MGX Minerals Announces Completion of Geotechnical Drilling at Driftwood Creek Magnesium; Reports 87 Meters of 41.3% Magnesium Oxide

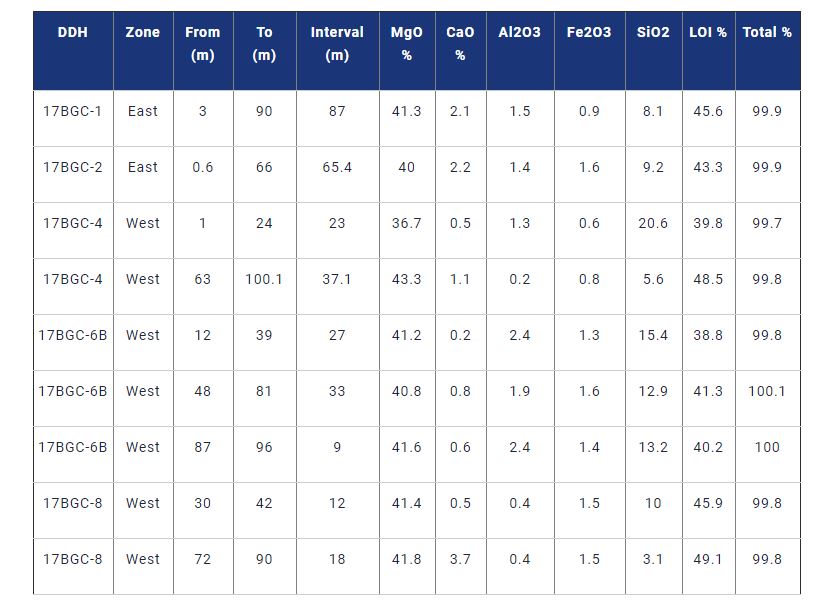

MGX Minerals Inc. (XMG:CNX) (MGXMF) ()is pleased to announce the completion of a geotechnical drill program and associated assay results from its Driftwood Creek magnesium project (“Driftwood Creek”) in southeastern British Columbia. The objective of the drill program was to establish pit wall stability and assess static pressure of groundwater using piezometers. A summary of assay results is provided below:

Based on the new results, the East Zone appears to have considerable potential to expand the magnesite mineral zone to the east and north. The West Zone has potential to contain additional magnesite with high silica-low calcium content in the north (this zone is characterized by a distinct purple coloured magnesite). Based on the grade and interval of magnesite mineralization encountered in geotechnical drilling, the results will also be evaluated to further target additional exploration drill holes. The Company plans to carry out an additional 3,350 meters of exploration core drilling at Driftwood in 2018. The intent of the drill program will be to further expand the drill indicated resource estimate.

Engagement of Hatch Ltd.

The Company has engaged engineering firm Hatch Ltd. (“Hatch”) to conduct a comprehensive review and multi-phased work program for Driftwood Creek. Hatch will review current mine planning and mine design, mineral processing process design, environmental and social impact assessment (ESIA) and permitting work completed to date. Additionally, Hatch will suggest project implementation logistics such as power, access, local infrastructure and more. The objective of the work program is to prepare Driftwood for completion of a N.I. 43-101 Pre-Feasibility Study (“PFS”). The PFS will build on the positive N.I. 43-101 Preliminary Economic Assessment (“PEA”) completed for Driftwood in March (see press release dated March 6, 2018). The PEA study was independently prepared for MGX by AKF Mining Services Inc. (AKF), Tuun Consulting Inc. (Tuun) and Samuel Engineering Inc. (Samuel) in accordance with CIM guidelines and National Instrument 43-101 Standards of Disclosure for Mineral Projects. Highlights include:

- Life of Mine Pre-Tax Cash Flow during Production of $1,051 million

- Pre-tax NPV@5% of $529.8 million, IRR of 24.5% with a 3.5-year payback

- Post-tax NPV@5% of $316.7million, IRR of 19.3% with a 4.0-year payback

- Initial capital costs of $235.9 million (Total life-of mine ("LOM") - $239.8 includes sustaining/closure costs of $3.9 million and contingency costs of $40.0 million)

- Conventional quarry pit mine with a 1200 tonne per day ("tpd") process plant using conventional crushing, grinding, flotation upgrading, calcination, and sintering to produce a saleable DBM product

- Average annual MgO production of 169,700 tonnes during a 19-year mine life

- LOM average head grades of 43.27% MgO

- LOM MgO recoveries of 90%

- LOM strip ratio of 2.4 to 1 of rock to mineralized material

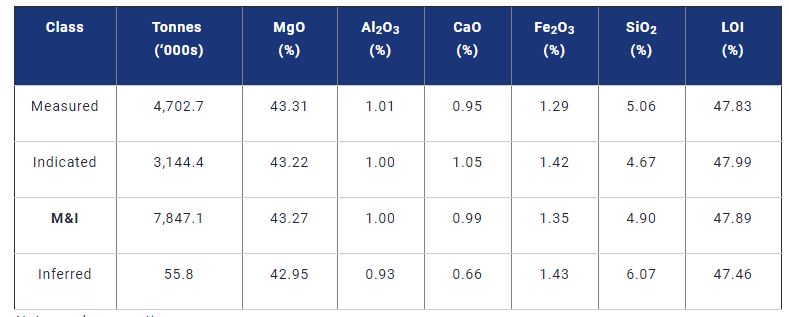

The tonnage and grades of the Driftwood Creek Project mineral resource at a 42.5% MgO cut off are shown in the table below:

Notes and assumptions:

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources estimated will be converted into Mineral Reserves.

- The Lerchs-Grossman (LG) constrained shell economics used a mining cost of US$8.82/t, processing+ g&a costs of US$106/t, and a commodity price of US$600.00/t 95%MgO DBM.

- Mineral resources are reported within the constrained shell, using a cutoff grade of 42.5% MgO (based on a 20-year LOM) to determine “reasonable prospects for eventual economic extraction.”

- Mineral Resources are reported as undiluted

- Mineral Resources were developed in accordance with CIM (2010) guidelines

- Tonnages are reported to the nearest kilotonne (kt), and grades are rounded to the nearest two decimal places

- Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade, and contained metal.

M&I = Measured and Indicated.

Quality Assurance / Quality Control

The sample chain of custody is managed by MGX under the supervision of Mr. Andris Kikauka. Drill core is split at three meter intervals, secured in a nearby storage facility and shipped to ALS Minerals (“ALS”). Blanks and standards are used for data verification purposes. ALS is an independent, ISO-certified analytical laboratory located in North Vancouver, British Columbia. ALS conducts whole-rock analysis using ME-XRF (x-ray fluorescence), 2 gm fused disc, and LOI by furnace.

About MgO

Magnesium Oxide (magnesia) is a widely used industrial mineral that comes in various forms including dead burned magnesia (DBM) and fused magnesia (FM). End uses include fertilizer, animal feed, and environmental water treatment as well as industrial applications primarily as a refractory material in the steel industry. The majority of refractory grade MgO used in the US and Canada is imported from China. MGX aims to provide a stable, secure, long term supply of MgO to the North American market with quality MgO products of consistent grade and purity.

Qualified Person

Andris Kikauka (P. Geo.), Vice President of Exploration for MGX Minerals, has prepared, reviewed and approved the scientific and technical information in this press release. Mr. Kikauka is a non-independent Qualified Person within the meaning of National Instrument 43-101 Standards.

About MGX Minerals

MGX Minerals is a diversified Canadian resource company with interests in advanced material and energy assets throughout North America. Learn more at www.mgxminerals.com.

In the interest of full disclosure, we call the reader's attention to the fact that Equities.com, Inc. is compensated by the companies profiled in the Spotlight Companies section. The purpose of these profiles is to provide awareness of these companies to investors in the micro, small-cap and growth equity community and should not in any way be considered as a recommendation to buy, sell or hold these securities. Equities.com is not a registered broker dealer, investment advisor, financial analyst, investment banker or other investment professional. We are a publisher of original and third party news and information. All profiles are based on information that is available to the public. The information contained herein should not be considered to be complete and is not guaranteed by Equities.com to be free from misstatement or errors. The views expressed are our own and not intended to be the basis for any investment decision. Readers are reminded to do their own due diligence when researching any companies mentioned on this website. Always bear in mind that investing in early-stage companies is risky and you are encouraged to only invest an amount that you can afford to lose completely without any change in your lifestyle. Equities has been compensated with cash, common shares and/or warrants for market awareness services provided.

DISCLOSURE: The views and opinions expressed in this article are those of the authors, and do not represent the views of equities.com. Readers should not consider statements made by the author as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please go to: http://www.equities.com/disclaimer

Source: Equities.com News

(July 18, 2018 - 10:31 AM EDT)

News by QuoteMedia

www.quotemedia.com