CNX Resources Corporation (ticker: CNX) has agreed to purchase Noble Energy, Inc.’s (ticker: NBL) 50% membership interest in CONE Gathering LLC for $305 million in cash.

The agreement between Noble Energy and CNX also settles any and all claims between the two parties. In association with this transaction, Noble Energy has terminated its prior agreement to divest its entire Marcellus midstream holdings to Wheeling Creek Midstream, LLC, a portfolio company of Quantum Energy Partners.

CNX to own 100% of Cone following transaction

CONE Gathering holds all of the interests in CONE Midstream GP, LLC, which in turn holds the general partnership interest in CONE Midstream Partners, LP (ticker: CNNX) and all of the incentive distribution rights in CONE.

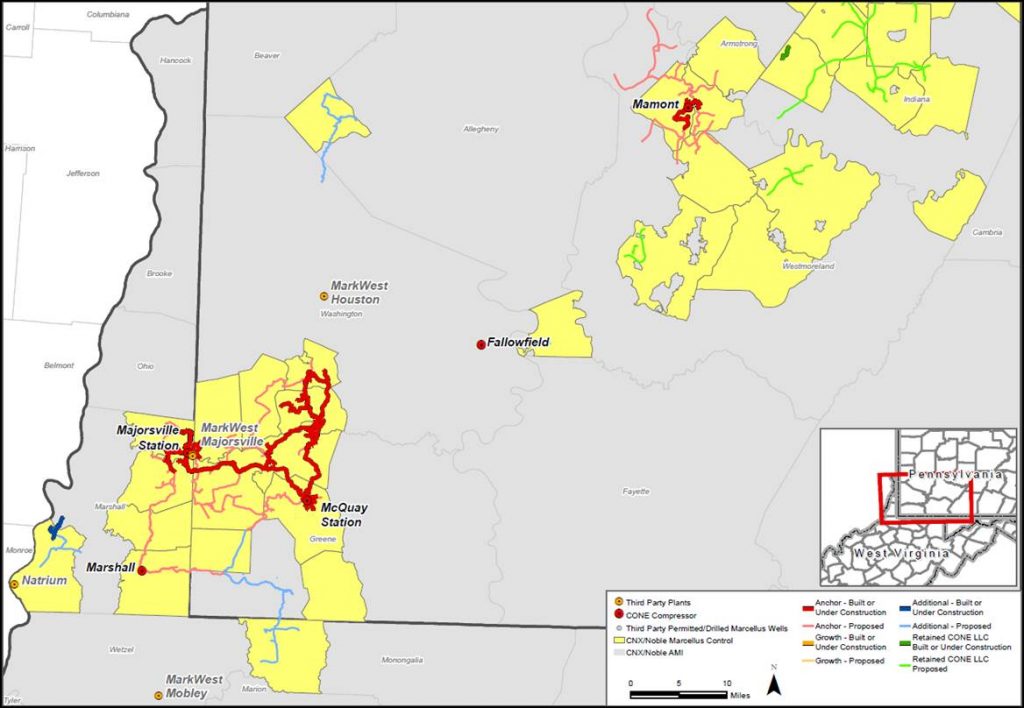

As a result of this transaction, CNX will own 100% of CONE Gathering, making CONE a single-sponsor master limited partnership. CONE Midstream Partners operates approximately 250 miles of pipeline with installed compression of more than 91,000 horsepower.

(Click to Enlarge)

Noble Energy is retaining its 21.7 million common limited partner units and plans to maximize value through the divestment of the units over the next few years.

“This transaction is expected to create significant value for both CNX and CONE,” commented Nicholas J. DeIuliis, CNX president and CEO. “As the single sponsor of CONE, CNX will benefit from increased flexibility with respect to the scope and timing of midstream development, which will enhance the value of existing development and create future opportunities such as future dropdowns and gathering more CNX volumes including dry Utica.”

Noble Energy Executive VP and CFO Kenneth M. Fisher commented, “The transaction announced this morning represents strong value realization for the general partner interest and an expeditious path forward to realize the full value of our Marcellus midstream interests.

“This action further focuses our portfolio and company on the assets that will drive meaningful margin expansion in the future. For CONE Midstream, a single sponsor and better clarity on activity plans going forward will drive additional value, which we will capture through our retained unit ownership.”

The closing of the purchase agreement is not subject to a financing condition and is expected to close in the first quarter of 2018.