Marathon’s newest $700 million bolt-on acquisition adds 21,000 net Delaware acres to the 70,000 it bought earlier in March

Marathon Oil (ticker: MRO) announced the acquisition of 21,000 net acres in the Delaware basin today, with an estimated purchase price of $700 million. The acreage will be purchased from Black Mountain Oil & Gas and other private sellers. With about 400 BOEPD of current production, this purchase has an adjusted acreage valuation of about $34,000/acre according to Capital One.This acquisition is the second recent Marathon purchase in the Permian, as the company digs its heels into the most popular play in the U.S.

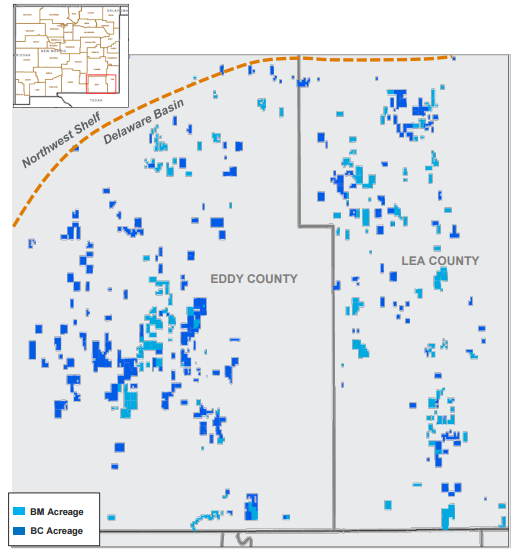

On March 9, the company announced its entry into the Permian with the $1.1 billion acquisition of 70,000 net acres in the Delaware basin. The acreage bought in this transaction is primarily located in Eddy and Lea Counties in New Mexico.

These two acquisitions have given Marathon 91,000 acres in the overall Permian basin, with about 71,500 net acres in the Northern Delaware Basin.

According to the company, these acquisitions have 1,070 risked drilling locations, primarily targeting the Bone Spring sands and Wolfcamp. An additional 1,580 locations represent possible downspacing opportunity, as the Brushy Canyon, Leonard shale, and Avalon formations are also possible targets.

Marathon reports that it currently has one operated drilling rig in the Permian, and plans to add two more in mid-2017. Both Permian acquisitions are expected to close in the second quarter of 2017.

$6.5 billion in A&D since the beginning of 2016

Marathon has made $6.5 billion in acquisitions and divestitures since the beginning of 2016. The company sold its interest in Canadian oil sands mining for $2.5 billion at the same time as it made its first Permian acquisition. Marathon acquired 61,000 acres in the STACK play in June for $888 million, and sold multiple non-core assets, primarily all Wyoming activities, for $950 million in April. The company actually divested its Permian assets in October when it sold its conventional CO2 and EOR assets in the area for $235 million.