Mexican imports of crude, gas and refined products rising quickly: country’s population growth rate is double OECD average

The liberalization of Mexico’s energy sector has the potential for big impacts on American operations, as the country is a major market for U.S. oil and gas.

Demand for oil, gas and refined products is growing quickly in Mexico. According to a recent webinar by Argus, the number of passenger vehicles in Mexico tripled from 2000 to 2014, and the company’s population growth rate is twice the average in OECD countries.

Lagging oil and gas production has hurt Mexico

Unfortunately, Mexico’s domestic production has lagged behind demand. The country has been forced to import increasing volumes from the U.S. Argus reports that gasoline imports from the U.S. in the first half of 2017 averaged 373 MBOPD, up 60% from 2015 levels. Imports of crude oil and natural gas have grown similarly.

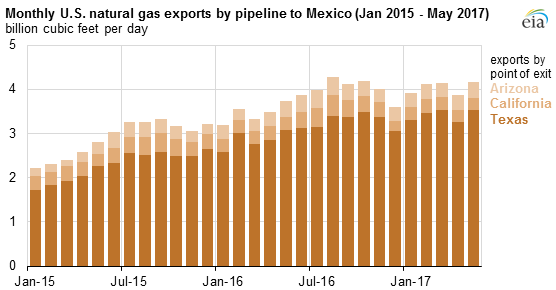

According to EIA data, U.S. exports to Mexico of crude and refined products have been growing steadily in recent years. Oil heading into Mexico from the U.S. averaged around 560 MBPD from 2011 to 2014, but have grown to over 1 MMBPD in June this year. U.S. natural gas exports to Mexico have risen also, from just over 2 Bcf/d in the beginning of January 2015 to nearly 5.3 Bcf/d in June this year.

Fuel price caps going away, private investment encouraged

Mexico is attempting to adapt to this new environment by transforming its energy sector, aiming to improve both domestic production and its capacity for imports. Part of this program is the removal of restrictions on gasoline prices. For many years Mexico has imposed governmental price controls, setting a maximum allowable price for gasoline and diesel. However, this has begun to change.

The government began to phase out price controls in Baja California and Sonora at the end of March this year, and expanded these efforts to the northeastern states in mid-June. The program will expand to other regions gradually, and rest of the country is expected to be fully market-driven by the end of the year.

Additional programs include private construction of fuel storage, as the country currently only has a few days of demand in storage. Additional pipelines are also planned, both importing more hydrocarbons from the U.S. and improving domestic supply.

In addition, the government has been allowing private companies to work on projects for the first time in many years. The country’s first private offshore well in 80 years, the Zama-1, found great success. Operated by Talos Energy, Sierra Oil & Gas and Premier Oil (ticker: PMO), the well discovered 1.4 billion barrels of oil in place, far beyond the 100-500 million barrels expected.

The Mexican government is hoping to see similar success in onshore operations, as it is opening the Burgos basin, the Mexican portion of the Eagle Ford, to private investment. If the country is able to replicate the success of U.S. shale it may unlock significant natural gas reserves.

New political leadership may reverse changes

These programs may not be permanent, however. Mexico’s next presidential election will be held in July 2018, and could bring reversals for the country’s energy industry. The opposition frontrunner, Andrés Manuel Lopez Obrador, has promised to review several of the contracts and programs implemented by the current administration, meaning some may be overturned.