Midstates Petroleum Company, Inc. (ticker: MPO) reported a net loss of $85.1 million, or $(3.39) per share in 2017. In Q4 2017, the company reported a net loss of approximately $121 million, or $(4.78) per share.

For 2017, the company averaged 18,181 BOEPD (28% oil, 24% NGLs, 48% natural gas) in the Mississippian Lime and 3,967 BOEPD in the Anadarko Basin, for a total of 22,148 BOEPD. Total company production was 21,217 BOEPD in the fourth quarter of 2017, of which 82% was in the Mississippian Lime, with the remainder in the Anadarko Basin.

Midstates reported year-end 2017 SEC proved reserves of 108.9 MMBOE. Utilizing March 9, 2018 strip pricing, the company’s year-end 2017 proved reserves had a PV-10 of approximately $600.1 million.

In the Mississippian Lime, Midstates spud nine wells and placed five wells on line during the fourth quarter of 2017. For the full year, the company spud 32 wells and placed 26 wells on line in 2017.

Midstates said it has engaged SunTrust to explore strategic alternatives for its Anadarko Basin producing properties. The company will retain the NW STACK undeveloped acreage in Dewey County, Oklahoma.

In the fourth quarter of 2017, the company invested $33.6 million of operating capital, predominantly devoted to the Mississippian Lime assets. Total Q4 2017 CapEx was $35.1 million, and for 2017, Midstates spent about $140.4 million overall, with $121.8 million directed toward D&C activities.

2018

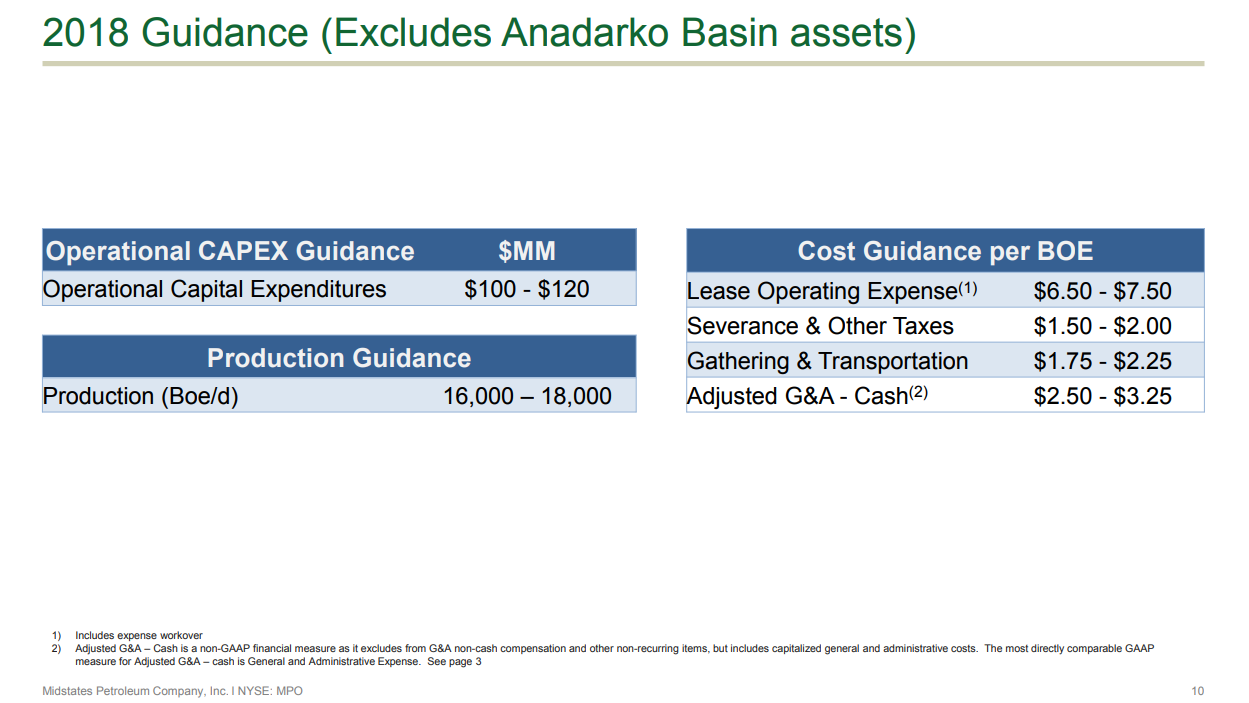

Midstates will have a 2018 capital budget of $100-$120 million, with a one-rig drilling program. The company expects production of 16-18 MBOEPD. The company noted that this excludes the Anadarko Basin assets.

CEO Sambrooks: proposed SandRidge Energy, Inc. (ticker: SD) merger will have zero net debt

President and CEO David Sambrooks commented, “During the second half of 2017, we made several key strategic decisions to streamline our company with a focus on the Miss Lime and to pursue a drilling and development program that will be return driven and fully funded with internally generated cash flow. By committing to a single-rig drilling program for the foreseeable future, we will be able to generate free cash flow, but as a result, we had to reclassify a portion of our proved undeveloped reserves to probable… We continue to rationalize our portfolio and last year we sold our non-core assets in Lincoln County, Oklahoma, and will conclude our Anadarko Basin strategic review process soon.”

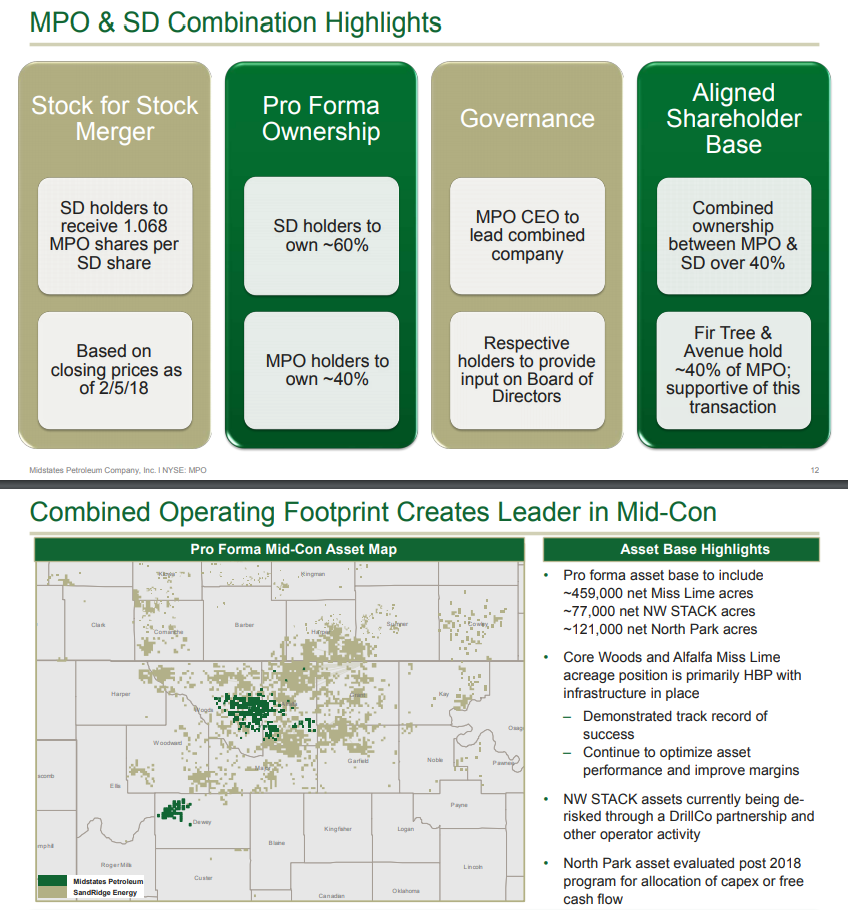

Sambrooks continued, “Even with our confidence in the future for Midstates as a standalone company, we believe there are significant benefits from an at-market, all stock merger with SandRidge. Combining these two companies would form a stronger, more formidable company and deliver undeniable benefits to all stakeholders. The strategic fit and geographic overlap of both companies’ assets in the Mid-Con builds critical mass, creates significant synergies, and generates attractive risk-adjusted returns, while having options for growth in the Miss Lime, NW STACK and North Park assets. The combined company will have zero net debt, strong liquidity and forecasted free cash flow generation of up to $400 million over the next five years.”