27,500 acres sold for $581.5 million

Linn Energy (ticker: LNGG) announced today the sale of its western Wyoming properties to Jonah Energy for $581.5 million.

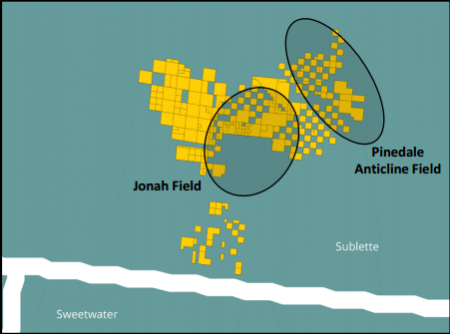

Linn is selling its interest in 1,200 producing wells and 27,500 net acres in the Jonah and Pinedale fields. In total, these assets produced an average of 150 MMcfe/d in 2016 with proved reserves of 384 Bcfe.

The Jonah field is estimated to contain 10.5 Tcf of natural gas, and was first found to be economic in 1993. The field has multiple stacked pay sections over nearly 3,500’ of depth, meaning most development utilizes vertical wells. However, Linn Energy recently participated in several horizontal wells that have produced encouraging results.

Linn Energy emerged from bankruptcy in late February with a focus on growth. The Jonah field assets are one of several properties the company has been investigating selling. Linn plans to sell its Williston, Permian, South Texas and Californian properties in order to focus development on its SCOOP/STACK properties in Oklahoma.

Linn owns about 185,000 net acres in the SCOOP and STACK, where the company plans to drill 25 wells this year. Linn will use the proceeds from this sale to reduce outstanding debt in the company’s credit facility and term loan. Additionally, the company planned to spend $16 million in capital on these assets this year, which will instead be used for growth and de-leveraging.

Jonah Energy consolidating assets

Jonah Energy is a privately held natural gas producer created in 2014 to develop the Jonah Field in Wyoming. The acquired assets are very close to Jonah’s current properties. In fact, Jonah Energy already operates more than half of the wells it acquired in this transaction. Pro Forma for the acquisition, Jonah will produce about 450 MMcfe/d net from 2,100 producing wells over 145,000 net acres.

Jonah will begin developing the acquired assets in the second half of 2017, and expects to have three active rigs by early 2018. The transaction should close by the end of June.