LINN Energy, Inc. (ticker: LNGG) reported its 2017 results today and provided details on its announced split into three entities.

“Through our successful divestiture program of almost $2.0 billion, we have extinguished all our debt, executed on our share repurchase program and recently completed a sizable tender offer to return capital to our shareholders. At the same time we performed exceptionally well operationally, having consistently met or exceeded guidance each of the past four quarters. This year, we plan to further enhance value by implementing our plan to separate into three unique public companies and believe this separation will unlock the inherent value of each as they focus on the growth and development of their high-quality assets,” said Mark E. Ellis, LINN’s president and CEO.

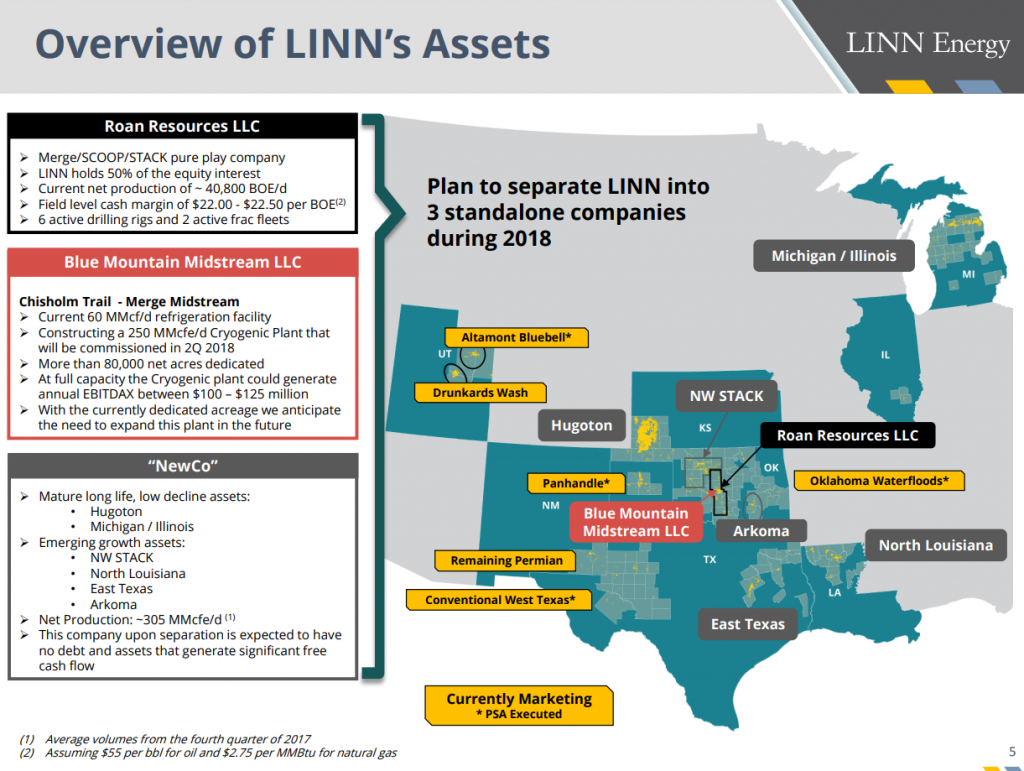

The company outlined its separation into three standalone companies in 2018, as follows:

- Roan Resources LLC. – A pure play company focused in the Merge/SCOOP/STACK play. LINN Energy, Inc., which currently trades on the OTCQB market under the ticker LNGG, will serve as a holding company solely for the existing 50% equity interest of Roan and would prepare to up list on either the NYSE or NASDAQ in 2018.

- Blue Mountain Midstream LLC. – A midstream business centered in the core of the Merge. The board continues to evaluate all options which include, among other things, hiring a separate management team, establishing an independent capital structure, pursuing additional third party acreage dedication, exploring potential strategic alternatives and/or a separate public listing independent from LNGG. The Chisholm Trail Midstream business in the Merge is expected to be the primary asset for Blue Mountain at separation.

- NewCo – The company expects to form a new public company comprised of the following assets: Hugoton, Michigan/Illinois, Arkoma, NW STACK, East Texas and North Louisiana. NewCo is expected to be unlevered and generate significant free cash flow with a strategic focus on developing its growth oriented assets.

Roan Resources

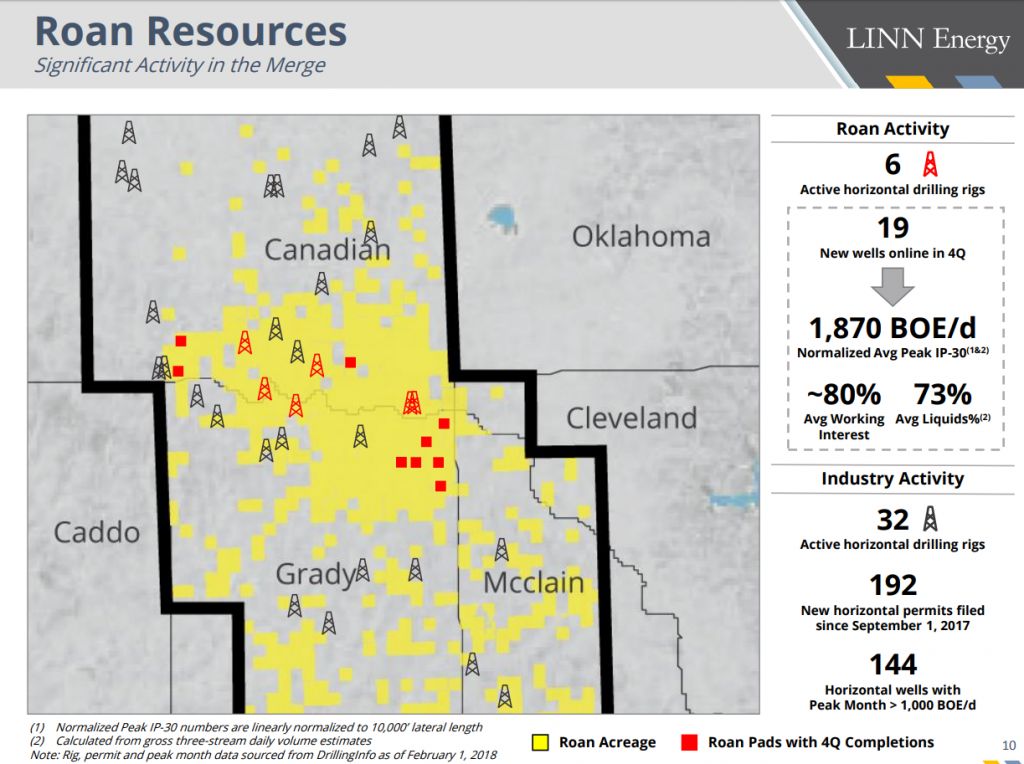

Roan has approximately 150,000 net acres in the Merge/SCOOP/STACK play of Oklahoma. Roan currently has six drilling rigs and two completion crews active in the Merge. During the fourth quarter of 2017, Roan completed 19 wells that are now on production and Roan currently has five DUCs with approximately 8 miles of uncompleted lateral length.

Roan’s daily net production increased to approximately 40,800 BOEPD at the end of January 2018. Activity continues to increase in the Merge area where more than 190 new permits have been filed over the past five months, LINN said, and there are currently 32 active drilling rigs.

Roan plans to focus on improving the technical execution of its development program during 2018, specifically as it relates to geosteering and completion design. Recent well results have shown initial success at this strategy, where gross three stream peak IP-30 rates have averaged approximately 1,870 BOEPD (73% liquids) when normalized to 10,000 ft. lateral lengths.

North Louisiana, East Texas

In North Louisiana, the company drilled two operated horizontal wells last year in Ruston to test the Lower and Upper Red formations. The Lower Red test resulted in a choke managed 24-hr IP rate of approximately 12.7 MMcf/d and a peak IP-30 rate of 11 MMcf/d.

The Upper Red test resulted in a choke managed 24-hr IP rate of approximately 20.4 MMcf/d a peak IP-30 rate of 19.4 MMcf/d.

In 2018, the company said it plans to primarily focus on participating in non-operated activity on its acreage, and depending on commodity prices, may pursue operated drilling activity.

In East Texas, the company drilled two operated horizontal wells last year targeting the Bossier and Cotton Valley Lime formation. The wells resulted in 24-hr IP rates of approximately 13.5 MMcf/d and 10.2 MMcfe/d while being closely choke managed.

The company plans to drill additional wells in 2018 to further delineate its operated acreage and to maximize returns.

Reserves

Proved reserves at December 31, 2017, were approximately 1,968 Bcfe, of which approximately 70% were natural gas, 22% were natural gas liquids and 8% were oil. Approximately 97% were classified as proved developed, with a total standardized measure of discounted future net cash flows of approximately $1.05 billion.

PV-10 (non-GAAP) was approximately $1.3 billion with exclusion of income taxes and the inclusion of helium.

Blue Mountain Midstream

In July 2017, Blue Mountain entered into a definitive agreement to construct a 250 MMcf/d cryogenic gas processing system to expand its existing Chisholm Trail midstream business located in the heart of the liquids-rich Merge/SCOOP/STACK play.

According to LINN, construction is on schedule and the new cryogenic plant is expected to be commissioned during the second quarter of 2018. In December 2017, the company reached an agreement with a third-party to increase the total acreage dedicated to Chisholm Trail to more than 80,000 net acres.

Blue Mountain continues to pursue additional third-party dedications to accelerate the timeline to reach full capacity and further expand in the future.

Q1/FY 2018 guidance

The company has approved a 2018 capital budget of $134 million that includes $34 million of oil and natural gas capital, $98 million of plant and pipeline capital and $2 million of administrative capital. The 2018 capital program is focused on the completion of the Chisholm Trail cryogenic facility in the Merge, the technical development of unproved inventory in East Texas and non-operated activity in NW STACK and North Louisiana. The 2018 guidance, provided below, excludes LINN’s 50% equity interest in Roan and assumes all previously announced asset sales are completed in the first quarter.

|

|

Q1 2018E FY 2018E |

|||

| Net Production (MMcfe/d) | 375 – 415 | 296 – 328 | ||

| Natural gas (MMcf/d) | 257 – 284 | 220 – 243 | ||

| Oil (Bbls/d) | 7,327 – 8,098 | 2,619 – 2,894 | ||

| NGL (Bbls/d) | 12,426 – 13,734 | 10,073 – 11,133 | ||

| Other revenues, net (in thousands) (1) | $ 13,000 – $ 15,000 | $ 71,000 – $ 79,000 | ||

| Costs (in thousands) | $ 72,000 – $ 81,000 | $ 205,000 – $ 226,000 | ||

| Lease operating expenses | $ 43,000 – $ 48,000 | $ 101,000 – $ 111,000 | ||

| Transportation expenses | $ 20,000 – $ 23,000 | $ 78,000 – $ 86,000 | ||

| Taxes, other than income taxes | $ 9,000 – $ 10,000 | $ 26,000 – $ 29,000 | ||

| General and administrative expenses (2) | $ 24,000 – $ 27,000 | $ 60,000 – $ 66,000 | ||

Share repurchase plan continues

On January 22, 2018, the company completed its tender offer to purchase for cash up to 6,770,833 shares of its Class A common stock at a price of $48.00 per share for an aggregate purchase price of approximately $325 million.

On October 4, 2017, the company’s board authorized an increase to its share repurchase program up to a total of $400 million of the company’s outstanding shares. During the period from June 2017 through December 2017, the company repurchased an aggregate of 5,690,192 shares at an average price of $34.85 per share for a total cost of approximately $198 million.

As of February 21, 2018, the company repurchased an additional 206,839 shares at an average price of $38.96 per share, for a total cost of approximately $8 million, and approximately $194 million remained on the current $400 million repurchase authorization.

Balance sheet

From its divestiture program in 2017, the company extinguished all outstanding debt. The company currently has no borrowings outstanding under its $425 million revolving credit facility and there is approximately $378 million available borrowing capacity including outstanding letters of credit.

Pending the closing of previously announced asset sales, the company forecasts to have approximately $405 million of cash on its balance sheet at the end of the first quarter of 2018.

Key financial results (1) |

||||

| Fourth Quarter | Full Year | |||

| $ in millions | 2017 | 2016 | 2017 (2) | 2016 |

| Average daily production (MMcfe/d) | 505 | 748 | 637 | 796 |

| Oil, natural gas and NGL sales | $ 180 | $ 256 | $ 898 | $ 874 |

| Income (loss) from continuing operations | $ 86 | $ (262) | $ 2,750 | $ (367) |

| Income (loss) from discontinued operations, net of income taxes | $ 0.2 | $ (572) | $ 82 | $ (1,805) |

| Net income (loss) | $ 86 | $ (834) | $ 2,833 | $ (2,172) |

| Adjusted EBITDAX (a non-GAAP financial measure) (3) | $ 75 | $ 113 | $ 394 | $ 710 |

| LINN Adjusted EBITDAX for Roan (a non-GAAP financial measure)(4) | $ 22 | N/A | $ 27 | N/A |

| Net cash provided by (used in) operating activities | $ 73 | $ (20) | $ 235 | $ 831 |

| Oil and natural gas capital | $ 31 | $ 61 | $ 239 | $ 127 |

| Total capital | $ 61 | $ 74 | $ 344 | $ 172 |

| (1) | All amounts reflect continuing operations with the exception of net income (loss). | |

| (2) | All amounts reflect the combined results of the ten months ended December 31, 2017 (successor) and the two months ended February 28, 2017 (predecessor). | |

| (3) | Excludes Adjusted EBITDAX from discontinued operations of approximately $164,000, $15 million, $30 million and $51 million for the three months ended December 31, 2017, the three months ended December 31, 2016, the year ended December 31, 2017 and the year ended December 31, 2016, respectively. See Schedule 1 below for a reconciliation of Adjusted EBITDAX. | |

| (4) | Represents the Adjusted EBITDAX for LINN’s 50% equity interest in Roan for the period from September 1, 2017, to December 31, 2017. See Schedule 1 below for a reconciliation of Adjusted EBITDAX. |