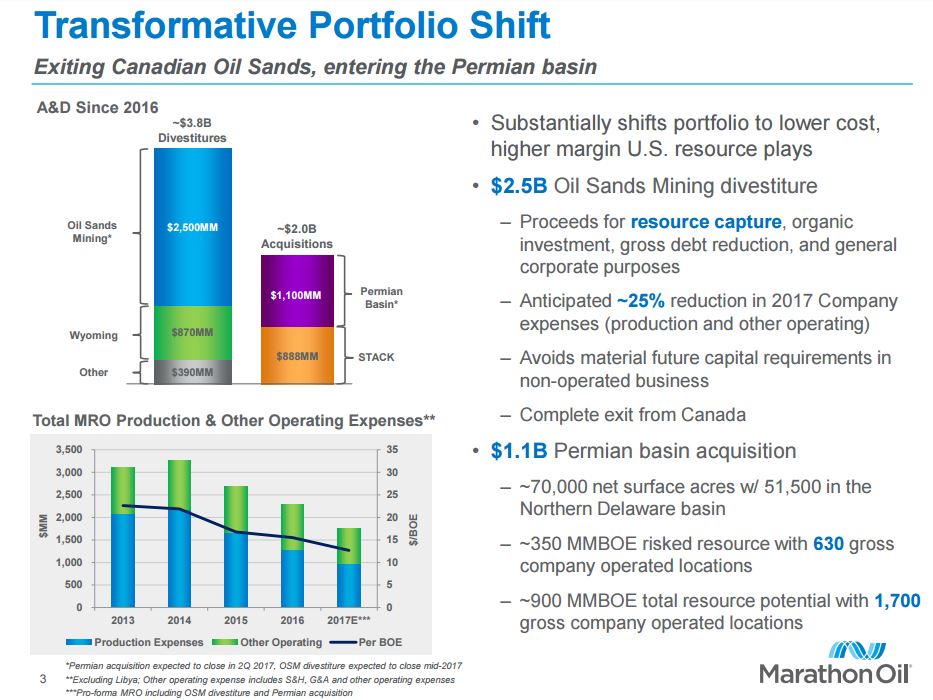

Marathon enters Permian for $13,900 per acre; exits oil sands with $2.5 billion cash sale to Shell and Canadian Natural Resources

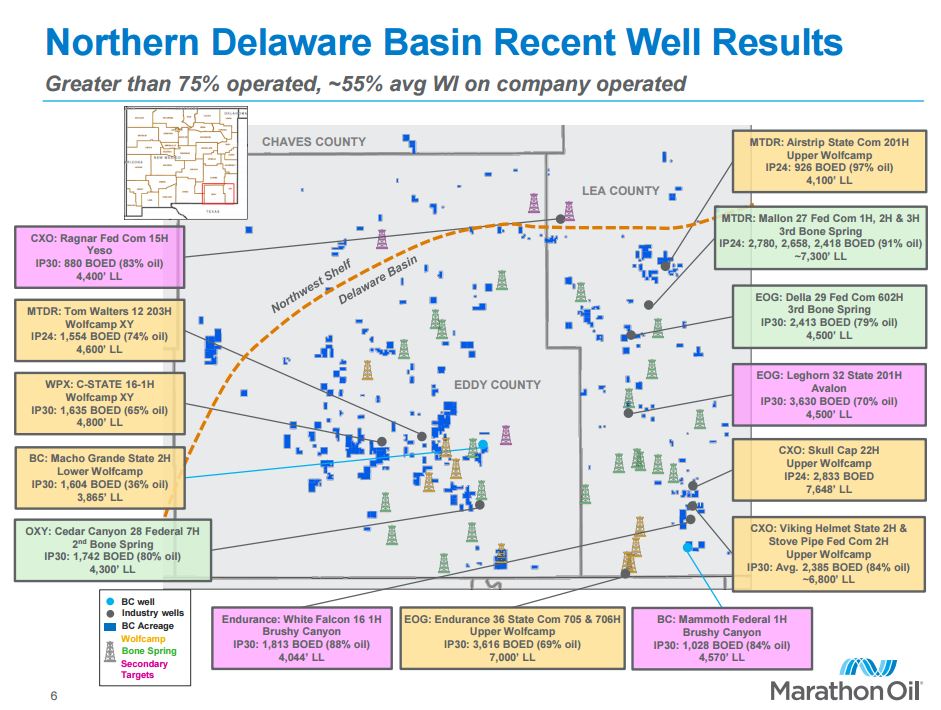

Marathon Oil (ticker: MRO) has agreed to acquire approximately 70,000 net surface acres in the Permian basin from BC Operating, Inc. and other entities for $1.1 billion in cash.

The acquisition includes 51,500 acres in the Northern Delaware basin of New Mexico, and current production of approximately 5,000 net BOEPD.

Marathon also said it had signed an agreement to sell its Canadian subsidiary, which includes the company’s 20% non-operated interest in the Athabasca Oil Sands Project (AOSP), to Shell (ticker: RDSA) and Canadian Natural Resources Limited (ticker: CNQ) for $2.5 billion in cash.

“This deal expands the quality and depth of our already robust inventory while securing a foundational footprint in the Delaware basin with 5,000 feet of oil-rich stacked pay,” the company said in a press release.

“Divesting of our Oil Sands Mining business at an attractive value while also acquiring 70,000 net acres in the world-class Permian basin are transformative milestones that will further align our portfolio with our strategy,” Marathon Oil President and CEO Lee Tillman said.

“Historically, our interest in the Canadian oil sands has represented about a third of our company’s other operating and production expenses, yet only about 12 percent of our production volumes,” Tillman said.

Under the terms of the Canadian divestiture, $1.75 billion will be paid to Marathon Oil upon closing and the remaining proceeds will be paid in first quarter 2018. The sale is expected to close in mid-2017 with an effective date of Jan. 1, 2017, and concurrent with a related transaction between Shell and Canadian Natural Resources, also announced today. Proceeds will be used to fund resource capture, organic investment, to reduce gross debt and for general corporate purposes.

Permian acquisition highlights:

- Up to 10 target benches within approximately 5,000 feet of stacked pay; base case assumes up to 6 target benches

- 70,000 total net acres with 51,500 net acres in the Northern Delaware basin

- Total implied acreage cost of approximately $13,900 per acre, adjusting for existing production

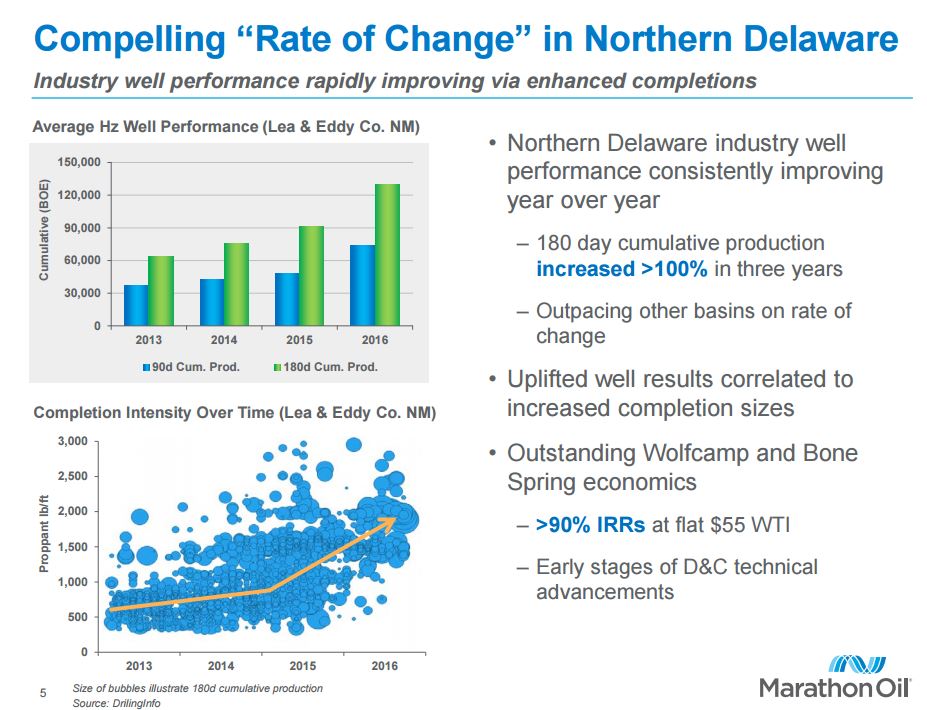

- High quality Northern Delaware inventory produces greater than 90% before-tax IRRs at $55 WTI flat and competes for capital allocation at top of Marathon Oil’s portfolio

- Primary targets in world-class Wolfcamp and Bone Spring

- Approximately 350 million BOE of risked resource at a cost of about $2.80 per BOE with 630 gross company operated locations

- Approximately 900 million BOE of total resource potential with 1,700 total upside locations from both tighter density and secondary targets

- One operated rig drilling with plans to add a second rig mid-year; one rig required to hold term lease

Marathon said the BC Permian basin acquisition is expected to close in second quarter 2017 with an effective date of Jan. 1, 2017.

Oil sands divestiture highlights:

- $2.5 billion sale price equates to approximately 15 times 2016 OSM operating cash flow

- Anticipating approx. 25% reduction in 2017 company expenses (production and other operating) based on expected closing dates for both transactions

- Avoids material future capital requirements in a non-operated business

- Net synthetic crude oil production averaged 48,000 barrels per day in 2016

- Year-end 2016 proved reserves from Canada totaled 692 million barrels of synthetic crude oil

Goldman, Sachs & Co. and TD Securities served as advisors on the divestiture transaction, and Evercore served as advisor on the acquisition transaction.