Private companies may investigate Mexican portion of the Eagle Ford

Mexico is beginning to recognize the benefits of private investment, and is opening its Burgos basin to development by private companies. This is notable as the Burgos basin has been the domain of state-owned PEMEX since 1938.

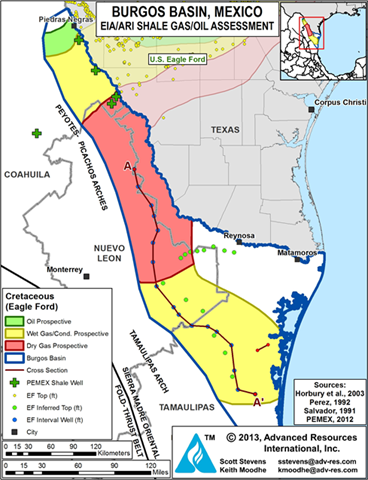

The Burgos Basin is located directly south of Texas with mostly natural gas fields. Since beginning exploration in 1942, PEMEX has discovered about 225 fields in the area. The basin also includes the Mexican portion of the Eagle Ford, which extends miles beyond the border.

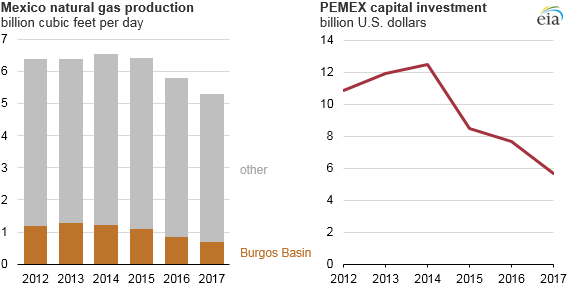

According to the EIA, the Burgos Basin accounts for about 15% of all Mexican natural gas production, and holds the largest undeveloped shale resources in the country. However, production from the basin is declining. The vast majority of current wells target non-shale reservoirs. Investment in the basin has fallen sharply in recent years, from nearly $660 million in 2012 to a mere $51 million in 2017.

PEMEX has tried to develop the shale reservoirs in the Burgos Basin, with limited success. The EIA reports that many early wells had low production rates, and PEMEX’s shale operations are not at commercial production.

Private companies find success offshore

This, ideally, is where private companies come in. The Mexican government is planning to open acreage in the Burgos and other shale plays to private companies before the end of 2018. This should allow companies that already have an understanding of shale plays to move in and explore the basin. The Mexican government hopes that these private companies will be able to repeat the stunning rise of shale in the U.S., where unconventionals are dominating modern operations.

Inviting private companies to areas formerly dominated by PEMEX has paid off for Mexico recently. The country’s first private offshore well in 80 years resulted in a major discovery, with more than 1 billion barrels of oil recoverable. Considering the well’s operator estimated the prospect would yield 100-500 million barrels, the discovery significantly exceeded expectations.

Mexico needs more natural gas

Mexico needs this new, private-company-driven production, as domestic natural gas production is falling quickly. Natural gas generation continues to expand, and according to the EIA Mexico will add about 25 gigawatts of natural gas power from 2016 to 2029. The country is importing increasing volumes of natural gas from the U.S., in a trend that is not likely to end any time soon. In fact, Mexico’s growing need for natural gas recently allowed the U.S. to be a net exporter of natural gas for the first time since 1958.