US rig count has declined by more than half, US production has only recently begun to decline. Moreover, Saudi Arabia and Russia have both increased production to their highest levels since the early 1990s.

“We do not think global production will fall before the second half of 2016 at the earliest, when the effects of this year’s investment cuts lead to less new production to offset existing declines. The increase in world oil supply continues to outpace demand. Taking into account our forecast for economic growth and trends in energy intensity in each of the G20 countries, we expect oil demand to increase by around 1.3 million barrels per day in 2016. This is higher than our previous expectations, as long-term declining trends in oil intensity of the economy have stopped or slowed in a number of countries, including China, India, Russia and the US, all major consumers.

“Such large global inventories will take time to unwind and will continue to weigh on prices. Moreover, the agreement between international parties and Iran could lead to an increase in the country’s exports in early 2016. Although years of underinvestment have probably hampered the country’s production capacity significantly, the possibility or reality of higher Iranian exports will weigh on oil prices through at least early 2017 and may have a significant impact on prices when they become a reality.”

“At the start of 2015, crude prices of about $50 per barrel reflected factors including growing non-OPEC supply, supply outpacing demand worldwide and Saudi Arabia’s decision not to keep acting as OPEC’s swing producer,” Managing Director, Steve Wood said in a statement. “While we see no catalysts that would change the supply-demand equation in the near term, our long-term oil price assumptions reflect our view that prices will eventually rebound.”

“We do not expect oil prices to shift significantly in 2016 from their late 2015 levels,” the Moody’s commentary said, “which have touched multi-year lows in December. We assume that Brent crude, the international benchmark, will average $43/barrel (bbl), and West Texas Intermediate (WTI) crude, the North American benchmark, $40/bbl. For Brent, this marks a $10/bbl reduction from our previous assumption, and for WTI, an $8/bbl reduction. We assume that both prices will rise by $5/bbl on average in 2017 and 2018,” the report states.

“The longstanding price difference between Brent and WTI crude has also narrowed, mainly because a North American transportation bottleneck in Cushing, Oklahoma, has eased while international production has increased.”

Winners and Losers from Low Oil Prices

The Moody’s report sees the industries for which fuel is a direct and significant cost achieving a positive effect from lower oil prices, as will consumer-dependent businesses since lower gasoline prices leave consumers more cash to spend on other items. Airlines, shipping and packaged foods are among the business sectors that will benefit most from lower oil prices, according to the report.

The report singled out oil and gas exploration and production companies and oilservice companies as recipients of the most pain from lower crude oil prices, not a surprise.

“Passenger airlines’ financial performance will improve in 2015 as a result of lower fuel costs,” said Moody’s vice president, Jonathan Root. “American Airlines should realize the maximum benefit, but Delta, United, Lufthansa and Air Canada will also be among those that gain.”

Moody’s said suppliers of aircraft and components could suffer as falling prices increase the risk of order cancellations and deferrals. “Oil prices have fallen to a level that significantly reduces the operating cost benefits airline customers will realize from new fuel-efficient aircraft on order compared to when orders were placed, when Brent crude averaged more than $80 a barrel,” said a Moody’s senior vice president, Russell Solomon. “As a result, we expect order deferrals and cancellations to increase beyond the bump that has recently been anecdotally noted.”

“Sustained lower prices will boost the margins of processed food manufacturers such as Nestlé, Mondelez International and Kraft Foods, which spend 10%-15% of the cost of goods on freight and fuel. These companies should also see sales increase as cheaper oil leads consumers to spend their extra cash on discretionary food items. Restaurants will likely benefit for the same reason, though not as dramatically, with quick-service outlets such as McDonald’s and Wendy’s benefiting from lower-income consumers, who tend to see the biggest increase in their disposable income when gas prices are low,” the company said.

According to the report North America automotive demand will shift toward larger, higher-margin vehicles such as SUVs at the expense of smaller, more fuel-efficient models. Sales should improve for companies including General Motors and Ford. But sales aren’t likely to improve much in the saturated Japanese market, and since motorists there don’t drive as much on a daily basis as they do in the U.S., they are less likely to shift to larger cars. High taxes in Japan and Europe are likely to blunt the impact of cheaper crude on car sales, the agency said.