Middle East Oil will account for Most of the World’s Demand Growth IEA Believes

An updated analysis from the International Energy Agency (IEA) has determined that the current oil price environment has boosted the share of oil produced in the Middle East. At 31 million barrels per day, the region now accounts for 35% of global oil supplies, the highest level since 1975, according to data from the IEA.

The agency said a $300 billion decline in investments in the oil sector in 2015 and 2016 represents the first consecutive two-year drop in three decades, with North America accounting for about half the drop.

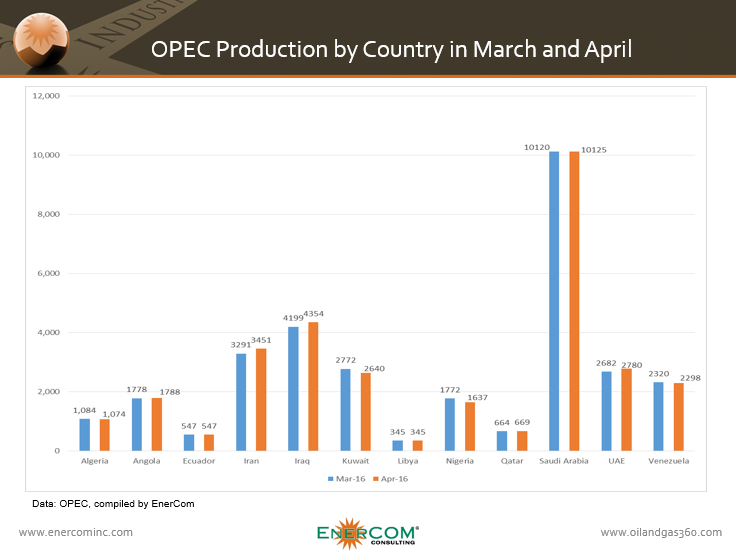

“Growth in production from Saudi Arabia, Iraq and Iran, highlights the fact that low-cost producers in the Middle East remain central to oil markets,” the IEA said in a press release. The agency’s conclusion was that “if prices remain at current levels, a significant rebound appears unlikely in 2017.”

Gains in Market Share for OPEC Come at a Price

A report from the EIA in June showed OPEC’s revenues fell by nearly half from 2014 to 2015 as the group pursued a strategy of defending market share over oil prices. The EIA estimates that the members of OPEC earned about $404 billion in net oil export revenues last year, down $349 billion from 2014’s $753 billion. The 46% decline in revenues was the lowest the group has seen since 2010, according to the report.

Approximately one-third of total OPEC oil revenues went to Saudi Arabia, the group’s largest producer. The EIA estimates that OPEC’s de facto leader likely earned $130 billion in revenue last year, down from $247 billion in 2014. The net earnings included Iran, unlike in previous reports. However, Iran’s net export revenues were not adjusted for possible price discounts the country may have offered customers between late 2011 and January 2016 when international sanctions were in place. The EIA believes the Islamic Republic earned roughly $27 billion last year from oil exports.

EIA projects that OPEC net oil export revenues could fall further to about $341 billion this year, based on projects of global oil prices and OPEC production levels predicted in the EIA’s most recent Short-Term Energy Outlook. On a per capital basis, OPEC net oil export earnings are expected to decline about 17% from $606 in 2015 to $503 in 2016.

Low Prices at the Pump Driving Higher SUV Sales in China and the U.S.A.

The IEA said lower oil and gasoline prices are hurting energy efficiency trends in countries where they have boosted sales of sport utility vehicles. “Consumers have moved away from energy-efficient vehicles that they favored when oil prices were higher. In the United States, SUV sales are now 2.5 times higher than light duty vehicles. In China, SUV sales are 4 times higher than light duty vehicle sales,” the agency said.