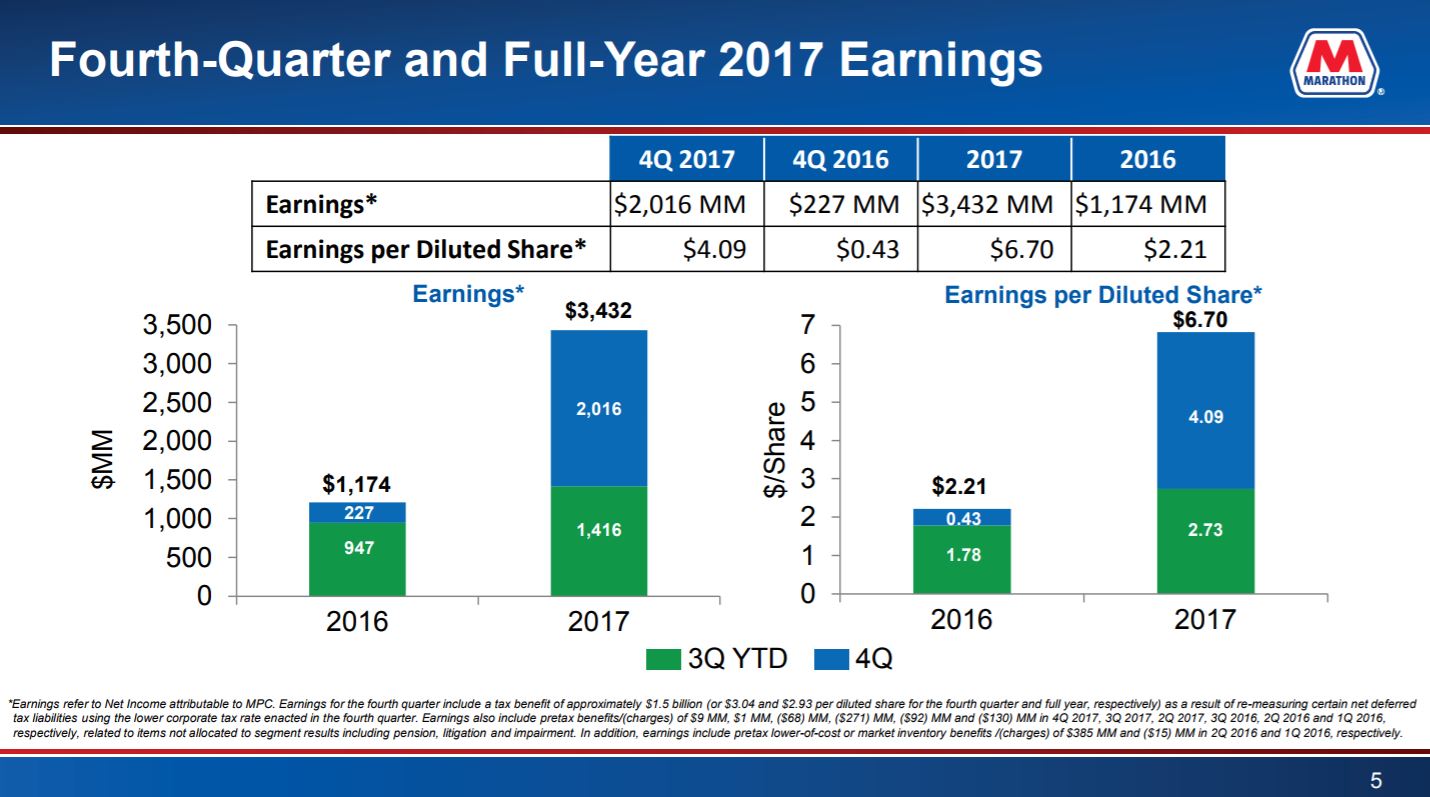

Marathon Petroleum Corp. (ticker: MPC) earned $2.02 billion, or $4.09 per diluted share, in Q4 2017. This is significantly more than in Q4 2016, where the company had earnings of $227 million, or $0.43 per diluted share. FY 2017 earnings saw a significant increase as well – $3.43 billion, or $6.70 per diluted share. Compared to FY 2016’s $1.17 billion, or $2.21 per diluted share, 2017 nearly tripled last year’s earnings.

U.S. tax cut

Almost all of the oil majors have benefited from the recent Tax Cuts and Jobs Act so far – MPC is no exception. Earnings for the fourth quarter and full year include a tax benefit of approximately $1.5 billion (or $3.04 and $2.93 per diluted share for the fourth quarter and full year, respectively).

MPC, MPLX CapEx

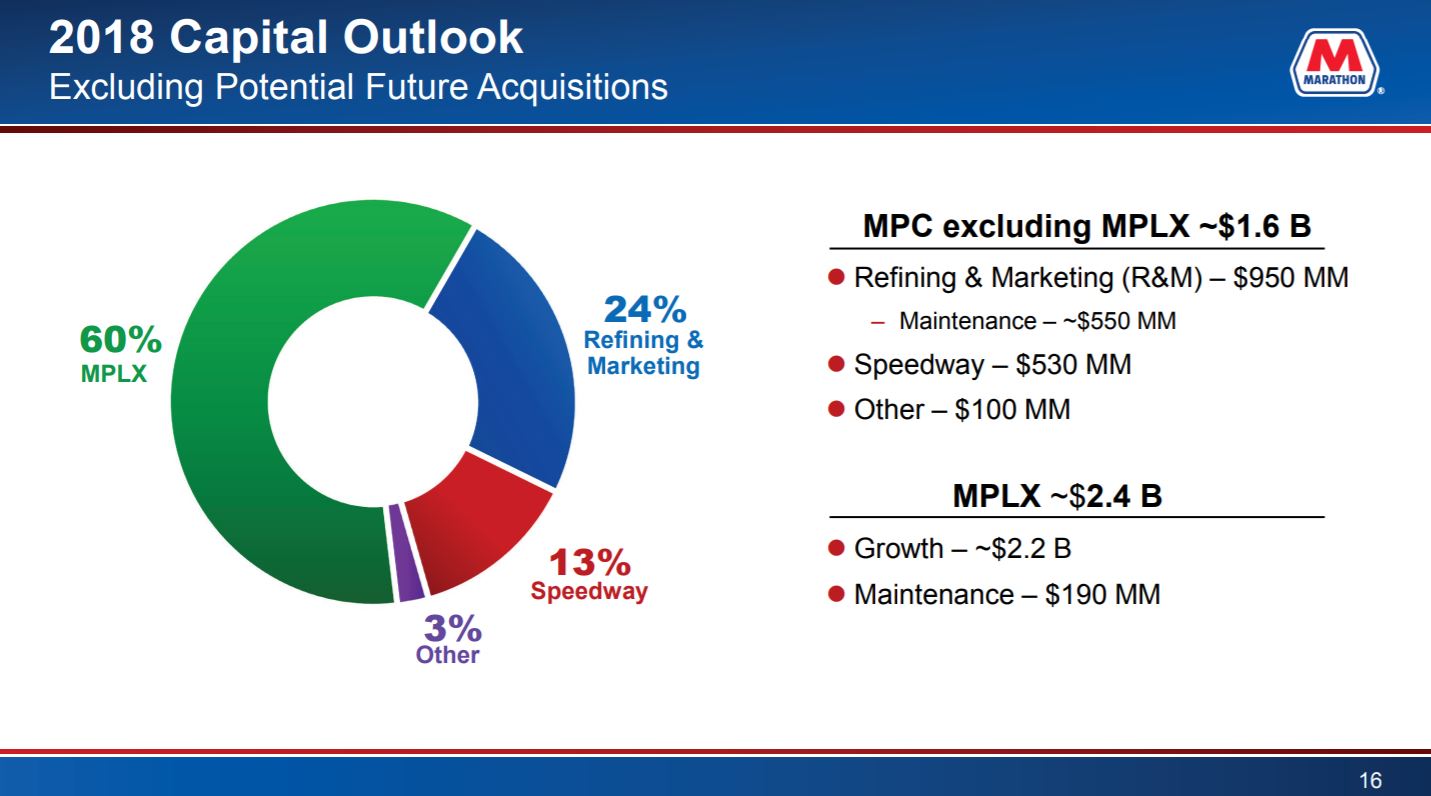

MPC’s 2018 capital investment plan, excluding MPLX, totals approximately $1.6 billion.

- The capital plan for the refining and marketing segment is $950 million. Of that amount, approximately $400 million is growth capital focused on optimizing the Galveston Bay refinery

- Sustaining capital is approximately $550 million, which includes approximately $210 million related to regulatory spending for tier 3 gasoline

- Speedway’s capital plan is $530 million, a $150 million increase from last year

- The capital plan also includes approximately $100 million to support corporate activities and the remaining assets in MPC’s Midstream segment, excluding MPLX

MPLX LP’s (ticker: MPLX) 2018 capital investment plan includes approximately $2.2 billion organic growth capital and $190 million maintenance capital. This plan includes the addition of 8 processing plants, representing nearly 1.5 Bcf/d of incremental processing capacity as well as 100,000 BOPD of additional fractionation capacity in the prolific Marcellus, Utica and Permian basins.

$5.5 billion public offering

MPLX recently priced $5.5 billion in aggregate principal amount of unsecured senior notes in an underwritten public offering consisting of five series of senior notes:

- $500 million of 3.375% senior notes due in 2023

- $1.250 billion of 4.000% senior notes due in 2028

- $1.750 billion of 4.500% senior notes due in 2038

- $1.500 billion of 4.700% senior notes due in 2048

- $500 million of 4.900% senior notes due in 2058

MPLX intends to use the net proceeds from this offering to repay the principal amount and accrued interest on its $4.1 billion term loan borrowing made on Feb. 1, 2018, and to pay related fees and expenses. The closing of the senior notes offering is expected to occur on February 8, 2018.